UTII (single tax on imputed income or “imputed income”) is one of the special tax regimes introduced by the state in order to ease the tax burden for small businesses. Proper use of this regime allows entrepreneurs to significantly save on mandatory payments to the treasury, and also reduces the time for preparing mandatory reporting. Not all businessmen know that UTII allows you to take into account insurance premiums paid by individual entrepreneurs for themselves, thereby providing even more opportunities for optimizing tax expenses. However, the rules for paying taxes differ depending on whether the individual entrepreneur has hired personnel or works independently in his enterprise.

UTII subjects and features

As is known, those companies and individual entrepreneurs that are engaged in strictly defined types of activities, including the production and sale of goods, as well as the provision of various services to the population, can pay the Unified Tax on imputed income. Each region determines the list of activities falling under UTII independently, depending on on individual economic characteristics.

The main distinguishing feature of UTII is that the tax is paid by tax subjects not on actual profit, but on estimated income. The tax payment amount is fixed, although it may vary slightly depending on the location of the taxpayer.

If an enterprise or individual entrepreneur has switched to paying UTII, then this tax will have to be paid regardless of the amount of revenue. Even if for some period of time the business stood still, there were no agreements, contracts or transactions, you will still have to pay the tax fee. The only exceptions are those situations that are valid reasons for suspending activities, however, they must be documented.

The transition to UTII is strictly voluntary and requires only the submission of a corresponding application to the tax authorities.

What is UTII for individual entrepreneurs in simple words

The most important feature is that the tax is paid in a fixed amount, regardless of actual income. The tax is calculated using a formula depending on the type of activity and other indicators. Whether the entrepreneur received this income or not, more than the established one or less, does not matter.

As in other special regimes, payment of a single tax for individual entrepreneurs replaces taxes:

- Personal income tax, but only in relation to the activities that the individual entrepreneur conducts on UTII;

- property tax on property that an individual entrepreneur uses for activities on UTII;

- VAT only on the activities that the individual entrepreneur conducts on UTII

You must file a return quarterly and pay tax. The imputation for individual entrepreneurs has undergone changes in 2021, but the tax calculation has not fundamentally changed.

There are a number of nuances that individual entrepreneurs must take into account when switching to UTII. It does not apply to every type of activity, and, as a rule, it is necessary to submit an application and report at the place where the activity is carried out. Therefore, despite its apparent simplicity, in some cases imputation for individual entrepreneurs can cause difficulties. For the same activity, the tax may differ significantly, so you must first calculate it very clearly. Although there is no need to keep accounting records, physical indicators must be taken into account. And in the case of conducting other activities under UTII or using a different taxation system, separate accounting must be maintained.

simplified tax system plus UTII minus fixed contributions

Contributions that reduce tax:

- Insurance premiums for individual entrepreneurs for themselves: fixed part and 1% of income over 300 thousand rubles;

- Contributions for employees for pension, medical and social insurance to the tax authorities and for injuries to the Social Insurance Fund;

- Sick leave for an employee for the first three days;

- VHI contributions for employees.

Let us remind you once again that in 2021 the amount of contributions for yourself is 32,385 rubles. per year, which is a fixed payment independent of the ILO. This amount must be transferred strictly before the end of the year; the last days of December are the deadline! Everything else - in one amount or in parts, identical parts or different - you decide for yourself. As it suits you, that's how you pay. There are no deadlines for months/quarters; the main thing is to pay this amount before the end of the year.

Most individual entrepreneurs using the simplified tax system divide this amount into 4 equal parts and pay quarterly: this is done so that contributions can be deducted from the tax evenly throughout the year and not overpay advance payments. That is, this division into 4 equal parts is done simply for convenience! You can divide the entire amount into 12 equal parts and pay every month, you can pay all 32,385 rubles.

It is better to pay contributions to UTII in equal parts every quarter - when calculating UTII, imputed income is used as the base, so in the absence of changes in physical indicators, the tax amount will be the same every quarter!

Unified social tax and single tax 2021: calculations for private entrepreneurs

Let us recall that back in 2021, the adjustment coefficient K1 was supposed to be 2.083, but the Ministry of Economic Development of the Russian Federation decided to leave K1 at the 2015 level - 1.798. For 2021, K1 in the amount of 1.798 continued to be valid for the purpose of calculating UTII.

