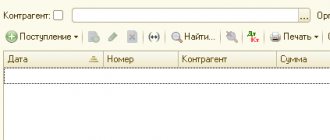

Accounting account 62 is a special analytical account that is used to reflect transactions

Step-by-step instructions The organization delivered goods to the buyer Domostroy LLC (debtor) in the amount of 144,000 rubles.

What new information should legal entities enter into the EFRSDLE? To the Unified Federal Register of information about

Consider, using an example, how to fill out and reflect 6-NDFL under GPC agreements and work contracts.

Opening a foreign currency account To receive foreign currency, you will need a foreign currency account. To open it

Procedure and deadlines for payment of transport tax Transport tax rates in the Kostroma region Benefits for

Form It should be noted right away that there is no specific form for drawing up a power of attorney for the chief accountant.

In this article we will look at accounting for returnable production waste. Let's find out what is considered waste.

Code at the place of UTII registration for Russian legal entities For Russian companies the following are provided:

Land tax is always classified as local taxes. It is obligatory to pay where