I remember that in Soviet times, people lived with the idea that if they worked honestly and conscientiously at a young and mature age, then they would be guaranteed a calm and measured old age, full of respect from the younger generation. Those who managed to reach retirement age in the USSR, in most cases, encountered this. Many were really waiting for retirement, because... were firmly convinced that their services to the state and society would not be forgotten by anyone. Now the situation is different. Realizing the fact that the minimum pension as of the end of 2021 is about 15,000 rubles per month, a good part of the population becomes “terrified” about their future. You can probably “exist somehow” with this money, but no more. It’s good when there are two pensioners living in a family, to whom their adult children, and maybe even grandchildren, provide financial assistance. But what, one wonders, can we say about the lonely? Here things are much worse, as you yourself understand.

And yet, the desire not to go to work, to “spit on everyone” with their heads held high, sometimes outweighs them and, having reached retirement age, employees leave the organization, going on a well-deserved rest. Well, our task for today is to give the employer instructions on how to provide such rest for an employee, and also to understand what awaits the retiree at work and outside of it.

Old age retirement

In the Russian Federation, the assignment of labor (insurance) pensions for men and women has some differences, which are associated with the retirement age established at the legislative level:

- upon reaching age for men - 60 years, for women - 55 years. For some categories of citizens, an insurance pension may be assigned early;

- persons holding public positions since 01/01/2017 retire later than other categories of citizens. They are subject to an increased age, increasing by 6 months every year. As a result, men in this category will retire at 65 years old, and women at 63 years old. Read more about pensions for civil servants in a separate article;

- if you have work experience. In 2021, the minimum work experience is 9 years; in 2025, this figure must be at least 15 years. When recalculating the minimum length of service, the transitional provisions of Law No. 400 Federal Law of December 28, 2013 are taken into account;

- the presence of a minimum amount of pension coefficients. In 2018, the individual amount of pension points must be at least 13.8, in 2025 - 30.

The pensioner continues to work

If a retired employee decides to continue working in this organization, then all labor rights and obligations provided for in the legislation continue to apply to him (Part 2 of Article 9 of the Labor Code of the Russian Federation). Any restriction in his labor rights in connection with reaching retirement age is discrimination (Part 2 of Article 3 of the Labor Code of the Russian Federation).

Moreover, when an employee retires, he is provided with additional guarantees. For example, an organization is obliged, at the request of a working pensioner, to provide him with leave without pay for up to 14 calendar days a year (Part 2 of Article 128 of the Labor Code of the Russian Federation).

If an employee, having reached retirement age, continues to work in the organization, then no internal personnel documents need to be drawn up in connection with retirement. In this regard, there is no need to make entries related to retirement in the employee’s work book (clause 10 of the Rules approved by Decree of the Government of the Russian Federation of April 16, 2003 No. 225).

Remind the employee: starting from 2021, all working pensioners receive an old-age insurance pension and a fixed payment to it without taking into account planned indexations.

A working pensioner has the right to receive a pension. But starting from 2021, the insurance pension and the fixed payment to it are paid without taking into account planned indexations. This procedure is established by Article 26.1 of the Law of December 28, 2013 No. 400-FZ and Article 7 of the Law of December 29, 2015 No. 385-FZ.

If a pensioner stops working between October 1, 2015 and March 31, 2021, he can notify the Pension Fund of the Russian Federation about this. To do this, a person submits an application and the necessary documents to the Pension Fund of the Russian Federation. This can be done until May 31, 2021.

If the Pension Fund of the Russian Federation makes a positive decision after considering the application, the pensioner will be paid an insurance pension starting next month, taking into account indexation. If the pensioner then gets a job again, the size of his insurance pension will not be reduced.

Pensioners who stop working after March 31, 2016 do not need to submit an application to the Pension Fund of the Russian Federation. The fact is that from the second quarter of 2021, employers will report monthly to the Pension Fund about which people work in the organization (entrepreneur).

