A declaration is a tax reporting document that tax agents are required to provide as required by law.

Recognizing expenses for future periods The main task when accounting for BPR is to distinguish between costs and expenses

Customers have the right to purchase from a single supplier for a certain contract amount. Considered here

The quarterly statistical report in the form of salary-education contains information on the number of employees in the educational institution

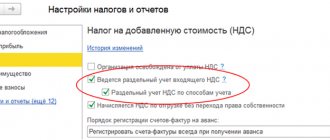

Let's look at how to properly maintain separate VAT accounting and what settings to use for this in

Interest on loans must be reflected in the VAT return. These operations bring

Minor defects Various inaccuracies in invoices, unfortunately, occur quite often. When an error is detected

The difference in status The pros and cons of working under an agency agreement begin with status. Human,

Along with the proud title of “entrepreneur”, you have new responsibilities in terms of paying taxes,

Dividends - what are they? Dividends are the profits of privately owned enterprises that remain after