In what cases should you write

As a rule, all payments to company employees are made through banks. Therefore, as a rule, employees do not have problems with timely receipt of payments. But some companies still continue to issue salaries to their employees through the accounting department.

As mentioned above, the employer is obliged to give the employee a full payment on the last day of his stay at the enterprise. But situations are not uncommon when, for one reason or another, a person cannot receive money on the due day. For example:

- due to personal circumstances, for example illness;

- due to delay in payments by the employer;

- if the employee disagrees with the amount of payments received.

In such cases, the employee should write a request for payment upon dismissal.

Why register

Cases in which the employer is obliged to notify the employee of the termination of the employment contract are stipulated in the Labor Code of the Russian Federation. The deadlines within which the notification procedure must be completed are also indicated. A notice of dismissal of an employee must be prepared in the following cases:

- the fixed-term employment contract is terminated;

- the employee is not suitable based on the results of the probationary period;

- staff is being reduced;

- the enterprise is liquidated;

- the employee is an external or internal part-time worker;

- the employee is the payer of alimony or other debts;

- the employee is a foreigner;

- the employee is liable for military service.

What does the document provide?

If the employee contacted the employer with a statement for a reason that prevented him from receiving payment at the enterprise cash desk on the day of dismissal, the money must be issued no later than the next day.

If the resigning employee does not agree with the assigned settlement amount, the director must promptly pay the undisputed amount. The rest of the money will be paid after judicial review. Moreover, the employee can count not only on the issuance of the payment in full, but also on compensation for its retention.

The ultimate goal of issuing a demand is an order for settlement upon dismissal and payment of funds due.

How to compose correctly

Depending on the case for which the notification is being prepared, its appearance and content vary. Be sure to include information:

- name of the enterprise;

- personal information about the employee, position, details of the employment contract;

- reason and date of termination of the contract;

- signature of the person authorized to prepare the document;

- data on the transmission and direction of the document to the addressee.

But the sample letter to the bailiffs about the dismissal of an employee necessarily contains information about whether the alimony provider has any debt, whether the final payment has been made to him and when this happened.

A notification about the need to receive a payment and documents is sent if the employee does not appear for payments due to him after termination of the contract. It does not have a unified form, so they compose it in any order.

A notification for a foreigner is prepared in the form approved by Order of the Federal Migration Service of Russia dated June 28, 2010 No. 147.

Employer's liability

According to Art. 13 of the Labor Code of the Russian Federation, the payment must be paid by the employer on the day the employee is dismissed.

In case of delay in settlement funds, employers bear:

- financial liability according to Art. 236 Labor Code of the Russian Federation (fines);

- criminal liability. The type of criminal punishment for non-payment of wages is determined by the court, Art. 145.1 of the Criminal Code of the Russian Federation establishes the limits of sanctions. A fine and forced labor are possible. In special cases - imprisonment for up to 5 years.

Liability for dismissal without notice

Existing legislation provides for liability for evading the preparation of a notification document. For example, if you hide information about the termination of the alimony worker’s work, the official faces a fine in the amount of 15,000 to 20,000 rubles, and the organization - from 50,000 to 100,000 rubles. If the employer concealed from the FMS that a foreigner had been relieved of his position, a fine in the amount of 35,000 to 50,000 rubles is imposed on the official. A legal entity is subject to a fine in the amount of 400,000 to 800,000 rubles. This is indicated by paragraph 3 of Article 18.15 of the Code of Administrative Offenses of the Russian Federation.

Important points

The paper is written in any form. It is better to make it in two copies. One is for the employer, the second (with the signature of the boss) the employee keeps for himself (may be useful in court). Information about the document submitted to the manager must be entered in the incoming correspondence journal.

Sample request for payment upon dismissal

At the top of the document we indicate:

- position and full name employer, name of organization;

- FULL NAME. the dismissed person, his passport details;

- date of document preparation.

The following is the text:

- FULL NAME. applicant, position, period of work and date of dismissal;

- the reason for the request;

- the settlement amount that the employee is claiming;

- It is also advisable to indicate a list of attached documents (if any).

After this, it must be signed and handed over to the employer or his representative.

Submission deadline

If the document is prepared in relation to an unsuitable employee or upon termination of a fixed-term employment contract, it is handed over three days before the date of dismissal. Part-time employees are notified two weeks before leaving, and in case of reduction or liquidation, this period is two months. As for debtors, Part 4 of Article 98 of Law No. 229-FZ dated October 2, 2007 states that the employer is obliged to immediately transmit information about the termination of the employment contract and the writ of execution to the bailiffs. In addition, the Family Code obliges the employer to notify the bailiffs within three days of this fact and of his new place of work, if known.

When terminating an employment contract with foreigners, the employer is obliged to notify the Ministry of Internal Affairs in the field of migration within three days if the contract is terminated early. If a contract with a foreigner studying at a state professional organization or university is terminated, this must be reported to the employment service.