Such clarifications are provided by the Pension Fund of the Russian Federation in information dated January 13, 2021.

Individual pension coefficient

| ★ Best-selling book “Accounting from Scratch” for dummies (understand how to do accounting in 72 hours) purchased by {amp}gt; 8000 books |

First of all, we note that today in the Russian Federation old-age retirement is carried out by women at 55 years old, and by men at 60 years old. Under certain conditions, an employee has the right to early retirement, this includes cases of hard and harmful work, certain specialties, as well as work in the Far North and equivalent areas. You can read how to calculate the retirement age for workers in the Far North here.

Documentation of old age pension

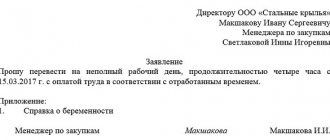

If an employee decides to resign voluntarily, then the first thing he needs to do is write a letter of resignation. You can read how to write it in this article. Moreover, in this case, a two-week work period will not be required; dismissal will be made on the day indicated in the application form.

Based on the employee’s application, the employer draws up an order using the unified T-8 form. The date of dismissal indicated in the order must coincide with the date of dismissal indicated in the application form. The reason for dismissal will be “at the initiative of the employee in connection with retirement (clause 3, part 1, article 77 of the Labor Code of the Russian Federation).”

The future pensioner must read the order and sign it.

A dismissal order drawn up in the prescribed form will serve as the basis for making appropriate entries in the employee’s work book and personal card. The grounds for dismissal must coincide with those specified in the order.

All civil pension rights in Russia are formed in pension coefficients (points). Their number depends on how much insurance contributions have been accrued and paid to the Pension Fund, as well as the amount of work experience. To avoid confusion, use the cheat sheet: which periods to include in the length of service.

The coefficients are formed for each year of work, provided that the employer has calculated and transferred or the citizen has personally paid insurance contributions for compulsory pension insurance.

The maximum number of pension points can be 8.7 in 2018, and 10 from 2021. The amount of accrual of annual pension coefficients is affected by the type of pension provision. If a citizen has chosen to form only an insurance pension, then the maximum you can receive is 10 pension points per year. If you choose two types of pension formation at once - insurance and funded, the maximum coefficient per year will be 6.25.

If an employee continues to work after retirement, he can count on an annual recalculation of his pension, which is carried out automatically. The basis for such an operation are the employer’s reports, which are submitted to the Pension Fund of the Russian Federation for each employee. Funds that were sent to the individual personal account of a pensioner during the previous year are subject to recalculation, provided that such funds were not taken into account in previously carried out calculations.

https://www.youtube.com/watch?v=ytabout

SP = SPST x SIPC,

where SP is the recalculated pension, SPST is the pension that is used for recalculation on July 31 of the current year, SIPC is the value of individual pension coefficients on the date of recalculation. In 2021, this cost is 81 rubles. 49 kopecks

Upon reaching retirement age, a citizen has the right to retire. When an employee retires, the employer is obliged to pay the following funds:

- wages;

- compensation for unused vacation.

In some organizations, according to the collective agreement, resigning employees are entitled to special payments in connection with retirement. The amount of such payments is established by the organization itself; such payments are not regulated at the legislative level.

If an employee resigns at the initiative of the employer (staff reduction, liquidation of the organization), then in addition to the above payments, the employee has the right to demand severance pay.

In modern society, employed pensioners have become increasingly common, regardless of the fact that they receive a pension.

According to Appendix No. 6 of Law No. 400-FZ of December 28, 2013, as amended on March 6, 2019, a woman will be considered to have reached retirement age in 2019 if she is 56 years old and a man is 61 years old. However, legislators have provided transitional provisions according to which, if employees reach retirement age in the period from 01/01/2019. until 31.12.

- 2019 – 60.6 years old man and 55.6 years old woman;

- 2020 – 61.6 years old male and 56.6 female

According to this law, it is not enough to have age indicators; you also need to have a minimum work experience of 10 years and an individual pension coefficient of at least 16.2 points.

