We continue the series of articles that are devoted to the legal and tax issues of concluding a contract. The previous article examined in detail the conditions for concluding a work contract, which have the same meaning for both parties to the contract (read more in No. 1 (January) “BUKH.1S”, p. 37). In the material offered, 1C:ITS specialists talk about what taxes the contractor must pay depending on the conditions contained in the contract.

Contract agreements are widely used in practice. It is concluded between organizations to perform various types of work. Let's consider what tax obligations arise for the contractor, who is one of the parties to this agreement.

Payment for work performed

The terms of the contract may provide for different payment procedures for work performed. These conditions affect the rules for calculating taxes for both the contractor and the customer. The customer can pay the contractor before the work begins or after it is completed.

Tax consequences

VAT

If the terms of the agreement provide for payment before the start of execution of the agreement (a separate stage), then VAT must be calculated and paid from the amount of the advance received (clause 2, clause 1, article 167 of the Tax Code of the Russian Federation). In this case, no later than five calendar days from the date of receipt of the advance payment, the contractor must issue the customer an “advance” invoice for this amount (clause 3 of Article 168 of the Tax Code of the Russian Federation).

After the work is completed (stage of work) and the acceptance certificate is signed, the contractor, on the basis of paragraph 14 of Article 167 of the Tax Code of the Russian Federation, again has the moment of determining the tax base for VAT. Therefore, he must also calculate VAT on the cost of the work performed and issue a “shipping” invoice to the customer. At the same time, he can submit the VAT paid on the advance payment for deduction from the budget (clause 8 of Article 171, clause 6 of Article 172 of the Tax Code of the Russian Federation).

If the customer transfers funds to the contractor after completion of the work, then he calculates VAT in relation to these works once on the date of signing the acceptance certificate for the work performed. Accordingly, he issues an invoice to the customer once.

Income tax

The procedure for reporting funds received from the customer in income for profit tax purposes depends on what method of income recognition the contractor uses.

If the contractor uses the accrual method, then income is recognized on the date of signing the acceptance certificate for the work performed, regardless of whether funds were actually received from the customer on this date or not (clauses 1, 3 of Article 271 of the Tax Code of the Russian Federation). This means that prepayment amounts received from the customer are not included in income until the completion of the work (clause 1, clause 1, article 251 of the Tax Code of the Russian Federation).

If the contractor uses the cash method, then the moment of recognition of revenue in income does not depend on the date of signing the acceptance certificate for the work performed. For such a contractor, revenue is included in income on the date of receipt of funds from the customer (clause 1, clause 1, article 251 of the Tax Code of the Russian Federation, clause 2, article 273 of the Tax Code of the Russian Federation).

Accounting info

5.1. Contractor accounting Specialized contracting construction and installation organizations are one of the subjects of investment activities carried out in the form of capital investments.

When performing construction contracts, contractors generate information on accounting items using the following indicators: 1) costs of performing contract work on accounting items in the reporting period and from the beginning of the construction contract; 2) work in progress in the context of accounting objects, including for paid or accepted for payment work performed by involved organizations under a construction contract; 3) income received from customers for objects handed over to them under a construction contract; 4) financial results for work performed under the construction contract; 5) advances received from developers for work performed. We list the options for maintaining accounting records for a contractor.

1) when the formation of costs is added up for accounting objects in the period from the beginning of the execution of a construction contract until the time of its completion (final payment for the completed construction project and its transfer to the developer).

2) when the costs of individual completed structural elements or stages of work, if the financial result is determined from them before the delivery of the construction project to the customer as a whole, can be taken into account as part of work in progress at the contractual cost.

The contractor's costs consist of all actual expenses incurred in connection with the contract work performed by him in accordance with the construction contract.

Costs are formed by accounting objects, during the period from the beginning of the construction contract to the time of its completion, that is, until the final payment for the completed construction project and its delivery to the developer.

The costs incurred to carry out the work are taken into account by the contractor on an accrual basis as work in progress, and interim payments are taken into account as advances received until the work under the contract is fully completed at the construction site.

Costs associated with the work

In the process of performing work, the contracting organization bears costs.

Such expenses, in particular, include the cost of purchasing materials necessary to complete the work, paying wages to employees, transportation costs, etc.

