Taxation when performing R&D

A scientific budget organization conducts business activities in the form of R&D on the basis of business agreements (including with foreign customers), which are exempt from VAT in accordance with paragraphs. 16 clause 3 art. 149 of the Tax Code of the Russian Federation.

1. Should we register in the sales book invoices issued for these transactions, including for advances received, if there is no obligation to calculate VAT?

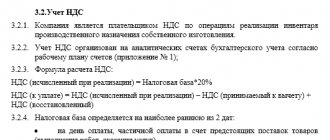

2. On what date should exchange rate differences on revenue from foreign customers be calculated in order to determine the tax base for calculating income tax? Has anything changed in the regulations on these issues?

1

.

In accordance with paragraphs

16 clause 3 art. 149 of the Tax Code of the Russian Federation, the implementation of research and development work by educational institutions and scientific organizations on the basis of business contracts is an operation not subject to taxation on the territory of the Russian Federation.

According to paragraph 1 of Art.

148 of the Tax Code of the Russian Federation, the place of implementation of work

during research and development work is the territory of the Russian Federation, if

the buyer of the work carries out activities on the territory of the Russian Federation

.

The buyer's place of business is considered to be

territory of the Russian Federation in the case of the actual presence of the buyer of works on the territory of the Russian Federation on the basis of state registration of the organization, and in its absence - on the basis of the place specified in the constituent documents of the organization, the place of management of the organization, the location of its permanent executive body, the location of the permanent representative office (if works (services) are provided through this permanent establishment).

According to paragraph 1 of Art. 146

The following transactions are recognized as subject to VAT taxation:

1) sale of goods ( works

, services)

on the territory of the Russian Federation

.

2) transfer of goods on the territory of the Russian Federation (performance of work, provision of services) for one’s own needs

, expenses for which are not deductible when calculating corporate income tax;

3) execution of construction and installation works

for own consumption;

4) import

goods into the customs territory of the Russian Federation

.

That is, the implementation of work

is recognized as an object of VAT taxation only if

the place of implementation of work is the Russian Federation

.

Therefore, performing R&D for foreign companies in your situation is not subject to VAT, not due to the exemption on the basis of clauses 16 clause 3 art. 149 Tax Code of the Russian Federation

, but because this operation

is not subject to VAT

(unless your foreign customers act through their permanent representative office in the Russian Federation).

Thus, when performing work exempted

from taxation with value added tax in accordance with

Art.

149 of the Tax Code of the Russian Federation or

not recognized as an object of taxation

by this tax in accordance with

Art.

148 of the Tax Code of the Russian Federation , value added tax

is not calculated

.

Accordingly, the tax base for value added tax is not determined

.

Consequently, the norm of Art. 167 Tax Code of the Russian Federation

, on the basis of which the day of receipt of

advance payments

(partial payment) towards the upcoming completion of work is the moment of determining

the tax base

does not apply

to such work .

In this regard, advance payments

, received by you on account of the upcoming implementation of research and development work, exempt from VAT taxation in accordance with

paragraphs

16 clause 3 art. 149 of the Tax Code of the Russian Federation , as well as research and development work that is not subject to VAT taxation according to

paragraphs.

4 paragraphs 1 art. 148 of the Tax Code of the Russian Federation

are not subject

to value added tax .

As for the preparation of invoices, clause 3 of Art. 169 Tax Code of the Russian Federation

obliges taxpayers

to prepare invoices

, in particular, when performing transactions

recognized as subject to VAT taxation

, including

those not subject to taxation

(exempt from taxation) in accordance with

Art.

149 Tax Code of the Russian Federation .

Since performing R&D for foreign customers who do not have permanent representative offices in the Russian Federation is an operation not recognized as an object of VAT taxation

should not

issue invoices for these works (including when receiving advance payments) .

In accordance with paragraph 5 of Art. 168 Tax Code of the Russian Federation

when selling goods (works, services), the sales operations of which

are not subject to taxation

(exempt from taxation), settlement documents, primary accounting documents are drawn up and

invoices are issued

without allocating the corresponding tax amounts. In this case, the corresponding inscription or stamp “Without tax (VAT)” is made on these documents.