The insurance period is a time period when an employee worked in production for a certain number of years and during this period, the organization made deductions of insurance contributions to the Pension Fund.

Workers who are exposed to hazardous production factors retire to a well-deserved retirement, women - at 45 years old, men - at 50 years old.

Pension benefits for long service are not provided to all citizens.

Those who are entitled to a long service pension are:

- Serving in the army, except contract soldiers;

- Astronauts;

- State and municipal employees;

- Aviation workers.

https://www.youtube.com/watch?v=ytpolicyandsafety

In this case, the time worked in favor of the state by military personnel must be at least twenty years, or at the time of dismissal the employee has reached 45 years of age and has a total work experience of 25 years, of which 12.6 were in military service.

If in 2021 a civil servant required 15 years of experience to retire, then, starting in 2021, its adjustment began to be applied, namely an increase of 6 months annually, and this will continue until the required 20 years.

According to Appendix No. 5 of Law No. 400-FZ of December 28, 2013, as amended on March 6, 2019, the age limits for retirement for employees and state employees have been increased. Moreover, the increase in the required age occurs gradually, increasing by 6 months for each year worked until the generally established age limits are reached.

Another innovation is contained in this law - by 2026, increase the minimum length of service for retirement according to length of service for this category of persons to 20 years, for example, in 2021 it is 16.6 years. This increase will also occur gradually - 6 months per year.

Employees of government agencies are granted an old-age pension when they reach retirement age. It is assigned when a disability is established for medical reasons, or due to the loss of one of the able-bodied family members.

With increasing length of service in an employee position, the pension amount is increased every three years to 75% of the average monthly earnings of such employees, minus the amount of old-age insurance benefits.

Old age pension is provided to citizens in the following situations:

- Reached retirement age;

- He is a citizen of the Russian Federation;

- He registered with the Pension Fund;

- The company makes deductions of insurance premiums for it.

The boss must remember that when his employee retires, this does not entail dismissal. If an employee, upon retiring, decides to resign, then the manager must terminate the employment contract on the day that the employee indicated in the resignation letter.

Next, he needs to contact the Pension Fund for the assignment of a pension, and the accounting staff must submit reports in the DAM form, in which they indicate the amount of insurance contributions and information about the insurance period.

Such a document is signed by the director of the organization and confirmed by a seal. This report can be submitted through telecommunications channels, that is, via the Internet, certified with an electronic digital signature.

After submitting personalized accounting information, the future pensioner writes an application to the Pension Fund office to be assigned a pension. He is required to submit for verification his passport, SNILS, work record book (original or notarized copy), a certificate of five-year average earnings, and certificates confirming the presence of children.

A pensioner can obtain such a certificate from any organization in which he worked and had income for five years.

https://www.youtube.com/watch?v=ytcopyright

A certificate of average salary for five years is issued within 3 days from the date of the employee’s application. It can be compiled by an employee of the HR department in any form.

What documents need to be submitted to the Pension Fund?

If a person obtains a pension independently, he must provide the Pension Fund with a package of necessary documents, which, according to Order of the Ministry of Labor and Social Protection of the Russian Federation dated November 28, 2014 No. 958n, includes:

- statement;

- passport;

- certificate of compulsory pension insurance (SNILS);

- work record book, employment contracts, civil, copyright contracts;

- military ID (if any);

- registration certificate;

- birth certificates of children (if any);

- educational documents;

- certificate of average monthly earnings for 5 consecutive years until 01/01/2002.

In some cases, the Pension Fund may request other documents (certificate from the employment center; certificates confirming the change of personal data (for example, last name), etc.).

According to the rules, an application for establishing a pension payment can be submitted no earlier than a month before the retirement age. This service must be provided within 10 business days.

Early retirement

Certain categories of employees have the right to early retirement. These categories include:

- Workers working in special conditions (for example, working in harmful or dangerous conditions);

- Workers working in the Far North or equivalent areas.