Tax consequences

VAT

VAT paid on the purchase of materials, etc., can be deducted by the contractor if the necessary conditions are met, that is, if the materials are purchased for activities subject to VAT, an invoice is received from the supplier of the materials and the materials are registered.

Income tax

Expenses associated with the performance of work are reflected in the contractor's tax records as follows.

A contractor who uses the accrual method and whose expenses are divided into direct and indirect, assigns direct expenses to the current expenses of the reporting (tax) period in which revenue from the work is recognized. In this case, indirect expenses in full relate to the expenses of the reporting (tax) period in which they were incurred (clause 2 of Article 318 of the Tax Code of the Russian Federation).

A contractor using the cash method recognizes costs associated with the performance of work as expenses after their actual payment, regardless of the recognition of revenue from the work (clause 3 of Article 273 of the Tax Code of the Russian Federation).

Provision of services – accounting entries

Author of the article Olga Evseeva 20 minutes to read 13,551 views Contents In this material we will look at the provision of services - accounting entries.

We will find out how services are reflected in accounting, how services are accounted for by the customer/performer, as well as what are the features of the provision of services by an agent.

We will answer frequently asked questions and analyze common mistakes. Service is a type of activity that cannot be expressed financially. Its results are provided to individuals and legal entities for a fee or are used in the course of business activities within the company. When providing any types of services, the parties to the transaction are:

- Consumer (customer).

- Service Seller,

Services are: (click to expand)

- Storage services;

- Other types of services.

- Auditing;

- Communication services (telephone, postal, Internet provider);

- Educational;

- Transport;

- Informational;

- Services in trade (work of consultants with clients, merchandisers for displaying goods, etc.);

- Legal;

- Medical services in various medical centers.

institutions; - For leasing premises, fixed assets, inventories, etc.;

The main document issued upon completion of the service is the Service Provision Certificate. Also, companies paying VAT draw up an invoice.

Reimbursement of expenses by the customer

The contract may provide that in addition to paying the cost of the work, the customer compensates the contractor for expenses that do not directly relate to the performance of the work, but without which it is impossible to complete the work. For example, travel expenses to the place of work, living expenses, etc. Are compensation amounts included in the tax base for VAT and income tax for the contractor?

Tax consequences

VAT

Chapter 21 of the Tax Code of the Russian Federation does not contain an answer to this question. However, there are two points of view on this issue.

Thus, in the opinion of the regulatory authorities, the contractor must include the reimbursement amounts received from the customer in the tax base for value added tax, since they are related to payment for work performed.

It does not matter that in contracts these expenses may be indicated separately from the cost of these works. The amounts are included in the tax base in the tax period in which the funds are received, and VAT on them is calculated at the rate of 18/118 (letter of the Ministry of Finance of Russia dated March 2, 2010 No. 03-07-11/37, dated November 9, 2009 No. 03- 07-11/288, etc.).

Some arbitration courts do not agree with this position. They believe that since the amounts of compensation received do not increase the cost of the work performed, then, therefore, they do not relate to the amounts that are associated with payment for these works, and therefore should not be included in the tax base for value added tax (resolutions of the Federal Antimonopoly Service of the North-West District dated 08/25/2008 in case No. A42-7064/2007, FAS Volga-Vyatka District dated 02/19/2007 in case No. A17-1843/5-2006, FAS East Siberian District dated 03/10/2006 No. A33-20073/04- S6-F02-876/05-S1 in case No. A33-20073/04-S6).

Since there is no clear answer to the question, the contractor will have to make the appropriate decision on his own. Moreover, if the contractor will charge VAT on the compensation amount, then he can issue an invoice in one of two ways. In the first case, the invoice is issued in one copy and is not presented to the customer. In the second case, the contractor issues an invoice in two copies, one of which is presented to the customer. Based on this invoice, the customer will be able to deduct VAT. Note that the second option is somewhat risky, since, according to regulatory authorities, the contractor does not have the right to issue an invoice to the customer for the amount of reimbursable expenses. The reason is that there is no sale of goods (works, services).

At the same time, the courts believe that the presentation of an invoice is possible (see decisions of the FAS North Caucasus District dated January 13, 2010 No. A53-9707/2009, dated January 20, 2009 No. A53-10111/2008-C5-44, FAS Moscow District dated 04/27/2010 No. KA-A40/4081-10, Federal Antimonopoly Service of the Ural District dated 05/25/2009 No. F09-3324/09-S3).

