Payment

• Registration • Making changes • Liquidation The site uses government services: Required when filling out forms

The UTII taxation system is one of the special tax regimes for entrepreneurs working primarily in

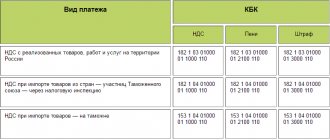

Organizations applying the general taxation regime will have to submit a VAT return for the first quarter of 2021

Why is the basic yield for UTII established and how to find out its Basic yield -

Home › Finance 01/02/2018 Let’s figure out what changes have affected financial assistance to employees in 2021.

If a company has hired employees, it must necessarily pay for them

The property tax declaration is prepared by taxpayers in the form approved by the Federal Tax Service by order dated March 31, 2017

About the difference between the concepts of “acceptance for accounting” and “receipt of goods” Why an accountant needs to look

Important in reporting in 2017 The first three months of 2021 will be a reporting campaign

Since 2013, UTII at the federal level has for the first time radically changed the conditions of application and rules