The full list of employees entitled to receive an early pension is specified in Articles 30 - 33 of the Federal Law of December 28, 2013 N 400-FZ “On Insurance Pensions”.

Employees have the right to early retirement if:

- women with work experience of 40 years or more, men with work experience of 45 years or more;

- persons working under harmful and dangerous working conditions: miners, metallurgists, railway workers, pilots, rescuers, etc.;

- mothers of many children with five or more children;

- visually impaired people and citizens injured during hostilities;

- working in the Far North and similar regions.

A complete list of persons who have the right to receive an early pension is given in Art. 30-32 of Law No. 400-FZ of December 28, 2013.

What you should pay attention to

Employers are advised to pay attention to the following points:

- a specialist from the employer can assist the employee in obtaining a pension, but is not obliged to issue a pension for the employee;

- employees may request proof of experience from the employer. They are needed if the entry in the work book was not certified by a signature or seal, or in the case when Pension Fund employees discovered errors or inaccuracies. These certificates are also required when applying for an early pension;

- The arrival of an employee's retirement age does not mean his dismissal. A person can choose: receive benefits and continue working or retire. You need to know that if a person applies for an insurance pension for the first time after the period of entitlement to it, then the amount of payment will increase every year due to premium coefficients;

- if an elderly employee who has received a pension expresses a desire to resign, the employer must terminate the employment contract within the period specified in the resignation letter (Part 3 of Article 80 of the Labor Code of the Russian Federation). In this case, the worker is not obliged to inform the employer of his intention to terminate the employment relationship at least two weeks before dismissal.

The Russian Pension Fund welcomes and recommends that policyholders (employing organizations) implement an electronic document management system using electronic signatures. If the reporting is provided in electronic form with an electronic signature, then it is not necessary to duplicate it in paper form. Insured organizations are required to use an electronic document management system if it is necessary to submit information for more than 25 employees. With fewer employees, the use of an electronic system is encouraged. The necessary software can be found on the Pension Fund website.

Territorial grounds for early retirement

The Russian Federation guarantees a pension to employees working in special territorial conditions, as well as in special working conditions.

There are categories of persons who have the right to receive a pension without waiting until retirement age. You can get acquainted with them in more detail in Art. 32 of Law No. 400-FZ dated December 28, 2013, as amended on March 6, 2019. Here are just a few of them:

- Women who have more than 5 children. In the case when a woman raises them until they are 8 years old, but at the same time she has at least 15 years of insurance experience. The pension is granted when she turns 50 years old.

- Parents raising disabled children under eight years of age, with the adoptive mother having 15 years or more of insurance coverage, and the adoptive father having 20 years or more.

- Citizens who became disabled due to injury as a result of participation in hostilities. Work experience for women is 20 years, for men - 25 years.

- People whose disability is prescribed due to diseases of the visual organs. At 50 years old - men and at 40 years old - women. This also happens if women have 10 years of experience and men 15 years.

- Persons whose work was carried out in the Far North.

There are persons whose right to early retirement must be confirmed:

- Those employed in jobs with hazardous working conditions and in hot production;

- Those working in educational structures, working with children and schoolchildren;

- Employees of medical institutions;

- City transport drivers;

- Women working in the textile industry;

- Northerners;

- Maritime related workers.

You can list many more jobs that are defined by a specially developed list of professions with working conditions harmful to humans.

Organizations compile lists of such beneficiaries by name, which indicate working conditions, employment at work (full or part-time) and other characteristics for each profession. Then these lists must be submitted to the Pension Fund authorities.

Employees who are dismissed due to the cessation of the enterprise's activities, or due to a reduction in rates, but who have seniority, can retire early.

When reaching retirement age, people can receive early retirement benefits at the request of labor exchange specialists.

- To do this, it is necessary that the person is recognized as unemployed and registered with the employment center.

- At the same time, the exchange cannot provide this person with a job suitable for his position.

- When people have two or three years left until retirement age for women and men, respectively.