If the contractor does not include the reimbursement amounts in the VAT tax base, then he will not be able to deduct the VAT charged to him for these expenses by suppliers for the following reason. As you know, one of the conditions that must be met to deduct VAT is that the purchased goods (work, services) must be used in taxable activities. If these expenses are compensated by the customer, but are not included by the contractor in the VAT tax base, then it turns out that these expenses do not participate in taxable activities. Accordingly, VAT should not be deducted on such expenses.

Income tax

In Chapter 25 of the Tax Code of the Russian Federation there are no rules governing the procedure for recognizing for profit tax purposes the amounts that taxpayers receive as reimbursement of expenses. At the same time, in our opinion, the contractor should reflect them in tax accounting taking into account the following.

If the contractor includes costs that will be reimbursed by the customer as expenses, then he must recognize the received reimbursement amounts in income. If these costs are not included in tax accounting expenses, then the amounts reimbursed by the customer should not be reflected in income.

Accounting - postings for services

> > > September 17, 2021 Accounting for services - postings for transactions involving it will be discussed in the article - is regulated by PBU standards. 5 tbsp. 38 of the Tax Code of the Russian Federation). Services exist in a wide variety, in particular:

- real estate agents;

- communications;

- training, etc.

- consulting;

- transport;

- storage;

- audit;

- informational;

In accounting, all services are included in costs based on primary accounting documents.

Let's consider the main methods of accounting for services. Services are a type of activity that does not have material expression, the results of which are sold and consumed in the process of economic activity of the enterprise (clause

The main primary documents confirming the execution of services are:

- Agreement.

- Certificate of completion of work or other document confirming acceptance of services.

IMPORTANT!

The Ministry of Finance believes that if the agreement does not provide for a clause on drawing up an act, then it needs to be drawn up only in cases provided for by law (letter dated November 13, 2009 No. 03-03-06/1/750). The Civil Code obliges the drawing up of an act confirming the acceptance of work only in the case of a construction contract (Art.

720 of the Civil Code of the Russian Federation). The procedure for concluding and terms of the contract for the provision of services are regulated by Ch.

37–41, 47–49, 51, 52 Civil Code of the Russian Federation. The main actors in the contract are the contractor and the customer of the services.

Let's look at the accounting procedures for each of them. The contractor's accounting directly depends on the type of activity and taxation regime. Most often, companies providing services in order to reduce the tax burden choose special regimes: UTII or simplified tax system.

Along with them, OSNO can also be used.

- Income accounting.

Revenue from services provided is income from ordinary activities.

The procedure for its accounting is regulated by clause 5 of PBU 9/99. Postings from the contractor when selling services will be as follows:

- Dt 62 Kt 90.1 - reflects the sale of services.

Elimination of deficiencies in completed work

Sometimes, after completion of the work, the customer identifies shortcomings in the work performed and turns to the contractor with a demand to eliminate them. As a rule, the contractor eliminates these deficiencies free of charge. As a result of performing such work, he is faced with two questions: is it necessary to calculate VAT on the cost of gratuitous work and can the costs associated with the performance of this work be taken into account when taxing profits?

Tax consequences

VAT

In this case, the object of VAT taxation does not arise. The fact is that by eliminating deficiencies free of charge, the contractor, in fact, fulfills the obligations assumed under the contract. In turn, the cost of work under this agreement is already included in the VAT tax base. Therefore, there is no need to charge and pay VAT on the cost of “corrective” work.

Income tax

As for the recognition for profit tax purposes of the costs incurred by the contractor when carrying out work to eliminate deficiencies, they can be included in expenses in tax accounting on the basis of subparagraph 47 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation as losses from defects.

Accounting entries in construction

Capital construction is one of the leading sectors of material production.

Its operation ensures financial investments in the construction of real estate, their reconstruction, repairs, and repurposing. In the article we will talk about the features of accounting in construction companies for beginners, and also, using examples, we will look at operations that are typical for this industry. The procedure for organizing accounting in construction has a number of features characteristic of this industry. The specifics of reflecting accounting transactions are determined by certain factors, the main of which are:

- duration of the design and construction process;

- dependence of the quality and timing of construction of an object on its location;

- territorial isolation of construction projects (even during their mass production);

- the presence of various types of construction and installation work carried out during the construction of the facility.

