When is severance pay reflected in the 2-NDFL certificate? Since the dismissal benefit is material

Appointing a chief accountant: how to take into account all the nuances The organization maintains accounting records throughout the entire

Administrative liability for tax violations Abstract. This article reflects the main aspects of administrative

Primary accounting documentation is the documents that are prepared for any business transaction. They

All employers submit monthly reports to the Pension Fund. This applies to every employer who has

. The document contains information about the seller and buyer. How many copies need to be issued?

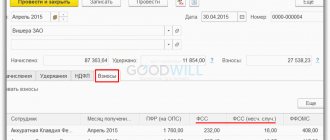

How FSS contributions are calculated in 1C Tariff for automatic calculation and calculation of contributions

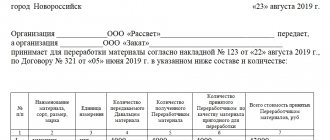

Under what conditions is it possible to transfer customer-supplied materials between the organization that uses the materials and their

“Consultant”, N 12, 2004 RESERVE FOR FUTURE EXPENSES FOR PAYMENT OF HOLIDAYS For even distribution in

The concept of special tax regimes is spelled out in Art. Tax Code of the Russian Federation. They provide a special procedure for determining