- When an unemployed person has already completed his work experience, but has not yet reached retirement age.

These conditions for granting early retirement must be complied with.

We generate individual information about the employee

After the documents necessary for a pension to be assigned have been collected, the citizen must contact the employer with an application to provide the Pension Fund with personalized information about deductions from his salary for the current year. The employee indicates in the application the expected date of assignment of the pension in order to limit the period of payment of his insurance contributions in the current period to this date.

Within 10 calendar days after receiving this application, the head of the organization is obliged to provide to the territorial body of the Pension Fund of the Russian Federation:

- information about the citizen’s insurance experience in the SPV-2 form (data on the experience should be generated before the date of assignment and start of benefit payment, which the employee must have indicated in his application), certified by the manager’s signature and seal. The employee must be given a copy of this document (clause 4 of article 11 of the Federal Law of April 1, 1996 No. 27-FZ “On individual (personalized) registration in the compulsory pension insurance system”);

- inventory of the data provided according to form ADV-6-1.

Information for assigning a pension

In order for a citizen to be assigned a pension, he must contact the Pension Fund. In this case, the following package of documents is provided:

- application for a pension;

- passport;

- certificate of pension insurance;

- documents confirming that the citizen worked during the periods included in the length of service;

- an extract from the personal account of the future pensioner containing information about the individual pension coefficient;

- confirmation of activity for early assignment of pension.

The labor pension is assigned from the date of application, but not earlier than the date of retirement age. Let's consider how to register an employee's retirement in 2021.

Keep in mind that you can fire an employee due to retirement only once!

An employee, having decided to stop working, must submit a resignation letter at his place of work. The application is drawn up in any form, since the standard form of the document is not provided for by legislative acts. Based on the application, the employer issues an order to prepare documents in connection with the employee’s retirement.

How can a pensioner be useful?

And yet it is absolutely wrong to write off pensioners from accounts. Do not forget that in Russia the retirement age comes much earlier than many Western European countries, and at 60-65 years old a person, as a rule, is in relatively good shape and of sound mind. If he does not take the dexterity and willingness to go on adventures (a distinctive feature of the younger generation), then his professional and life experience will be a good help for the management team. You can consult with them, clarify their forecasts about the future development of the industry, based on their historical knowledge (not always, of course, but often). In a good situation, a retiree can become a good and, importantly, valuable mentor for the entire production department. Is it really worth persuading him to resign if he doesn’t want to leave?

Don't miss: “From budget to commerce. How can an accountant start his professional path with a clean slate?

In any case, there is such a thing as “expectation” and there is “reality”. What the author of this article described relates more to the first. In reality, let’s admit it honestly, many people don’t like or value pensioners. Moreover, they are not treated in the best way in the corporate environment. Read the vacancy announcements - wherever you look, almost everywhere you need “young and ambitious people with a desire to earn money.” This is much more beneficial for the employer. Experience is secondary. The main desire. This makes me sad, to say the least.

Employment history

When submitting documents for a pension, an employee will need a work book. It is this document that confirms that the future pensioner has work experience.

The work book is kept in the personnel department. All responsibility for filling it out correctly falls on the personnel officer. He must know all the nuances of filling it out, make sure that there are as few corrections as possible, and that the stamps affixed are legible. Corrections to the document must be made in compliance with certain rules. The personnel officer must own them.

If the employee continues to work in this organization, then the specialist should not hand over the work experience book to the employee.

When an employee resigns upon retirement, the work permit is issued on the day the employment contract with the employer ends. The HR department employee enters the corresponding dismissal record into it.

If, nevertheless, the personnel officer decides to hand over the book to a non-dismissed employee, then the personnel specialist and the head of the company bear responsibility for this document. In this case, it is better to issue a notarized copy of the document.

An employee of the personnel department can make an extract from the work book, which also reflects the number of years of insurance.