When an employee liable for military service leaves, the employer notifies the military registration and enlistment office within two weeks.

Procedure for dismissing an employee

Dismissal is a process in which both the employee and the employer are required to comply with certain regulations. A certain procedure must be followed both in relation to the termination of an employment agreement and in relation to the payment of material obligations to the employee. The employer is obliged to pay the employee in full upon dismissal, and the calculation includes not only the salary for the period of time worked, but also various types of compensation (for example, for vacation not taken) and severance pay (if this payment is provided upon dismissal).

Does the employee need to be given a pay slip?

Article 136 part 1 of the Civil Code of the Russian Federation.

Article 136 part 1 of the Civil Code of the Russian Federation states that when issuing wages, the employer is obliged to notify the employee in writing:

- about the components of his earnings for the established period;

- about other accruals, including monetary compensation due as a result of the director’s violation of salary payment deadlines, vacation pay, severance pay, etc.;

- about the total amount of accruals;

- about the amount and reasons for deductions from wages;

- on the amount of funds to be paid.

The information listed is contained in the pay slip, so the employer is required to provide it. It does not matter how the salary is paid - in cash or transferred to a bank card.

There is no unified form of pay slip, so the organization creates it independently. The order of their issuance is determined by the order of the head.

Nuance! According to the rules of the law, the employer is required to issue pay slips to employees who work from home, part-time or remotely.

Typically, information about accruals and deductions is printed on paper, but can also be in electronic form. Upon dismissal, a pay slip is issued on the last working day. For untimely issuance or absence at all, a fine is provided for employers.

| For officials | From 10 to 20 thousand rubles. |

| For individual entrepreneurs | From 1 to 5 thousand rubles |

| For legal entities | From 30 to 50 thousand rubles. |

Instead of a fine, the activities of individuals and legal entities may be suspended for up to 90 days.

Procedure for registering termination of an employment contract (order, note-calculation)

The general procedure for formalizing the termination of an employment contract is set out in Article 84.1 of the Labor Code of the Russian Federation.

Termination of labor relations is formalized by order of the unified form No. T-8. The employee must be familiarized with the dismissal order against signature. If the employee refuses to put his signature on the order, then a corresponding entry about this is made on the order. The same is done in the case where, for some reason, the dismissal order cannot be brought to the attention of the employee.

On the day of dismissal (the last day of work), the employee must be given a work book and make payments due to him (wages, compensation for unused vacation, etc.) Payments are calculated in the “Calculation Note” of the unified form No. T-61.

Upon written application from the employee, on the day of dismissal, he is given free of charge certified and sealed (if available) copies of documents related to his work. An approximate list of such documents is contained in Article 62 of the Labor Code of the Russian Federation. These are copies of orders on hiring, transfers to another job, and dismissal; extracts from the work book; certificates of wages, accrued and actually paid insurance contributions for compulsory pension insurance; certificate of period of work with this employer, etc.

An entry in the work book about the basis and reason for termination of the employment contract must be made in strict accordance with the wording of the Labor Code or other federal law and with reference to the relevant article, part of the article, paragraph of the article of the relevant legislative act (ground - part 5 of article 84.1 of the Labor Code of the Russian Federation ).

If on the day of dismissal the employee was absent from work or refused to receive a work book, then the employer sends the employee a notice of the need to appear for the work book or agree to have it sent by mail. From this day on, the employer is not responsible for the delay in issuing the work book.

Upon written request from an employee who has not received a work book after dismissal, the employer is obliged to issue it no later than 3 working days from the date of the former employee’s application.

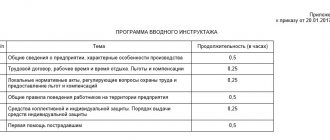

A description of the procedure for dismissing an employee using a practical example, as well as completed forms of documents No. T-8 and No. T-61 for this example are given in the appendices.

Dismissal of an employee

(formatization procedure using example)

On June 4, 2012, the janitor Sviridov submitted a letter of resignation effective June 18, 2012, that is, two weeks before the termination of the employment contract.

Note. According to Article 80 of the Labor Code of the Russian Federation, the two-week period begins the next day after the employer receives the employee’s resignation letter.

June 18, 2012 is the last day of work for the janitor. By this day, the accounting department must prepare a calculation of payments due to the employee, which are made on the last day of work of the resigning employee. On the same day, the employee must be familiarized with the dismissal order in the unified form No. T-8, and must also be given a work book.

In the heading part of the dismissal order there is a note “(cross out what is unnecessary).” In fact, when an employee is dismissed, two actions occur simultaneously, as follows from the wording of the Labor Code, namely: termination of the employment contract and dismissal of the employee. Therefore, in the order, as a rule, both lines are filled out: about the employment contract that is being terminated, and about the date of dismissal of the employee.