To account for the costs of constructing a facility, use account 08 “Investments in non-current assets”, subaccount 3.

Due to the specifics of the industry, analytical accounting on this account is carried out in the context of the technological structure of expenses:

- design, survey and geodetic work;

- other construction costs.

- equipment, tools, inventory that do not require installation;

- direct construction work;

- installation of equipment;

One of the main entities involved in the construction process is the contractor - a construction company that performs work under a contract concluded with the developer.

The procedure for concluding such an agreement is regulated by the Civil Code of the Russian Federation, according to which work can be performed either directly by the contractor or by involved persons (subcontractors). The basis for the delivery and acceptance of work performed under a contract is an act approved and signed by each party.

The construction company can carry out the delivery of work as per the fact

We recommend reading: Occupational disease list of painter professions

The customer refused to fulfill the contract

The customer may refuse to fulfill the contract for various reasons. Moreover, this can happen when some of the work has already been completed. The contractor's tax obligations in case of such a refusal depend on whether he received an advance payment for the work performed or not.

Tax consequences

VAT

If the customer refuses to fulfill the contract when part of the work has already been completed, then he must pay the contractor for the work actually performed. The contractor, in turn, must calculate VAT on the cost of these works in the generally established manner. Moreover, if under such an agreement the contractor received an advance payment from the customer and paid VAT on it to the budget, then, when deducting this VAT at the time of calculating the tax on the cost of work performed, he must remember the following.

If the amount of the advance received does not exceed the cost of the work actually performed, then value added tax is deducted in full amount as of the date of tax calculation on the cost of the work actually performed. If the amount of the prepayment exceeds the cost of the work actually performed, the contractor first transfers the corresponding part of the prepayment to the customer, reflects this operation in accounting, and only after that deducts “advance” VAT (clause 5 of Article 171, clause 4 of Article 172 of the Tax Code of the Russian Federation ).

Income tax

The cost of the work actually performed, paid by the customer in the event of refusal to fulfill the contract, is the contractor’s proceeds from the implementation of the work. Under the accrual method, it is included in income for tax purposes in the period in which part of the work is completed and the relevant documents are signed (clause 1, article 39, clause 3, article 271 of the Tax Code of the Russian Federation).

Moreover, if the customer made an advance payment to the contractor, then the income includes an amount corresponding to the cost of the work performed.

A contractor using the cash method includes the advance in income on the date the cash is actually received. Therefore, if the customer refuses the contract, he must exclude from income the amount of the advance payment that exceeds the cost of the work actually performed.

So, we have looked at the tax consequences of entering into a contract for a contractor.

In the next issue we will talk about the tax obligations that arise when concluding an agreement with the customer.

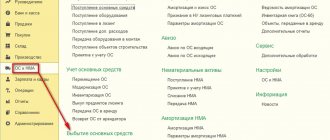

All information provided can be found in the ITS PROF system in the Handbook of Contractual Relations in the “Legal Support” section (see figure).

Rice. 1

How to formalize and record the income and expenses of a general contractor

- 3.

- 1.

- 6.

- 8.

- 2.

- 4.

- 7.

- 5.

If the construction contract does not provide for the contractor’s obligation to perform construction work independently, then the contractor may involve third parties to perform certain construction works. In this case, the contractor is, and the third parties involved by him are. At the same time, the general contractor is responsible to the developer for performing the entire range of works on the construction of the facility, including work performed by subcontractors. The general contractor can:

- carry out some of the work on our own, and some with the involvement of subcontractors;

- completely transfer the execution of construction work to subcontractors.

This is stated in Article 706 of the Civil Code of the Russian Federation. The relationship between the general contractor and the subcontractor is regulated by a construction subcontract agreement, to which the rules of Chapter 37 of the Civil Code of the Russian Federation apply.

The subcontractor is responsible to the general contractor for the quality of work, in particular, for violations of the requirements of technical documentation, building codes and regulations binding on the parties (clause 1 of Article 754 of the Civil Code of the Russian Federation). The general contractor is responsible to the developer for the consequences of non-fulfillment or improper fulfillment of obligations by the subcontractor, and to the subcontractor for the non-fulfillment or improper fulfillment of obligations by the developer under the contract.