Thus, over the course of three years (2015, 2021, 2021), there have been no significant changes in this tax system. The use of tax deductions and the procedure for making insurance contributions for individual entrepreneurs and organizations remains the same.

But 2021 brought a not very pleasant surprise. A draft law was proposed for consideration by legislators, increasing the K1 from 2018 by 3.9% from the K1 in force in 2021. The bill was passed and signed by the president. With such a percentage increase, K1 in 2018 for calculating UTII amounted to 1.868.

For 2021 , K1 was increased and is 1.915, which entailed an increase in the tax amount.

As stated above, 2021 will likely be the final year of this tax regime. The Minister of Finance A. Siluanov said the day before that UTII is often used by unscrupulous entrepreneurs who evade paying taxes. He added that on average, UTII payers pay taxes in the amount of only about 1% of their revenue. All this leads to the fact that the state budget does not receive the required amount of taxes.

In this regard, the Ministry of Finance does not support the idea of extending UTII after the end of 2021. The State Duma holds a similar opinion.

At the same time, already in 2021, UTII may be abolished in a number of regions of the Russian Federation by decision of local authorities. In particular, several municipalities of the Perm Territory have already adopted the relevant legislative acts.

Some entrepreneurs using UTII will have to switch to a different tax regime starting in 2021. The fact is that from January 1, 2021, changes to the tax code will come into force. According to Art. 346.27 of the Tax Code of the Russian Federation, UTII from 2021 cannot be applied in the field of trade in the following products:

- medicines subject to mandatory labeling;

- shoes and clothing, products made from natural fur and other products subject to mandatory labeling.

As of today, the bill has been adopted by the State Duma in the first reading, but has not been finally approved and is being finalized.

Let's consider a single tax on imputed income. It means a special fee regime that can be applied by an individual entrepreneur or organization, but only for established types of activities. There are 14 such types of activities. In each municipality, the government independently decides which types of activities (within the federal list) will be subject to UTII and which will not. And each of these decisions is governed by local law.

In UTII, the amount of actual income does not matter. This tax can be determined based on the amount of possible monthly income, which is established by the state. The amount and amount of imputed income for each type of activity under the Tax Code (Article 346.29 of the Labor Code) is clearly defined.

Like any other special regime, UTII with the calculation of one tax replaces several basic ones: income tax (for individual entrepreneurs), income tax (for organizations), VAT (with the exception of the customs territory of the Russian Federation, paid at the intersection of goods) and property duty.

Payment of UTII should be made before April 25th for the 1st quarter, before July 25th for the 2nd quarter, before October 25th for the 3rd quarter and before January 25th for the 4th quarter. .

It is possible to make a tax deduction only from contributions already paid, for example, to reduce UTII in the first quarter, you must have time to pay contributions to the Pension Fund, FFOM, Social Insurance Fund for the last quarter of the previous year.

— UTII is a tax that was introduced in 1998 on the principle of “better than nothing.” Times have changed: tax programs have become smarter, businesses have switched to online cash registers. The tax office knows the real income and will demand a percentage of it.

— UTII is an unfair tax. Companies using the simplified tax system pay much more. Imputed income is on average 27 times less than real income.

— UTII is suitable for gray schemes. Firms reduce VAT when they send goods through a chain of one-day products. If the end buyer uses UTII, there will be savings on income tax.

It's time to choose a new tax system. The criteria for selection are regime restrictions and tax burden. Choose the regime that will allow you to pay less taxes, and check that you have the right to apply it.

If you do nothing, from January 1, 2021 you will find yourself on the general tax system (OSNO). OSNO has high taxes and complex accounting. If you combine UTII with the simplified tax system, you will remain on the simplified tax system.

A patent and simplified tax system can also be combined. They often do this: one or more types of activities are transferred to a patent, and for the rest they work according to the simplified tax system. For example, clothing made from natural fur cannot be traded using the patent system, so the simplified tax system is paid for fur coats, and a patent is paid for down jackets.

