FREE CONSULTATION WITH A LAWYER

Tel.

+7 (800) 302-65-54 Free in Russia

Vacation is one of the basic guarantees for employees, to which they are entitled both under a regular and a fixed-term employment contract. However, the procedure for calculating rest days is different, since the employee usually works fewer months than required. Calculation rules and examples are described below.

Expert opinion

Chadova Svetlana

Leading HR specialist, lawyer, labor law consultant, website expert

Previously, we talked about the rules for using and calculating compensation for unused vacation; we recommend that you also read this material at the link here.

Is it allowed?

From the point of view of current legislation, conscripts are in many ways similar to permanent workers. Including in terms of the duration of paid leave.

According to Article 115 of the Labor Code of the Russian Federation, its annual duration must be at least 28 calendar days . Exceptions:

- if the duration of this period does not exceed 2 months;

- if the contract is concluded for seasonal work.

Under these circumstances, Articles 291 and 295 of the Labor Code of the Russian Federation dictate other requirements. An employee whose agreement provides for at least one of these conditions receives 2 working days of vacation for each month of work.

28 calendar days is the minimum duration of leave for conscripts. But if the contract provides for seasonal work and/or its validity period is less than 2 months, then the employee is awarded 2 working days of vacation for each month worked.

Let's look at an example. A certain applicant Trofimov entered into an employment agreement to perform seasonal work. The agreed period is 3 months. According to the terms of the agreement, he begins his duties from 06/01/2017 to 08/31/2017. After this period (09/01/2017), the employee is granted paid leave. The duration of rest is calculated as follows:

- Trofimov fully worked out the agreed period: June, July and August.

- For each of these 3 months he is entitled to 2 working days of vacation. In total, for the entire period of his activity he receives 6 such days, which begin on 09/01/2017 and end on 09/07/2017.

- These 6 days of vacation are paid by the employer.

- In fact, it lasts 7 calendar days. After all, September 4th falls on Sunday. The employer does not have to pay for this holiday.

Holidays are not included in the vacation period. There is also no charge for them. This rule is regulated by Art. 120 Labor Code of the Russian Federation.

Legislative framework: 3 calculation rules

The Labor Code provides for the provision of vacation days not only for employees with an open-ended contract, but also when signing an agreement before a specific date, for example, to perform seasonal work or when replacing an employee who has gone on maternity leave. It is important for how many months the contract was signed:

- If its duration is 2 months. and less, then for each month. 2 working days are provided for rest, i.e. maximum number of days – 4.

- The duration of rest is determined in a similar way for those employees whose agreements directly indicate that they perform seasonal work (usually their duration is no more than 6 months).

- If the agreement is signed for more than 2 months, and when performing seasonal work for more than 6 months, then the rest time is calculated according to the general rules. According to them, for each month an employee earns 2.33 days of rest. This number is obtained by dividing 28 days by 12 months.

Expert opinion

Chadova Svetlana

Leading HR specialist, lawyer, labor law consultant, website expert

We also recommend that you familiarize yourself with how to properly apply for sick leave during vacation; see detailed instructions here.

It is important to understand that for employees with a fixed-term contract, vacation is measured not in calendar days, but in working days. This means that only such days need to be taken into account when calculating, and according to the explanations of the Ministry of Labor, it should be based on a 6-day working week, and holidays should not be taken into account, as in all other cases.

The exception is when the agreement is valid for more than 2 months, and for seasonal workers - more than 6 months. In these cases, the calculation is made according to the general rules, i.e. vacation is measured in calendar days; Holidays are also not included in the vacation period.

Each employee can use rest only if he has worked continuously for at least 6 months (the period on sick leave is also counted towards continuous service). An exception is made for certain categories of workers - minors, women before maternity leave, as well as women or men who have adopted a child under 3 months of age.

Expert opinion

Chadova Svetlana

Leading HR specialist, lawyer, labor law consultant, website expert

Thus, in most cases, the employee will not receive rest days as such, but monetary compensation for unused vacation. However, by agreement of the parties, he can use these days for rest

Vacation pay calculation

The principle of financing vacation under a fixed-term contract is directly related to the amount of his average salary. The latter is calculated in accordance with Art. 139 Labor Code of the Russian Federation. The average salary must be multiplied by the number of vacation days. The resulting value will be the amount of funds that the employer must allocate.

Average earnings per working day × number of vacation days = amount of vacation pay for a fixed-term employment contract.

Example

A fixed-term contract was concluded with employee Shelyagina I.S. to perform seasonal work. Starting in April 2021, Shelyagina worked for 6 months in a row. The monthly salary was 50,000 rubles.

In September of the same year, the contract came to an end. It's time to calculate vacation pay. How much does the employer ultimately have to pay?

First you need to calculate the average salary. To do this, you need to know Shelyagina’s total income that she received for the entire period of seasonal work: 50,000 rubles. × 6 months = 300,000 rubles. Now you can calculate the average income per day. Employee Shelyagina worked honestly for 154 working days.

| April | 26 days |

| May | 24 days |

| June | 25 days |

| July | 27 days |

| August | 26 days |

| September | 26 days |

In total, she received 300,000 rubles: 154 days. = 1948.05 rubles for one working day. When Shelyagina worked for 6 months, she was entitled to a vacation of 6 months. × 2 days/month = 12 days. Vacation pay will be: 12 days. × 1948.05 rubles/day = 23,376.6 rubles.

The same principle of calculation is also valid for those “conscripts” whose employment agreements are concluded on standard terms. In other words, they do not fall under the previously mentioned exceptions to Art. 115 Labor Code of the Russian Federation.

