All employees of the organization who directly work with cash are responsible for strict compliance with strict standards

What is tax accounting? The definition of tax accounting is given in Article 313 of the Tax Code. So,

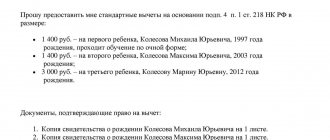

What are the costs from an accounting point of view? If you focus on Art. 318 and 319

Accounting policy of an enterprise: general requirements for registration Accounting policy is drawn up according to the rules established by law

Court decision In addition to the above-mentioned value of assets below the authorized capital at the end of the year, the grounds

Participants of the company are obliged, by decision of the general meeting of participants of the company, to make contributions to the property of the company.

Business entities of all organizational and legal forms, regardless of priority and additional types of activities, in accordance

The cost of all inventories (materials, finished goods, goods, work in progress), including those taken into account in

Home / Labor Law / Payment and Benefits / Compensation Back Published: 03/10/2016 Time

Covering letter for the updated calculation of the 6-personal income tax form - all about taxes Not always even