Registration of a pension: where to start

Where can you apply for an old-age pension in Moscow or in any other city in our country? Upon reaching retirement age, a citizen must personally apply for a benefit to a division of the Russian Pension Fund or to the MFC at his place of residence. If necessary, detailed consultation with a specialist can also be obtained there. Currently, this government service is available online. An application for a pension can be submitted through the “Personal Account of a Citizen” on the official website of the Pension Fund through the “Unified Portal of State and Municipal Services”. In order to register pensions for working citizens, an employer can apply to the Pension Fund.

Pensioner's right to work

Next, the employee is calculated, his salary, compensation for unused vacation days and other compensation payments provided for by the internal local acts of the organization or the collective agreement are considered.

Many employers pay employees retiring a one-time bonus, the amount of which is determined by the employer.

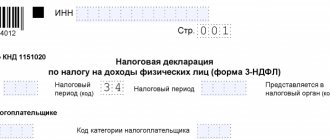

The amount of this incentive is included in labor costs and taken into account when calculating income tax.

In addition, insurance premiums must be paid from the payment amount. This amount will be taken into account when calculating the pension.

If this one-time payment is issued as financial assistance, and it is less than 4,000 rubles, then it is not subject to insurance contributions.

Payments to an employee upon retirement are not subject to personal income tax up to three times the monthly salary.

The employer must provide the Pension Fund with personalized accounting data to assign a pension to the insured person. Previously, this data was submitted using the SPV-1 form. Resolution of the Pension Fund of the Russian Federation dated July 21, 2014 No. 237p approved the new SPV-2 report form, which must be provided for calculating pensions. What the SPV-2 form is and how to fill it out can be read in this article.

Form SPV-2 must be submitted to the Pension Fund of the Russian Federation within 10 days from the date the employees wrote the application. This concludes the employer's actions. Next, the employee personally submits an application to the Pension Fund with the necessary documents attached.

https://www.youtube.com/watch?v=ytpress

When an employee reaches retirement age, the employer is obliged to submit the following documents to the Pension Fund:

- Information about the employee’s insurance experience in the SPV-2 form;

- Inventory according to form ADV-6-1.

The employer must submit the above documents no later than 10 days from the date the employee submits an application to reach retirement age and provide individual information about it. This application is drawn up by the employee in free form.

To assign a pension to an employee, it is also necessary to prepare the documents specified in Order of the Ministry of Labor of Russia dated November 28, 2014 N 958n “On approval of the list of documents necessary to establish an insurance pension, establish and recalculate the amount of a fixed payment to an insurance pension, taking into account the increase in the fixed payment to an insurance pension, assignment funded pension, establishing a pension under state pension provision.” These documents can be submitted either by the employee himself or by his current employer (with the written consent of the employee).

The list of required documents should include:

- Application for establishing a pension;

- Identity document;

- Documents confirming periods of work or other activities included in the insurance period;

- An extract from an individual personal account containing data on the employee’s individual pension coefficient;

- Documents confirming periods of work for early assignment of a pension.

Note: as a rule, a document confirming periods of work is a work book (Article 66 of the Labor Code of the Russian Federation).

In some cases you may also need:

- Certificate of average earnings;

- Help for workers in hazardous working conditions (in free form).

As usual, a certificate of average earnings is requested by Pension Fund employees only for periods of work in 2000-2001. or for any 60 consecutive months before 01/01/2002.

Note: it is recommended to submit an application for a pension to the Pension Fund at least 1 month before reaching retirement age.

The size of Russian pensions often does not correspond to a person’s needs, so many people of retirement age try to find some kind of part-time job.

The size of pensions of a working pensioner is not subject to annual recalculation, and from 2021 the government has completely abolished such indexation of labor pensions. In return, pensioners are paid a lump sum compensation at the beginning of the year.

A person of retirement age is faced with the question: work or live on one pension?

If a pensioner is satisfied with the salary he receives, then he can safely refuse pension bonuses and continue working. If the salary is below the premium, then it is better for him to quit.