At the same time, the developer and the subcontractor do not have the right to present claims to each other related to the violation of contracts concluded by each of them with the general contractor. Such rules are established in paragraph 3 of Article 706 of the Civil Code of the Russian Federation.

Proceed in a similar manner for the delivery and acceptance of work performed by the subcontractor.

The cost of construction and installation work accepted by the general contractor and performed by the subcontractor under a subcontract agreement is included in expenses for ordinary activities (clause 5 of PBU 10/99, clause 10 of PBU 2/2008).

Basis for reflecting the cost

Payment for work performed

The terms of the contract may provide for different payment procedures for work performed. These conditions affect the rules for calculating taxes for both the contractor and the customer. The customer can pay the contractor before the work begins or after it is completed.

Tax consequences

VAT

If the terms of the agreement provide for payment before the start of execution of the agreement (a separate stage), then VAT must be calculated and paid from the amount of the advance received (clause 2, clause 1, article 167 of the Tax Code of the Russian Federation). In this case, no later than five calendar days from the date of receipt of the advance payment, the contractor must issue the customer an “advance” invoice for this amount (clause 3 of Article 168 of the Tax Code of the Russian Federation).

After the work is completed (stage of work) and the acceptance certificate is signed, the contractor, on the basis of paragraph 14 of Article 167 of the Tax Code of the Russian Federation, again has the moment of determining the tax base for VAT. Therefore, he must also calculate VAT on the cost of the work performed and issue a “shipping” invoice to the customer. At the same time, he can submit the VAT paid on the advance payment for deduction from the budget (clause 8 of Article 171, clause 6 of Article 172 of the Tax Code of the Russian Federation).

If the customer transfers funds to the contractor after completion of the work, then he calculates VAT in relation to these works once on the date of signing the acceptance certificate for the work performed. Accordingly, he issues an invoice to the customer once.

Income tax

The procedure for reporting funds received from the customer in income for profit tax purposes depends on what method of income recognition the contractor uses.

If the contractor uses the accrual method, then income is recognized on the date of signing the acceptance certificate for the work performed, regardless of whether funds were actually received from the customer on this date or not (clauses 1, 3 of Article 271 of the Tax Code of the Russian Federation). This means that prepayment amounts received from the customer are not included in income until the completion of the work (clause 1, clause 1, article 251 of the Tax Code of the Russian Federation).

If the contractor uses the cash method, then the moment of recognition of revenue in income does not depend on the date of signing the acceptance certificate for the work performed. For such a contractor, revenue is included in income on the date of receipt of funds from the customer (clause 1, clause 1, article 251 of the Tax Code of the Russian Federation, clause 2, article 273 of the Tax Code of the Russian Federation).

Provision of services - accounting entries accounting for the provision of services

» » Accounting entries for services Accounting entries for transport services Accounting entries for sales of services The source of income for an enterprise can be not only the sale of goods, but also the provision of services. This activity has its own characteristics.

And this, naturally, is reflected in the accounting. Accounting entries for services for the customer and the contractor will, naturally, be different.

The service provider uses account 90 “Sales” for this purpose.

On it, actual expenses are taken into account as a debit, and as a credit, the revenue received is taken into account in accordance with the established tariffs. From the very specifics of the operation it follows that account 43 “Finished products” is not used in this case.

After all, services are always transferred directly to the client.

The answer to the question whether account 40 is used in this case (that is, “Output of products (services)”) depends on whether the enterprise uses the planned cost in current accounting.

Accordingly, the accounting entries for services in this case look like this: the amount of revenue from the debit of account 62 is transferred to the credit of account 90 (under subaccount 90-1).

This is how the debt for services rendered is reflected. The actual cost is taken into account by posting Debit 90-2 – Credit 20 “Main production” (or account 23). If the company pays VAT, then it is necessary to reflect the tax accrual - posting Debit 90 (under subaccount 3) - Credit 68 (under the subaccount of the corresponding tax).

When the buyer pays for the services, this will be reflected by an entry in which the amount of debt will be written off to the debit of account 51 from the credit of account 62.