In the dismissal order, in the line “Grounds for termination (termination) of the employment contract (dismissal),” the entry is made in strict accordance with the wording of the Labor Code of the Russian Federation and with reference to the clause and article on the basis of which the employee is dismissed. How to correctly make an entry in the work book is stated in Section II of the Rules approved by Decree of the Government of the Russian Federation dated April 16, 2003 No. 255. Thus, paragraph 15 establishes that upon termination of an employment contract on the grounds provided for in Article 77 of the Labor Code of the Russian Federation (except for grounds , specified in paragraphs 4 and 10 of this article), an entry about dismissal (termination of the employment contract) is made in the work book with reference to the corresponding paragraph of part one of this article.

Therefore, in the order to dismiss the janitor Sviridov A.P. entry made:

“The employment contract was terminated at the initiative of the employee, clause 3 of part 1 of article 77 of the Labor Code of the Russian Federation.”

Based on the dismissal order, an entry was made in Sviridov’s Personal Card (Form No. T-2), in his Personal Account (Form No. T-54) and in the work book. As in the order, these entries were made in strict accordance with the wording of the Labor Code. Sviridov was familiarized with the notice of dismissal made on his personal card against signature.

The settlement with the employee upon dismissal is made according to form No. T-61 “Note-settlement upon termination (termination) of the employment contract with the employee (dismissal)”.

At the enterprise of Individual Entrepreneur V.S. Nikolaev wages are paid 2 times a month in the following order:

- on the 20th of the current month - for the 1st half of the same month (advance);

- 5th day of the next month - for the 2nd half of the previous month.

Sviridov resigns on June 18. Therefore, upon dismissal, he must be paid wages for the period from June 1 to June 18 inclusive.

Let's calculate Sviridov's salary for June until the day of dismissal:

| 1.Salary according to staffing schedule | 7 000 |

| 2.Number of working days in June | 20 |

| 3.Number of working days worked | 11 |

| 4.Salary amount for days worked (page 1 : page 2 x page 3) | 3 850 |

| 5. Regional coefficient (page 4 x 1.3) | 1 155 |

| 6. Percentage bonus for work experience in a special climate zone (page 4 x 30%) | 1 155 |

| 7. Total wages accrued (page 4 + page 5 + page 6) | 6 160 |

The calculated amount of earnings in the amount of salary and bonuses (regional coefficient and percentage bonus) will be reflected in the Calculation Note in the “Calculation of Payments” section in columns 10 and 11, respectively.

In addition to wages, Sviridov must be paid compensation for unused vacation. The duration of annual leave is 36 calendar days.

Information about the vacations used by Sviridov is contained in his personal card (form No. T-2). Below is an extract from this card:

| Type of vacation | Work period | Number of calendar days of vacation | date | Base | ||

| With | By | started | graduation | |||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| Annual | 12.03.2010 | 11.03.2011 | 36 | 26.09.2010 | 31.10.2010 | order No. 105 from 09.22.2010 |

| Annual | 12.03.2011 | 11.03.2012 | 36 | 25.03.2011 | 29.04.2011 | order No. 94 from 03/20/2011 |

On the day of dismissal, Sviridov did not use vacation for the period from March 12, 2012 to June 18, 2012, that is, for 3 full months.

Let's calculate the number of unused vacation days for which Sviridov should be paid compensation: 36 days. : 12 months x 3 months = 9 days

The average daily earnings for vacation pay and compensation for unused vacations are calculated for the last 12 calendar months by dividing the amount of accrued wages by 12 and by 29.4 (the average monthly number of calendar days) (Article 139 of the Labor Code of the Russian Federation).

The calculation period for calculating compensation for unused vacation for Sviridov is the period from June 2011 to May 2012. The employee worked this period in full.

During the billing period, there was an increase in salaries for the enterprise as a whole. This happened in January 2012. Before the salary increase, Sviridov’s salary was 5,000 rubles, and taking into account the regional coefficient and percentage bonus, his monthly earnings were 8,000 rubles. After the increase, the salary was 7,000 rubles, and the amount of monthly earnings, taking into account allowances, was 11,200 rubles.

Since the salary increase occurred during the billing period, payments made to the employee in the months preceding the salary increase are recalculated taking into account the increasing factor. The increasing factor is determined by dividing the new salary by the previous salary. Let's calculate this coefficient for our example: 11,200 / 8,000 = 1.4.