You must apply this procedure for issuing invoices when performing R&D for customers operating in the Russian Federation (including for foreign customers operating through their permanent representative offices in the Russian Federation).

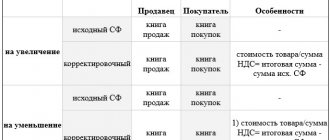

On the issue of drawing up invoices when receiving advances

from buyers on account of the upcoming supply of goods (as well as the performance of work, provision of services),

exempt

from VAT, the Ministry of Finance of the Russian Federation in a letter dated August 25, 2005 No. 03-04-11/209 reported that since

VAT is not calculated

and accordingly, tax deductions for VAT

are not made

; invoices

should not be

.

However, there is another point of view.

Its supporters note that clause 18 of the Rules of Conduct

journals of records of received and issued invoices, purchase books and sales books when calculating value added tax, approved by Decree of the Government of the Russian Federation of December 2, 2000 No. 914, obliging sellers to draw up and register invoices in the sales book upon receipt of funds in the form of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services),

does not make exceptions

for cases of receiving advance payment for transactions exempt from taxation in accordance with

Art.

149 Tax Code of the Russian Federation .

Although it is obvious that issuing such an invoice and registering it first in the sales book, and then (based on clause 13 of the Rules...) in the purchase book when shipping goods (performing work, providing services) does not make any sense, because the size of the tax base this does not change VAT.

In addition, the Government of the Russian Federation, in accordance with clause 8 of Art. 169 Tax Code of the Russian Federation

has the power to establish only

the procedure for maintaining a journal

of invoices received and issued,

purchase books and sales books

, and not to determine when taxpayers must prepare invoices.

does not directly provide for the obligation of taxpayers to prepare invoices for advances.

.

Thus, there is no clear answer to the question about the need to issue invoices when you receive an advance payment for R&D, the customer of which operates on the territory of the Russian Federation.

At the same time, the absence of invoices is, in accordance with Art. 120 Tax Code of the Russian Federation

a gross violation of the rules for accounting for income and expenses and objects of taxation and is punishable by a fine in the amount of

5 to 15 thousand rubles

.

To be on the safe side, you can send a request to your tax office, not forgetting to mention the position of officials of the Ministry of Finance of the Russian Federation that is favorable to you, or ask this question directly to the Ministry of Finance and be guided by the clarifications received.

2

.

For income in the form of a positive exchange rate difference

on property and claims (liabilities), the value of which is expressed in foreign currency, the date of receipt of income is the date of transfer of ownership of the foreign currency, as well as the last day of the current month (

clause 7, clause 4 of Art. 271 Tax Code of the Russian Federation

).

For expenses in the form of negative exchange rate differences

for property and claims (liabilities), the value of which is expressed in foreign currency, the date of expenses is the date of transfer of ownership of foreign currency when performing transactions with foreign currency, as well as the last day of the current month (

clause 6, clause 7 of Art. 272 of the Tax Code of the Russian Federation

).

Income and expenses expressed in foreign currency

, for tax purposes are recalculated into rubles at the official rate established by the Central Bank of the Russian Federation

on the date of recognition of the corresponding income (expense)

.

Obligations and claims expressed in foreign currency, property in the form of currency values are converted into rubles

at the official rate established by the Central Bank of the Russian Federation

on the date of transfer of ownership

when carrying out transactions with such property, termination (fulfillment) of obligations and claims and (or)

on the last day of the reporting (tax) period

, depending on what happened earlier (

clause 8 Article 271 of the Tax Code of the Russian Federation, paragraph 10 of Article 272 of the Tax Code of the Russian Federation

).

Thus, you must recognize income and expenses in the form of exchange rate differences arising in settlements with foreign customers on the date the foreign customer makes the payment or on the last day of the reporting (tax) period, whichever occurs first.