Otherwise, the purchase of services from the customer is reflected. The costs of their purchase must be taken into account in accordance with PBU 10/99.

Expenses that are generated for ordinary activities include all costs for the acquisition of services, except those related to the creation or purchase of fixed assets or other non-current assets. As for the accounting entries for services directly, settlements with the contractor are reflected by entries Debit 60 - Credit 51 (this entry is made on the basis of a bank statement).

Costs associated with the work

In the process of performing work, the contracting organization bears costs.

Such expenses, in particular, include the cost of purchasing materials necessary to complete the work, paying wages to employees, transportation costs, etc.

Tax consequences

VAT

VAT paid on the purchase of materials, etc., can be deducted by the contractor if the necessary conditions are met, that is, if the materials are purchased for activities subject to VAT, an invoice is received from the supplier of the materials and the materials are registered.

Income tax

Expenses associated with the performance of work are reflected in the contractor's tax records as follows.

A contractor who uses the accrual method and whose expenses are divided into direct and indirect, assigns direct expenses to the current expenses of the reporting (tax) period in which revenue from the work is recognized. In this case, indirect expenses in full relate to the expenses of the reporting (tax) period in which they were incurred (clause 2 of Article 318 of the Tax Code of the Russian Federation).

A contractor using the cash method recognizes costs associated with the performance of work as expenses after their actual payment, regardless of the recognition of revenue from the work (clause 3 of Article 273 of the Tax Code of the Russian Federation).

Accounting for services in accounting transactions: accounting for an enterprise

General accountant with 15 years of experience.

When engaged in an activity that involves the sale of its own manufactured products or the provision of services, the enterprise must keep records of all transactions carried out for its own customers.

Now that I’m retired, in order not to become sour, I study what has changed in the industry and collect materials that are interesting to me. I hope they will be useful to you in your work - as long as the economy is working, you cannot do without accounting.

If the organization is a supplier, then the situation is much simpler, because in addition to shipping the goods and maintaining the correct document flow according to these procedures, you can practically not worry about the final result, because the counterparty makes payment for the products received. But if an organization sells its goods on its own, then it is necessary to connect additional accounts to record transactions for the sale of products.

Contents For many organizations, the main source of income is the sale of goods and (or) services. Sales are reflected in accounting at the time of shipment or at the time of payment.

Each type of reflection has its own postings for the sale of goods and (or) services.

The most common types of sales of goods and services are:

- Sale of goods and services – retail postings.

- Sales of goods and services – posting to wholesalers;

Let's take a closer look at each type of implementation.

An organization that is a supplier enters into an agreement for the sale of goods (services) with a counterparty who is a buyer. Sales transactions depend on the method of transfer of ownership of shipped goods:

- The organization recognizes ownership rights only after payment for the goods (services) sold.

- The organization recognizes ownership rights at the time of sale of goods (services), regardless of the terms of payment;

Accompanying documents for the sale of goods (services):

- Issue a consignment note TORG-12;

- Invoice issued (item.

Reimbursement of expenses by the customer

The contract may provide that in addition to paying the cost of the work, the customer compensates the contractor for expenses that do not directly relate to the performance of the work, but without which it is impossible to complete the work. For example, travel expenses to the place of work, living expenses, etc. Are compensation amounts included in the tax base for VAT and income tax for the contractor?

Tax consequences

VAT

Chapter 21 of the Tax Code of the Russian Federation does not contain an answer to this question. However, there are two points of view on this issue.

Thus, in the opinion of the regulatory authorities, the contractor must include the reimbursement amounts received from the customer in the tax base for value added tax, since they are related to payment for work performed.

It does not matter that in contracts these expenses may be indicated separately from the cost of these works. The amounts are included in the tax base in the tax period in which the funds are received, and VAT on them is calculated at the rate of 18/118 (letter of the Ministry of Finance of Russia dated March 2, 2010 No. 03-07-11/37, dated November 9, 2009 No. 03- 07-11/288, etc.).

Some arbitration courts do not agree with this position. They believe that since the amounts of compensation received do not increase the cost of the work performed, then, therefore, they do not relate to the amounts that are associated with payment for these works, and therefore should not be included in the tax base for value added tax (resolutions of the Federal Antimonopoly Service of the North-West District dated 08/25/2008 in case No. A42-7064/2007, FAS Volga-Vyatka District dated 02/19/2007 in case No. A17-1843/5-2006, FAS East Siberian District dated 03/10/2006 No. A33-20073/04- S6-F02-876/05-S1 in case No. A33-20073/04-S6).