This option, as an alternative to UTII, is suitable only for individual entrepreneurs, and not for everyone. Only those who:

- provides services;

- sells goods of its own production, but does not resell others;

- has no employees;

- does not produce excisable goods;

- operates in one of the 21 experimental regions where the NAP regime has been introduced;

- earns no more than 2.4 million rubles. in year.

If you fall under all these restrictions, then you can work on more than preferential terms, namely:

- pay every month 6% on income from legal entities and 4% from individuals;

- accept money in any convenient way and do not use an online cash register. For each sale you only need to issue a receipt from the “My Tax” application;

- not filing a tax return;

- do not pay insurance premiums.

You can switch to NAP at any time. To do this, you need to register in the “My Tax” application, and then within a month refuse the applicable special regime. NAP and other taxation regimes cannot be combined.

The most popular tax regime today is the simplified taxation system. It is used by about 3.2 million taxpayers.

Previously, the deadline for submitting a notification in form No. 26.2-1 to the tax office for the transition from UTII to a simplified tax system was February 1, 2021. The document required to indicate the selected object of taxation “income” or “income minus expenses” and taxpayer code “2”. At the end of January, the State Duma gave late businessmen a deferment until March 31, 2021 inclusive (bill No. 1043391-7).

There are limitations to simplification:

- annual income should not exceed 150 million rubles,

- there should be no more than 100 employees,

- the maximum residual value of fixed assets is 150 million rubles.

Related article: Changes to the simplified tax system in 2021

For the simplified tax system there are two objects of taxation of income: “Income” 6% and “Income minus expenses” 15%. Regions at the location of the organization or at the place of residence of the individual entrepreneur can reduce the indicated rates from 6 to 1%, from 15 to 5%.

The patent has a limit on annual revenue - no more than 60 million rubles per year. Also, the entrepreneur must have no more than 15 employees.

The State Duma recently expanded the list of types of activities for a patent - from 63 to 80. All of them are specified in the Tax Code. In particular, the list includes:

- provision of parking spaces,

- distribution of outdoor advertising,

- advertising on transport and others.

Moreover, each region can expand this list.

To switch from UTII to PSN from the new year, you must submit an application in form No. 26.5-1 or in the form recommended by the Federal Tax Service in the attachment to letter No. SD-4-3 dated February 18, 2020 / This must be done before December 31, 2021.

If in the 4th quarter of 2021 individual entrepreneurs applied UTII for some types of activities, then they will be able to receive preferential patents. They will be issued for a period of one to three months. Patents will be valid until the end of the period specified in them, but no later than March 31, 2021.

The professional income tax is already applied throughout Russia. More than 1.3 million taxpayers have already chosen this mode.

The amount of tax for a self-employed person depends on who he received the income from:

- if from an individual, the tax rate will be 4%,

- if from a company or individual entrepreneur - 6%.

The payment amount is calculated from income, but income cannot be reduced for expenses. You need to calculate and pay your tax in the “My Tax” application.

You can register as a self-employed person (NPP payer) at any time.

Individual entrepreneurs will not be able to become payers of professional income tax if they:

- sell excisable and mandatory labeling goods,

- resell goods or rights to own, use and dispose of real estate,

- extract and sell minerals,

- conduct business on the basis of agency agreements, commission agreements or agency agreements.

Regardless of which tax regime you switch to in 2021, you will need to submit a UTII return for the 4th quarter of 2021 to the tax office.

The deadline for submission is no later than January 20, 2021.

If you do not submit documents to the tax office on time, you will be fined. The penalty amount will be 5% of the tax that is not paid on time. A fine will be charged for each month of delay, regardless of whether it is full or not.

No. The fact is that on UTII it was possible to use a fiscal accumulator with a validity period of 36 months. But such a FN cannot be used on OSNO.

The tax authorities allowed the use of the Federal Tax Fund for 36 months until the end of its validity period and continue to indicate the UTII mode on the check. There will be no fine for this. Therefore, if a company or individual entrepreneur is now working on UTII and plans to switch to a general taxation system, there is no need to change the cash register settings (letter of the Federal Tax Service No. AB-4-20 / dated December 3, 2020).