Accounting for other expenses

An organization has the right to take into account expenses not directly mentioned in paragraph 2 of Article 262 of the Tax Code of the Russian Federation as other R&D expenses. There is one condition: the costs must be directly related to the implementation of research or development. For example, these could be:

- consulting fees;

- products of own production, used as components and semi-finished products when performing R&D;

- works and services of a production nature performed on a self-employed basis;

- accrued depreciation on fixed assets partially used for R&D.

Such clarifications follow from the letter of the Federal Tax Service of Russia dated May 31, 2013 No. ED-4-3/9941.

The amount of other expenses not exceeding 75 percent of the organization’s expenses for remuneration of employees involved in R&D, the organization performing R&D according to the list approved by Decree of the Government of the Russian Federation of December 24, 2008 No. 988, has the right to take into account in the amount of actual costs increased by an increasing factor 1.5 (clause 7 of article 262 of the Tax Code of the Russian Federation). The amount of other expenses exceeding the limit (including accrued depreciation, labor and material expenses) can be written off only in the amount of actual expenses (without taking into account the increasing factor).

This procedure is established by subparagraph 4 of paragraph 2 and paragraph 5 of Article 262 of the Tax Code of the Russian Federation.

OSNO and UTII

Account for R&D expenses according to the rules of the taxation system in whose activities the development results will be used.

If the results of ongoing R&D will be used in both types of activities of the organization, then the costs of such work must be distributed (clause 9 of Article 274, clause 7 of Article 346.26 of the Tax Code of the Russian Federation). This is due to the fact that when calculating income tax, expenses related to the organization’s activities on UTII cannot be taken into account. This situation may arise, for example, if work is being done to improve a product that will be sold both through wholesale and retail trade. The cost of R&D related to only one type of activity does not need to be distributed.

For more information on how to allocate expenses related to both tax regimes, see:

- How to take into account income tax expenses when combining OSNO with UTII;

- How to deduct input VAT when accounting for taxable and non-taxable transactions separately.

simplified tax system

Organizations that pay a single tax on income do not take into account any expenses (including R&D expenses) when determining the tax base (Clause 1, Article 346.14 of the Tax Code of the Russian Federation).

Organizations that have chosen the difference between income and expenses as the object of taxation take into account R&D expenses when calculating the single tax. Recognize expenses in the manner established for organizations applying the general taxation system. This procedure is provided for in subclause 2.3 of clause 1 of Article 346.16 of the Tax Code of the Russian Federation.

Situation: is it possible to take into account R&D expenses in the initial cost of fixed assets (intangible assets)? The organization applies simplification.

Yes, you can.

This is explained as follows. The initial cost of fixed assets and intangible assets when applying the simplified procedure is formed according to the accounting rules (paragraph 9, paragraph 3, article 346.16 of the Tax Code of the Russian Federation). And in accounting, R&D expenses are included in the initial cost of fixed assets and intangible assets (paragraph 2, clause 8 of PBU 6/01, clauses 7, 9 of PBU 14/2007).

If, as a result of R&D, an industrially applicable design is obtained for which the organization does not plan to obtain exclusive rights, R&D expenses are included in the initial cost of the fixed asset.

If, as a result of R&D, a sample is obtained for which the organization plans to obtain exclusive rights, then the cost of R&D is also reflected in one of two ways:

- accounted for as part of intangible assets;

- written off as other expenses within two years.

This procedure is established by clause 9 of Article 262 of the Tax Code of the Russian Federation and follows from the right of an organization to independently choose a group of expenses if the costs incurred can simultaneously belong to several groups (clause 4 of Article 252 of the Tax Code of the Russian Federation).

If an organization applies a simplification and is a performer of R&D on orders from other organizations, then the costs incurred by it are taken into account as part of the expenses associated with carrying out activities aimed at generating income (see, for example, the letter of the Federal Tax Service of Russia for Moscow dated January 16, 2004 No. 21-09/02809). Such expenses are taken into account when calculating the single tax by cost item (for example, labor costs, purchase of materials, etc.) (Article 346.16 of the Tax Code of the Russian Federation).