Very often, professional tax lawyers and consultants are faced with the opinion that they simply do not understand the complex schemes of sellers of “paper” VAT and therefore do not recommend using it. The situation is just the opposite; we understand too well (not all, of course, but the majority) the entire internal “kitchen” of the “paper” VAT. And that is why we do not recommend contacting him.

Tax expert Kirill Soppa on his Yandex.Talk channel presented an analysis of all the myths and questions regarding VAT optimization schemes. The article turned out to be long because there are a lot of myths being spread. In this regard, at the beginning, in the form of a table of contents, there is a list of issues that are discussed in the article. You can only read what is interesting, but it is better in order.

- Why is VAT not legally optimized, unlike the income tax, although the principle of calculation seems to be the same for them - income minus expenses multiplied by the rate - it’s just that when calculating VAT, not all expenses are taken into account (only VAT ones)?

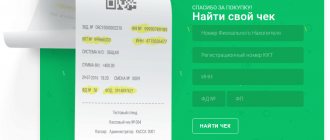

- How does ASK VAT-2 work? Why is it impossible to optimize VAT?

- How, despite the work of ASK VAT-2, do they continue to sell “paper” VAT? “Cashers” came up with a scheme to bypass ASK VAT-2?

- Why is “paper” VAT now sold separately from cash? Does this make the circuit safe?

- What are the various legal VAT optimization schemes that popular tax consultants sell at seminars?

- Sellers of “paper” VAT offer to buy deductions that do not create gaps in the VAT-2 ASK. Supposedly there are companies that have input VAT, but they don’t need it. This is true?

- Sellers of “paper” VAT sell a certain “export” VAT, which also does not create gaps according to the ASK VAT-2. Is it safe to buy?

- Is it even possible to buy real deductions from sellers of “paper” VAT? Are there ways to separate real deductions from artificial “paper” VAT?

- What happens if you buy an artificial “paper” VAT?

- An example of a real case when, at the request of a client, we analyzed the proposal of a “paper” VAT seller.

So, let's begin.

How does ASK VAT-2 work? Why is it impossible to optimize VAT?

Once it appears on your invoice issued by you to the Buyer, all VAT should appear in the budget. There are no grounds for reducing the tax base for VAT in the Tax Code. The operating principle of the ASK VAT-2 system is based on these features. The calculated tax has only two ways from you - either to the budget or to a declaration to another VAT payer. The system automatically builds this chain and sees the places where VAT is “leaked” online.

If before the introduction of the ASK VAT-2 system, the principle of evasion through shell companies was simple - such companies simply indicated in their VAT returns the amount of deductions approximately equal to the amount of VAT on sales. But after the implementation of the ASK VAT-2 system, all VAT taxpayers are required to submit, along with the VAT return, a transcript in electronic form of those companies that form the amount of deductions (purchases) and the VAT base (revenue). And submitting false declarations has become impossible; the system immediately sees that the specified deduction is not reflected in the sales book of the counterparty.

Signs of a justified tax benefit

There are formal requirements for recognizing the legality of a tax deduction; they are listed in Art. 172 of the Tax Code of the Russian Federation.

The business transaction that entitles the company to the deduction must be real. The buyer must have documents that demonstrate this reality: an agreement with a transport company, the purchase of containers, etc. Also get ready to demonstrate the warehouses. The tax office is not always ready to believe only documents.

Another requirement is due diligence when choosing a counterparty. Proof of such diligence is provided not only by the standard list of documents, but also by the company’s motives when choosing a supplier, and also by the circumstances under which the contract was concluded and executed. If you can explain and comment on all of this in a consistent manner, it will demonstrate your due diligence.

To work with VAT carefully and apply all legal deductions, we recommend the Kontur.Accounting web service. The system calculates preliminary VAT, gives recommendations on how to reduce the amount, suggests which documents are missing in accounting and what errors need to be corrected. Accounting provides simple accounting, payroll, reporting and other tools for accountants and business managers. The first 14 days of the service are free.

Why is “paper” VAT now sold separately from cash? Does this make the circuit safe?