Russian law does not prohibit a citizen from receiving a pension and continuing to work. An employee who did not quit upon reaching retirement age has the opportunity to increase his length of service, thereby increasing the amount of payments subject to recalculation annually on August 1.

But as of 2021, working pensioners have had their pensions indexed, which is due to other citizens of the Russian Federation receiving a pension, cancelled. This was done in order to reduce the expenditures of the Pension Fund budget.

The state invites citizens to apply for a pension not immediately upon reaching retirement age, thereby increasing its size by legally established increasing factors.

All necessary document forms and their samples can be found in the detailed recommendations of the State Finance System.

SP = SPST x SIPC,

Without difficulties - nowhere

In this case, we are discussing with you a situation where a person of retirement age independently expresses a desire to retire. However, many employers have cases when an employee does not want to retire under any circumstances. Why exactly this happens, we indicated above - the elementary reluctance of a person to find himself in a vulnerable social position, but this is not the only thing we are talking about. Based on the experience of communicating with our clients, we learned that pensioners do not want to remain aloof from society. Brought up on the norms of behavior and values of the USSR, they do not want to remain aloof from society or lose their active civic position. “I will work and benefit society as long as I stand on my feet” - that’s roughly how they reason. It is worth noting that this is a very commendable view of your own life and your purpose in it. We have a lot to learn. However, this can cause a number of inconveniences for the employer. Firstly, due to their advanced age, some of these employees are not in good health. Regular payments for sick leave and the absence of an employee from the office or production are losses. Secondly, the quality of work, as well as the approach to performing official tasks, can vary from fanatical pedantry to outright negligence. Thirdly, no one will argue with this; older people often have such a grumpy character that this begins to seriously harm the atmosphere in the team. Forcibly dismissing pensioners is not accepted in our country both from a moral point of view and from the point of view of the requirements of the Labor Code. Gently “asking” to leave of your own free will may also not be the best way out of the situation, because... the person will most likely be offended. The question is, what remains to be done? Basically, nothing. Typically, in such situations, the management of the organization invites (very significant) retirees to become “freelance consultants” or “informal mentors” if we are talking about engineering, for example. De jure a person retires and quits his job, but de facto he continues to adhere to the same active life position that we mentioned above. As a solution to this problem, we can recommend that a pensioner write a book or monograph, in other words, put his professional experience on paper in order to share it with the younger generation (of course, for a decent fee). Not everyone will agree to this, and yet such cases do occur in practice.

Hot experience

Work in hazardous working conditions is called “hot work”. It follows that hot work experience is a period of time worked under such conditions.

The presence of such length of service presupposes the early assignment of a pension benefit for labor.

Who is eligible for a preferential pension under the hot grid:

- People working in hot production and underground;

- Women textile workers, subject to increased complexity and intensity;

- Men employed in agriculture by profession: tractor drivers;

- Employees involved in ensuring the safety of railway locomotives and metro;

- Working northerners;

- Forestry workers;

- Foreman of unloading and loading works of sea and river ports;

- People whose work is related to geological exploration work;

- Seafarers associated with fish harvesting.

It happens when an employee’s longevity is only half of his total length of service, which reduces the retirement age by one year for several years of longevity.

Workers in the Northern regions receive a benefit if they have at least fifteen years of experience, and from twenty years of work experience when working in areas near the north.

If northerners have benefits for early retirement, the retirement age is reduced by five years.

We generate a salary certificate

In order for the future pension to be calculated correctly and not have to be recalculated, during the registration process the employer is obliged to issue the employee a salary certificate for the last 12 months. Employees who began working in this particular organization before 2002 must also provide a certificate of salary for 2000-2001 or for a period of 60 consecutive months until 01/01/2002. Based on the certificates received, the size of the pension capital will be determined, which, in turn, affects the calculation of the number of pension points. The certificate must be issued no later than 3 days from the date of receipt of the application from the citizen. There is no special form developed for such certificates, so its type can be arbitrary.