For example, Shelyagina worked for the same 6 months, but no longer in seasonal work. Let's say she replaced another employee in an organization. In this case, vacation pay would be calculated differently. Instead of 12 days, the employee was entitled to at least 28. And then the employer’s costs would be 28 days. × 1948.05 rubles/day = 54,545.4 rubles.

Algorithm and practical examples of vacation calculation

To understand how the duration of vacation is calculated for a fixed-term employment contract in a given case, you can consider several examples from real labor practice. In general, the following algorithm works:

- We determine the type of fixed-term contract - up to 2 months or more, up to 6 months (for seasonal work) or more.

- We determine the number of days that the employee actually worked in full.

- We calculate the average salary for 1 day.

- We determine the number of days for vacation or the amount of compensation that the employee must receive on the last working day (also the day of dismissal).

EXAMPLE 1. Seasonal work

An employee is hired for seasonal work, the contract is signed for 6 months. His salary is 25,000 rubles per month, and he worked all the allotted time and did not go on sick leave, unpaid leave, etc. Then you first need to determine the total number of working days. Let's assume that he works during a normal 5-day workweek, which works out to 21 days in 1 month. In 6 months – 126 days. Then 6 months * 25,000 rubles = 150,000 rubles.

Average daily earnings 150,000/126 = 1,190 rubles. The number of vacation days is determined to be 2 for each month, i.e. total 6*2 = 12 days. Then the company has the right, at its own choice (or by agreement with the employee himself), to provide either 12 working days of vacation, or 12 * 1190 = 14,280 rubles in compensation upon dismissal. It is also subject to personal income tax, so minus 13% the amount will be 12,423 rubles.

Expert opinion

Chadova Svetlana

Leading HR specialist, lawyer, labor law consultant, website expert

EXAMPLE 2. An employee quits early

For the same example, let’s imagine a situation in which an employee, although he signed a fixed-term employment contract, worked less than the required period. Let's say he quits after 4 months, not 6. Then the calculation of compensation is carried out for the time actually worked, i.e. it turns out 4*2 = 8 working days.

However, let’s assume a situation where a contract for seasonal work was concluded for 8 months, of which the employee worked only 4. Formally, leave should be calculated according to the general rules, since the employment agreement was signed for a period of more than 6 months. However, in fact, less than this period was worked. In this case, the TC takes the employee’s side, i.e. compensation should be calculated on a general basis.

Expert opinion

Chadova Svetlana

Leading HR specialist, lawyer, labor law consultant, website expert

EXAMPLE 3. An employee worked for less than a month

In this case, the general rule applies that if actual work is less than half of the month, this month is not counted at all. If the employee has worked more than half, the month should be considered full.

For example, let’s say that in the described case the employee worked for 4 months. and another 15 working days (half is 10-11 working days, depending on the number of days per month). Then it is necessary to assume that he worked conditionally for 5 months, therefore he is entitled to a vacation of 5 * 2 = 10 working days or provision of monetary compensation for the same period.

Registration procedure

When drawing up a short-term contract, it is important to pay attention to how to register vacation correctly in order to avoid further disagreements. An agreement focused on a seasonal type of activity may contain the following provision: “Taking into account the seasonal nature of the work, the employee is granted leave in accordance with Art. 295 of the Labor Code of the Russian Federation, according to which 2 paid days are accrued for each month worked.”

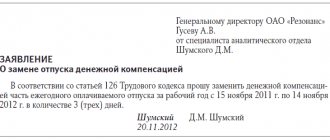

The number of vacation days may be increased, but this will require the written consent of both parties. An employee has the right to request leave both during the working period and at the very end. The latter option involves subsequent dismissal. To do this, you need to draw up an application approximately in the following template:

Please note that the first 12 months of working in a new company are not without pitfalls. As Art. 122 of the Labor Code of the Russian Federation, the employee has the right to provide leave under a fixed-term employment contract only after 6 full working months in a row.

Taking leave is possible even if its duration exceeds the time frame of the employment contract.

In this case:

- All settlements with the employee must be made before the start of his vacation.

- The day the vacation ends is noted in advance in the work book as the date of official dismissal.

- Other related documents are also prepared in advance.

Example. The validity period of the contract for seasonal work, which lasted for 7 months, is coming to an end on August 11. An employee who worked under the terms of this document has the right to request paid leave for 14 days. Guided by Article 127 of the Labor Code of the Russian Federation, he asks to be granted it from August 10 to August 24, followed by dismissal.

As a result, he will cease to be on the staff of this organization only on August 24th . However, calculations of vacation pay and issuance of a work book must be made before August 10th. ;

Compensation

For certain reasons, an employee may not take advantage of the right to go on vacation. Then the employer is obliged to pay him compensation. It is accrued for the number of full months worked by this employee.

A “full working month” subject to compensation is 15 or more days worked. Letter of Rostrud 944-6.

As a result, the employee is accrued 2.33 days of vacation for each month worked . Their cost is paid by the employer.

For short-term and seasonal contracts

In addition to the duration of rest, short-term and seasonal employment contracts differ in the amount of compensation for unused vacation.

For short-term and seasonal contracts, compensation is calculated at the rate of 2 days for each fully worked month.

Another tricky nuance is the actual time worked. An illustrative example is described below.

Example

An employment agreement was concluded for a period of more than two months and a non-seasonal type of work. The contract provides for the opportunity to take vacations. However, the employee took advantage of this opportunity without even working for two full months.

How to calculate the duration of vacation in this case? The period of its actual activity is less than 2 months. Does this mean he is only entitled to rest for 2 days, as with a short fixed-term contract?

No, that's not true. The resolution of this issue is affected only by the terms of the signed agreement. This example does not fall within the exceptions of Art. 115 Labor Code of the Russian Federation. Therefore, the employee is entitled to a standard period of rest. The number of months actually worked does not matter here.