To: An employee who is a parent, guardian or trustee of a disabled child(ren) under the age of 18

Legal uncertainty The main problem is that the legislator does not regulate clearly and specifically

Every accountant needs to know which account (sub-account) to account for office supplies in order to correctly maintain

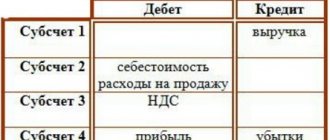

Accounting account 90 is an active-passive “Sales” account, used to reflect information related

General rules for issuing vacation pay Vacation pay represents financial support during vacation. Rely on employees

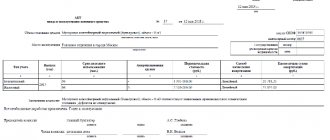

Approved by Decree of the Government of the Russian Federation No. 1 of 01/01/02. Starting from 01/01/17, valid

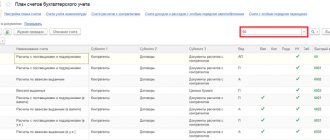

Turnover on account 60 and its application in accounting Account 62 “Settlements with

Registration of payment documents in foreign currency: where to start In order to understand the details

Why do you need a 2-NDFL certificate? The certificate may be needed by tax agents, individuals, individual

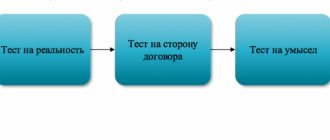

What to do if the tax office suspects your counterparty of dishonesty? For example, it can be counted