ASK VAT-2 is not the only weapon to combat VAT evasion and fly-by-night scams. An equally effective tool was the tightening of banking controls. If you read numerous Telegram chats of “cashers,” you can see that the average lifespan of a technical company through which money is transferred to current accounts is steadily decreasing and is already much less than three months. That is, they don’t even live for one tax period. It is not ASK VAT-2 that “kills” them, but the banks. An existing business is quite seriously different in payment structure from transit one-day businesses, and banks take advantage of this. Operating companies have employees, payments to suppliers of provisioning goods (office, clean water, cellular communications, Internet), rent payments, taxes. Of course, there are exception businesses that are more like transiters, but the regulator’s position here is very pragmatic - let us “crash” a couple of real businesses, but not a single “technical” one will leave.

This led to the fact that the classic “cashers” were divided into three types of specialization.

- Sellers of “paper” VAT. Their goal is to create the VAT funnel we talked about above. The main task facing these people is to create a bunch of fly-by-night companies, but not to spend money on them, because the banks will slam them faster than at least one declaration is submitted! They simply issue invoices and submit tax reports, confirming deductions for their customers. That is why this VAT is called “paper” VAT. And then they build various accounting chains between a bunch of their one-day accounts, including in reserve, so that if the client has problems, they can replace one deduction with another in previous periods. In addition, these people are constantly struggling with “nullifying” tax returns, providing documents for counter requests, and other problems.

- “Cashers” (droppers). These are the people who turn non-cash money into cash. Moreover, due to the tightening of banking and tax controls, they are no longer associated with VAT! They receive a VAT-free non-cash payment for their companies or individual entrepreneurs and turn it into cash. Either by rolling payments to drop physicists or from corporate cards through payment agents. Their main task is to look for drop physicists who are not yet included in the blacklists of banks, issue cards for them, carry the cache and transfer it to the customer.

- Transitors. These are the people who connect cash buyers and cashers. They accept a VAT non-cash with one purpose into their accounts and turn it into a non-VAT non-cash with a different purpose (which, for example, is suitable for a patent). Doing the so-called breaking and revolution. The main tasks of these people are to have connections in banks. They are constantly busy pulling their money out of the locks of various banks through writs of execution, decisions of the CCC and other methods. They prepare piles of documents for requests to banks.

Of course, there are people who can offer optimization of deductions and sell cash. But this most likely only means that they have found related partners and are simply reselling their services by increasing their 0.5-1%. This is evidenced by the fact that they always carry out deductions and cash sales from different “offices”.

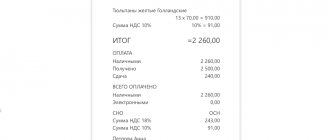

Filling out invoices for estimated rates

An invoice for the sale of property registered by an enterprise at a cost including VAT is determined by the rules for filling out an invoice, approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137. According to these rules:

- in column 5 the difference between prices is entered, taking into account tax;

- Column 8 reflects the estimated amount of tax (subparagraphs “e”, “h” of paragraph 2 of the filling rules);

- column 7 reflects the calculated rate that is applicable in this situation, the rate is indicated without the % symbol (i.e. 20/120, etc.);

- Columns 4 and 9 indicate the full price and sales price including VAT.

Read more about the rules for issuing advance invoices in the article “Rules for issuing advance invoices in 2021 - 2021”.

What happens if you buy an artificial “paper” VAT?

In fact, a break in the chain is not an independent basis for additional tax assessments. Here is an example of a case in which the tax authorities tried to charge the taxpayer with a gap. To which the court objected to the tax authority that the Tax Code does not say a word about ASK VAT-2, so they can use the data of this system only for their internal needs.

VAT poses the following risks:

- the likelihood of ordering an on-site tax audit seriously increases;

- additional VAT may be charged as part of a desk tax audit of the quarterly VAT return;

- collection incentive measures will be applied - employees of the district tax inspectorate will put pressure on the director of the organization - according to official statistics cited by the head of the Federal Tax Service of Russia in the annual report, budget revenues as a result of control and analytical activities outside the framework of tax audits almost doubled in 2017 and amounted to 56 billion rubles, and in 2018 almost 80 billion rubles.

To turn data on the gap into additional charges in court, tax authorities have to collect evidence of the unreality of transactions, and after Art. 54.1 of the Tax Code of the Russian Federation in the summer of 2021 - evidence of the unreality of the counterparty. Therefore, recently the tax authorities have shifted their main emphasis to the last method - forcing the taxpayer to voluntarily clarify his tax obligations, that is, to exclude all purchased “paper” VAT from the purchase book. This is clearly demonstrated by statistics.

