Payment

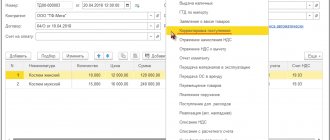

Setting up product accounting in 1C Accounting In the functionality settings (section “Main” – Settings –

The concept and features of a budgetary organization Budgetary institutions are organizations that are financed by

How to correctly pay an advance in 2020-2021 according to the Labor Code The concept of “advance” by labor legislation

Transport tax for 2014 From this year, changes in legislation come into force,

Everyone has their own reasons for uncovered losses. An uncovered loss may result from: excess

What taxes an entrepreneur will have to pay under the simplified tax system depends on the type of tax and whether there is

Who “surrenders” for VAT The obligation to submit a VAT return lies with (clause 5

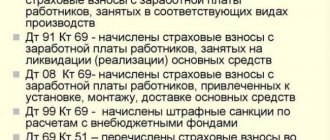

Accounting entries for account 69 List of main entries for debit 69: Dt69 Kt50 - payment

Tax amnesty - let's understand the concept. In a broad sense, such an amnesty means any concessions that allow

Calculation of advance payment of corporate property tax for the 2nd quarter of 2021