Now let’s calculate Sviridov’s earnings for the billing period using a multiplying factor:

| Month of billing period | Salary accrued | Conversion factor | Estimated salary for calculating average earnings (gr.2 x gr.3) |

| 1 | 2 | 3 | 4 |

| June 2011 | 8 000 | 1,4 | 11 200 |

| July 2011 | 8 000 | 1,4 | 11 200 |

| August 2011 | 8 000 | 1,4 | 11 200 |

| September 2011 | 8 000 | 1,4 | 11 200 |

| October 2011 | 8 000 | 1,4 | 11 200 |

| November 2011 | 8 000 | 1,4 | 11 200 |

| December 2011 | 8 000 | 1,4 | 11 200 |

| January 2012 | 11 200 | X | 11 200 |

| February 2012 | 11 200 | X | 11 200 |

| March 2012 | 11 200 | X | 11 200 |

| April 2012 | 11 200 | X | 11 200 |

| May 2012 | 11 200 | X | 11 200 |

| Total for the billing period | 134 400 | ||

Since the billing period has been fully worked out by Sviridov, and there are no periods in it that should be excluded from it in accordance with paragraph 5 of the Procedure for calculating the average salary (approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922), then the average daily earnings for paying compensation for vacation Let's calculate it as follows: 134,400 rubles. : 12 months : 29.4 = 380.95 rub.

Accordingly, the amount of compensation for unused vacation that must be paid to Sviridov will be: 380.95 rubles. x 9 days = 3,428.55 rub.

Now let’s transfer the results obtained to the Calculation Note in the “Vacation Payment Calculation” section and fill out columns 1-9. In this case, we calculate the number of calendar days of the billing period as follows: 29.4 days. x 12 months = 352.8 days.

We will transfer the amount for vacation from column 9 to column 12 and complete filling out the section “Calculation of payments”:

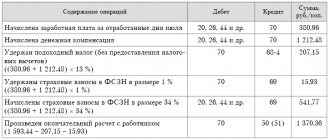

1) calculate the total amount of accrued payments:

column 13 = column 10 + column 11 + column 12 or in numbers: 3,850 + 2,310 + 3,428.55 = 9,588.55 rubles;

2) we will withhold personal income tax (NDFL) from the accrued amount:

RUB 9,588.55 x 13% = 1,247 rub. (Personal income tax is calculated only in whole rubles). We will reflect the received amount in column 14;

3) Sviridov has no other deductions other than personal income tax. Therefore, we will transfer the indicator from column 14 to column 16;

4) wages at the enterprise for the 2nd half of the month are issued on the 5th of the next month. Wages for May were paid to employees on June 5. Consequently, the organization has no debt to Sviridov for payment of wages, and in column 17 we will put a dash;

5) advance payment (salary for the first half of the month) is issued at the enterprise on the 20th. Consequently, Sviridov, who quits on the 18th, did not receive an advance, so we also put a dash in column 18;

6) determine the amount to be paid: column 19 = column 13 – column 16 or in numbers: 9,588.55 – 1247 = 8,341.55 rubles.

So, on June 18 (the day of dismissal) Sviridov should be paid 8,341.55 rubles. This will be the final settlement with the employee who quits.

Application for payment upon dismissal: sample

The amount of the final payment due to an employee who leaves the organization includes the following payments: The document must contain the following information: It is good if the employee can provide specific figures and facts to support his position.

Experts advise not to be afraid to contact regulatory authorities and hold unscrupulous employers accountable.

If you find an error, please select a piece of text and press Ctrl+Enter.

Sample complaint to employer for non-payment of wages

The delay period is 16 days.

According to Part 2 of Art. 142 of the Labor Code of the Russian Federation, I notify you of my suspension of work until my wages for November 2021 are fully paid, along with interest for the delay.”

At the same time, we note that the claim procedure for resolving a labor dispute is not mandatory and an employee who believes that the employer has violated his rights can immediately file a complaint with the supervisory authority and/or the court.

Sample complaint about non-payment of wages to the labor inspectorate: “I, Safyanov O.M., work as a manager in the sales department at Consensus-Trust LLC, located in Mytishchi, Moscow region, st.

Engelsa, 15. An employee’s claim for non-payment of wages is submitted to the employer in person or sent by mail.

The document is drawn up in any form.

Salary payment letter

15 of the Civil Code of the Russian Federation, a person whose right has been violated may demand full compensation for the losses caused to him, unless the law or contract provides for compensation for losses in a smaller amount.

Based on the above, guided by Art.

Art. 2, 21-22, 236, 237 Labor Code of the Russian Federation, “____” _______________

__________/_________________/ In the Non-Profit Partnership for the Development of Physical Culture and Sports “Women’s Basketball Club “_________”” In accordance with additional agreement No. ___ to the athlete’s employment contract, the following remuneration system was established: 1) the constant component (official salary) is ______ rubles , payable is ________ rubles.

2) The total amount of wages is _______ rubles, the total amount to be paid is ________ rubles. By virtue of Art. 21 of the Labor Code of the Russian Federation, an employee has the right to timely and full payment of wages in accordance with his qualifications, complexity of work, quantity and quality of work performed.