Learn about the secrets of filling out a standard document Adjusting the implementation of the operation type Correction in primary documents.

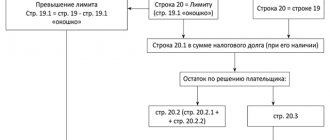

Formation of OZ The negative value is calculated according to the rules of clause 200.1 of the Tax Code as the difference between the amount

Fairness in pricing is a somewhat ambiguous term. Correct valuation of a company's assets is very important

Companies whose main activity is the production of agricultural products pay a single agricultural tax to the budget

With the advent of the new year, many individual entrepreneurs chose UTII as an alternative to the defunct UTII

The award is mentioned in Article 129 of the Labor Code of the Russian Federation. The law establishes it as a payment that carries

Published: 12/02/2019 Updated May 2021 As a rule, all employees of an organization or enterprise receive

Concept and elements of corporate income tax Organizational income tax occupies an important place

A new participant in an LLC: what to do before and after paying the share? Appearance at LLC

Who carries out the calculation of UTII According to Ch. 26.3 of the Tax Code of the Russian Federation, payers of UTII may be recognized as persons