What is the current VAT rate?

In practice, there are several rates, deductions for which are made depending on the type of product.

Different rates were created in order to provide the population with more necessary goods with less tax, and to sell goods that are not classified as socially significant at a higher tax rate. Let's take a closer look at how much VAT exists in Russia at the moment and what the difference is between them.

VAT 0%

Enterprises in the strategic raw materials and energy sectors, specializing in logistics operations for the import of various products and raw materials, are exempt from paying value added tax. In particular, this rate applies to the following goods and services:

- Export goods distributed under the free customs zone procedure;

- International delivery by all modes of transport with the final point of receipt located outside the Russian Federation;

- Services provided in the field of pipeline transport of oil and gas;

- Providing transport and containers for logistics operations carried out by companies registered outside the Russian Federation;

- Space sector of activity, sales of products and services for its maintenance;

- Various types of services and products for servicing foreign diplomatic missions

- Transfer for use of shipping vehicles built and registered in the Russian Federation.

This is only an incomplete list of services and products not subject to value added tax. Basically, it concerns export issues and is necessary to provide more favorable conditions for domestic organizations. Benefits are also created for strategically important areas of activity.

In order to be able to use 0 percent VAT, an organization must provide the appropriate package of documents to the tax service. In matters relating to import and export, appropriate permits and confirmations from the customs authority are also required. The zero rate is included in the declaration, which is submitted along with other company reports within the established deadlines.

An example of a real case when, at the request of a client, we analyzed the proposal of a “paper” VAT seller

A client contacted us and we categorically did not recommend working with “paper” VAT. But he read a lot of different chats on Telegram and convinced us to communicate with the specialists he found there. Allegedly, they came up with some kind of reliable scheme - they sold “paper” VAT, which did not create gaps in the VAT-2 ASK. He trusted us as experts, but he had an unbridled faith in miracles. I really believed that people who have been involved in illegal business all their lives could come up with a completely legal optimization scheme.

Well, okay, the client is good, we sat down to talk on Skype with the sketchers he had found. In general, they sold “paper” VAT for 4.5% (which is much higher than the market), and they promised that their invoices would not lead to a break in the ASK VAT-2 chains, since this VAT is “imported”. Allegedly, a certain company imports cosmetics and household chemicals, sells everything to the simplest (beauty salons and retail), and sells the VAT paid at customs upon import. And on this basis, the sellers of these deductions promised that everything would be “reinforced concrete”, because the VAT chain ends at customs. Of course, the first question we asked was “Where is the cache?” To which this unfortunate seller began to tell a story about the fact that this is a completely different specialization and that he only sells deductions, and to get cash we need to turn to other people. Which we knew perfectly well even without him. But we also knew that such a division applies only to those sellers of “paper” VAT who build long breaking chains. He didn't even understand the question!!! At the moment, we did not need a cache, we wanted to make sure that its legend was real, because, as we have already discussed above, in 99% of cases, excess deductions are accompanied by excess cache. Several attempts to explain this were met with counter-accusations of complete incompetence, supposedly everyone on the market does this.

Then we make another approach. This is an import. Accordingly, the money must be paid and go through customs (otherwise there can be no real VAT). This means that the importer needs a non-cash payment. To the question “Where then does the importer get the non-cash payment if you give only invoices without sending money,” our interlocutor gave an equally brilliant answer. In the tone of a parent answering a child’s question about why the Sun rises every morning, our interlocutor told us that his importer does not need a bank transfer, since “all literate boys have long been using cryptocurrencies for payments abroad!” Yes, cryptocurrencies are actively used for cross-border payments. But! They are used to pay for “gray” imports, when goods are imported bypassing customs, specifically so as not to pay import duties and import VAT. That is, cryptocurrencies and real “import” VAT are contradictory things. Which was obvious even to our client. The issue was unconditionally closed.

What do sellers of “paper” VAT tell you? What versions are offered to confirm that their deductions do not have gaps? Why are invoices provided from some companies, but payments must be made to others? After all, the real chain is not only connected in one direction by invoices, but also in the opposite direction by payments.