Salaries in accounting Accrual and payment of wages, as well as deductions from it are reflected

The only difference is that when filling out the cover page of the updated calculation for the corresponding

About how “1C: Accounting 8” edition 3.0 takes into account expenses that reduce taxes when applied

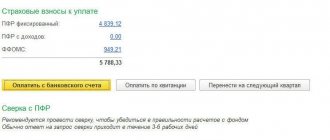

Kontur.Accounting is a web service for small businesses! Quick establishment of primary accounts, automatic calculation of taxes, sending reports

Simplified people who chose “income minus expenses” as an object at the end of the year may get a negative result

Situation The organization had on its balance sheet shares of another enterprise acquired several years ago. Promotions by

A company or individual entrepreneur, if they pay VAT, can, as they say, deduct “input”

The obligation to submit statistical reporting The obligation to submit statistical reporting for business entities is established by Federal Law No. 282-FZ[1]. According to

All alcohol market entities must ensure that legally required data is uploaded