What taxes an entrepreneur will have to pay under the simplified tax system depends on the type of tax and whether there is

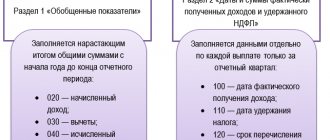

General rules for filling out 6-NDFL Let's consider how to reflect the recalculation of personal income tax in the 6-NDFL form. Application procedure

Who “surrenders” for VAT The obligation to submit a VAT return lies with (clause 5

Filling out procedure: general information At the top of each sheet of the declaration, indicate the TIN. Organizations other than

Starting next year, administration of insurance contributions for compulsory pension, medical and social insurance (for

We will not consider salary calculation in detail, but will analyze the entries that are generated in the accounting

Accounting entries for account 69 List of main entries for debit 69: Dt69 Kt50 - payment

Rule for preparing copies of documents A copy is one drawn up in accordance with the established procedure and

No later than May 2, 2021 inclusive, organizations and individual entrepreneurs who accrued in 2021

All organizations that pay income tax submit a profit declaration. In this declaration