Payment

The concept of fixed capital In general, capital means financial resources invested by an enterprise in its own assets

The inspectorate informs about the debt. The tax authority, having identified the arrears, sends the individual a request to pay tax,

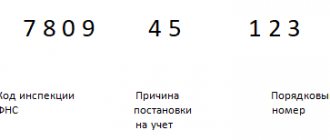

Any legal entity has its own registration data necessary to determine the place of registration

Leasing. Tax accounting. Accounting for the difference between payments and depreciation. Good afternoon Please tell me this

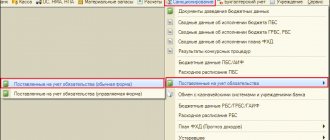

Electronic accounting: definition and what applies to it Under electronic accounting, as a rule,

Who is checked first Quite often, the director learns that the company is under

With the advent of new technologies, people are less and less likely to take a pen and write something on paper.

Income tax is one of the taxes transferred to the budget and levied on all

When the right to a deduction arises You cannot return tax for years before obtaining the right to a deduction.

Who to include in the report It is important to understand that as part of the SZV-M form for July 2021