Since there is no clear answer to the question, the contractor will have to make the appropriate decision on his own. Moreover, if the contractor will charge VAT on the compensation amount, then he can issue an invoice in one of two ways. In the first case, the invoice is issued in one copy and is not presented to the customer. In the second case, the contractor issues an invoice in two copies, one of which is presented to the customer. Based on this invoice, the customer will be able to deduct VAT. Note that the second option is somewhat risky, since, according to regulatory authorities, the contractor does not have the right to issue an invoice to the customer for the amount of reimbursable expenses. The reason is that there is no sale of goods (works, services).

At the same time, the courts believe that the presentation of an invoice is possible (see decisions of the FAS North Caucasus District dated January 13, 2010 No. A53-9707/2009, dated January 20, 2009 No. A53-10111/2008-C5-44, FAS Moscow District dated 04/27/2010 No. KA-A40/4081-10, Federal Antimonopoly Service of the Ural District dated 05/25/2009 No. F09-3324/09-S3).

If the contractor does not include the reimbursement amounts in the VAT tax base, then he will not be able to deduct the VAT charged to him for these expenses by suppliers for the following reason. As you know, one of the conditions that must be met to deduct VAT is that the purchased goods (work, services) must be used in taxable activities. If these expenses are compensated by the customer, but are not included by the contractor in the VAT tax base, then it turns out that these expenses do not participate in taxable activities. Accordingly, VAT should not be deducted on such expenses.

Income tax

In Chapter 25 of the Tax Code of the Russian Federation there are no rules governing the procedure for recognizing for profit tax purposes the amounts that taxpayers receive as reimbursement of expenses. At the same time, in our opinion, the contractor should reflect them in tax accounting taking into account the following.

If the contractor includes costs that will be reimbursed by the customer as expenses, then he must recognize the received reimbursement amounts in income. If these costs are not included in tax accounting expenses, then the amounts reimbursed by the customer should not be reflected in income.

Accounting and tax accounting of operations under a construction contract

GENERAL PROCEDURE FOR ACCOUNTING AND DOCUMENTARY OPERATIONS When maintaining accounting records of transactions performed as part of the execution of a construction contract, the parties (customer and contractor) must be guided by the general accounting rules enshrined in the Accounting Law and in all accounting regulations in force today .

In this case, first of all, of course, you need to be guided by two documents: - Accounting Regulations

“Accounting for agreements (contracts) for capital construction”

(PBU 2/94), approved by Order of the Ministry of Finance of Russia dated December 20, 1994 N 167 (hereinafter referred to as PBU 2/94); — Regulations on accounting of long-term investments, approved by letter of the Ministry of Finance of Russia dated December 30, 1993 N 160 (hereinafter referred to as the Regulations on investment accounting). When using these documents, keep in mind that they were adopted quite a long time ago.

Since then, the accounting regulatory framework has changed significantly. Therefore, today these documents are largely outdated and are used to the extent that they do not contradict later regulatory documents governing accounting procedures. For example, in the Regulations on Investment Accounting there is clause.

3.1.7, which defines the procedure for accounting for costs that do not increase the cost of fixed assets. Such costs, in particular, include costs associated with the demolition of buildings when allocating land plots for construction, costs of paying interest on bank loans in excess of the discount rates of the Central Bank of the Russian Federation, etc. expenses. However, when forming the initial cost of fixed assets, it is currently necessary to be guided exclusively by the norms of the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01 (approved by Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n).

And paragraph 8 of PBU 6/01 stipulates that the initial cost of a fixed asset is formed based on the entire amount of actual costs associated with its construction. Therefore, the question of including certain costs

Elimination of deficiencies in completed work

Sometimes, after completion of the work, the customer identifies shortcomings in the work performed and turns to the contractor with a demand to eliminate them. As a rule, the contractor eliminates these deficiencies free of charge. As a result of performing such work, he is faced with two questions: is it necessary to calculate VAT on the cost of gratuitous work and can the costs associated with the performance of this work be taken into account when taxing profits?

