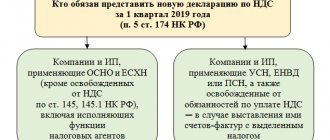

Deadlines for submitting a VAT return The VAT return is submitted to the Federal Tax Service on a quarterly basis electronically.

What is non-operating income? According to Art. 172 of the Tax Code of the Russian Federation when purchasing goods (works,

In this article we will look at how to calculate dividends in 1C 8.3 Accounting 3.0. Suppose

Photo from the website rest-kavkaz.rf Providing loans to employees can play into your hands twice -

The ABC method is widely used due to a number of advantages compared to traditional methods

Audio version of the article, listen to 09 accounting account is closed at the end of the month: deferred accounts are calculated

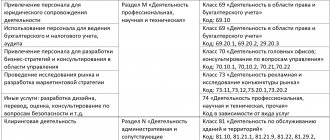

The services of recruitment agencies are needed both by ordinary citizens who want to find a job, and by organizations that

Companies can pay for travel for their employees. Moreover, such a benefit, according to the general rules, is

Foreign worker with - patent: we reduce personal income tax by - fixed advance payment 08/21/2021 at

Value added tax (hereinafter referred to as VAT, tax) is one of the key taxes in the tax