Payment

The procedure for drawing up estimates for organizations using the simplified taxation system (STS) is generally the same,

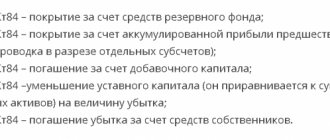

Is it true that retained earnings are net profits? Retained earnings are real

To correctly calculate wages, it is necessary to take into account the hours actually worked by employees. For this purpose the employer

If vacation pay is accrued in July, then should vacation pay be taken into account in tax expenses in

In accounting department 26 is needed to record expenses that are not related to production. Close

What is it and who must submit the Declaration in form 4-NDFL until 2021?

In accordance with Article 217 of the Tax Code (TC) of the Russian Federation, not all income of individuals

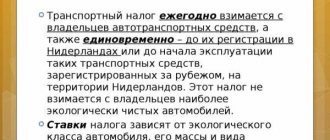

Tax policy is one of the most important attributes of the state and the full functioning of its institutions. Under

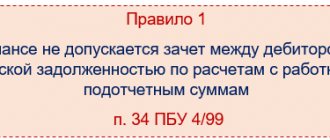

Transactions that are reflected in accounting on account 71 Account 71 in accounting is intended for

12/19/2015 20 326 2 Reading time: 9 min. Rating: Author: Konstantin Bely