Tax consequences

VAT

In this case, the object of VAT taxation does not arise. The fact is that by eliminating deficiencies free of charge, the contractor, in fact, fulfills the obligations assumed under the contract. In turn, the cost of work under this agreement is already included in the VAT tax base. Therefore, there is no need to charge and pay VAT on the cost of “corrective” work.

Income tax

As for the recognition for profit tax purposes of the costs incurred by the contractor when carrying out work to eliminate deficiencies, they can be included in expenses in tax accounting on the basis of subparagraph 47 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation as losses from defects.

Features of accounting and taxation for a contractor

02.10.2021 | Buhscheta.ru A contract is an agreement under which one party (contractor) undertakes to perform certain work on the instructions of the other party (customer) and deliver the result to the customer, and the customer undertakes to accept the result of the work. The Civil Code of the Russian Federation defines a list of works performed under a contract, which includes: a) manufacturing of a thing; b) processing (processing) of a thing; c) performing other work and transferring its result to the customer.

Under a contract concluded for the manufacture of a thing, the contractor transfers the rights to it to the customer. Accounting Regulations PBU 2/2008 “Accounting for Construction Contracts” ((hereinafter referred to as PBU 2/2008), approved by Order of the Ministry of Finance of the Russian Federation dated October 24, 2008.

No. 116n regulates the specifics of the procedure for the formation in accounting and disclosure in financial statements of information on income, expenses and financial results by organizations (with the exception of credit organizations and state (municipal) institutions) that are legal entities under the legislation of the Russian Federation and acting as contractors or as subcontractors in construction contracts, the duration of which is more than one reporting year or the start and end dates of which fall on different reporting years. Contract agreements subject to PBU 2/2008 include the following agreements:

- other services inextricably linked with the facility under construction;

- engineering and technical design in construction;

- construction contract;

- to carry out work on the restoration of buildings, structures, ships;

- for the liquidation (dismantling) of buildings, structures, ships, including associated environmental restoration.

- provision of services in the field of architecture;

The contractor can choose one of the accounting methods. The first method, when costs are added up by object

What are the benefits of transferring accounting functions?

Outsourcing is the transfer of certain functions of an organization to a specialized company. By the way, this phenomenon is not domestic, but came to us from abroad.

In the United States, the services of accounting companies are used by about 92% of small and medium-sized businesses, in Western European countries - 86%. In Russia, the accounting outsourcing market is developing rapidly, but has not yet reached such figures.

Perhaps the main principle of outsourcing can be formulated as follows: trust us with what we can do better than others, and do what you can do better than others. In other words, the customer company, transferring accounting to an outsourcing company, can concentrate all its efforts on developing the main line of business. This saves time and money on organizing financial work, which is necessary if you have internal accounting.

Organization of internal control over accounting

Most often, accounting outsourcing is used in the following situations:

- a newly created enterprise or individual entrepreneur does not have the financial capacity to equip a workplace and pay a full-time accountant;

- the company does not have full-time specialists to perform one-time procedures (for example, audit) or certain functions (for example, payroll and personnel records);

- business requires multilateral expert support, for example, when collaborating with foreign companies, executing non-standard transactions;

- to relieve your own accounting department in case of unplanned absence of a full-time accountant (due to illness, force majeure);

- when the qualifications of internal employees do not meet the stated requirements of the organization;

- if there are conflict situations between the company’s management and the chief accountant/accounting department. By the way, we wrote about why it is better for two founder friends to outsource accounting.

It is important to understand that accounting must be carried out continuously and in full. Failure to comply with this principle is fraught with violation of the law, which leads to the imposition of fines and penalties from regulatory authorities. Restoration of “neglected” accounting and financial sanctions (often multimillion-dollar) from government agencies can jeopardize both the financial situation and the existence of the company as a whole.

Who is responsible for organizing accounting

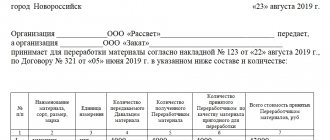

Primary documents for accounting of services provided to us

Look at examples of primary documents.

Look at the tabular parts of the documents - everywhere they indicate the name of the service, department (if necessary), expense account (correspondent account), amount. And in the header of the document we indicate the service provider and the contract. If necessary, also information about the supplier's invoice.