Fines for online cash registers in 2021 The Code of Administrative Offenses provides for several types of sanctions

The Labor Code allows workers to hold multiple positions or have multiple employers. But if

The type of financial statements prepared depends on the purpose and time range. The essence of reporting documents is

Confirmation of income of an individual entrepreneur: when necessary Situations when an individual entrepreneur is obliged to provide information about his

Sometimes an enterprise accountant is faced with a situation where the expenses he has accepted for tax purposes are recognized

What documents are affixed with the official seal of the institution? What documents are affixed with the official seal of the institution?

Tax system for individual entrepreneurs with VAT VAT is a tax paid by a business that chooses

Every company is required to report its activities to government agencies. In particular, in the Federal Tax Service

Home Finance Taxes Currently, for many organizations that apply VAT, everything is born

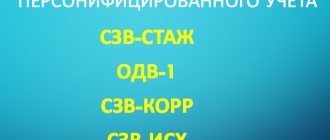

Personalized accounting since 2017 From January 1, 2021, calculation and payment of insurance