- UTII: who can apply

- UTII: how an individual entrepreneur can become a tax payer

- Imputation: how to calculate tax

- Let's look at calculations for UTII using examples

- How does an individual entrepreneur report on imputation?

What contributions can be included when calculating the reduction?

To calculate UTII, accountants use a special formula. It is quite simple, but when using it you need to know the existing correction factors K1 and K2. K1 is formed at the federal level by the Ministry of Economic Development and depends on the amount of inflation, and K2 is developed by local governments based on certain territorial factors. These coefficients change every year, so it is important to track these changes.

Conditional basic yield * physical indicator * K1 * K2 * 15% = UTII

It should be remembered that the basic profitability for each type of activity is different, the same applies to physical indicators.

If an organization or individual entrepreneur has several types of activities on UTII, then taxes must be calculated for each of them separately.

After calculating UTII, a completely logical question arises: what ways exist to reduce the calculated tax using legal methods?

Attention! Reducing UTII, as well as any other tax levy, is quite possible. The procedure for reducing the “imputation” is prescribed in Article 346.32 of the Tax Code of the Russian Federation. It clearly indicates the expenses that reduce this tax levy.

https://www.youtube.com/watch?v=swjG0rgTmPI

These include:

- contributions under personal insurance contracts,

- payment of sick leave benefits at the expense of the employer,

- all insurance payments to extra-budgetary funds.

The Directive of the Central Bank of the Russian Federation dated October 7, 2013 No. 3073-U specifies the requirements regarding compliance with the maximum amount of cash payments (in an amount not exceeding 100 thousand rubles) within the framework of one agreement.

For example, it has been established that cash payments in the currency of the Russian Federation (subject to the maximum amount) between participants in cash payments and individuals for transactions with securities, under real estate lease agreements, for the issuance (repayment) of loans (interest on loans), activities related to the organization and conduct of gambling are carried out at the expense of cash received at the cash desk of the participant in cash payments from his bank account.

At the same time, on March 21, 2014, the Ministry of Justice of the Russian Federation received for registration a new Directive of the Central Bank of the Russian Federation dated March 11, 2014 N 3210-U “On the procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses,” according to which Individual entrepreneurs and small businesses will not be able to maintain a cash book.

Since January 1, 2014, increasing coefficients for the amount of transport tax have been established for expensive cars.

Advance payments of transport tax in respect of vehicles costing more than 3 million rubles are calculated without the use of increasing coefficients, since the specifics of calculating advance tax payments taking into account the coefficients of the Tax Code of the Russian Federation are not provided for.

Such clarifications are communicated to taxpayers by the Federal Tax Service of Russia in Letter No. BS-4-11/7781 dated April 23, 2014.

There are differences between the two categories.

| Category | Individual entrepreneurs who do not hire employees | Individual entrepreneurs who recruited employees and organizations |

| Contributions | Contributions to pension and health insurance for yourself, including an additional mandatory pension contribution, which is calculated as 1 percent of the excess income of 300,000 rubles. | Contributions for compulsory health insurance, compulsory medical insurance, social insurance against occupational diseases and accidents, maternity and disability. This also includes the amount of payment for sick leave at the expense of the policyholder. |

Calculation of the single imputed tax for individual entrepreneurs

In 2021, the procedure for calculating tax, as before, is made according to the formula:

Basic yield * Physical indicator for each month of the quarter * K1 * K2 * tax rate, where:

- basic profitability - established by law depending on the type of activity per each physical indicator (clause 3 of article 346.29 of the Tax Code of the Russian Federation);

- physical indicators are indicated in paragraph 3 of Art. 346.29 Tax Code of the Russian Federation. Determined for each type of activity (in square meters, pieces or number of employees);

- deflator coefficient K1 - in 2021 is 1.798, remained unchanged compared to 2015 - 2021;

- the correction factor K2 must be found out at the place of registration and payment of tax;

- The tax rate is generally 15%. But starting from 2021, local authorities can reduce the tax rate to 7.5% (Article 346.31 of the Tax Code of the Russian Federation).

The result of the calculation using a formula of several indicators, which can differ significantly depending on the region and type of activity, is what imputed income is for individual entrepreneurs.

It should be noted that the main difficulty can be caused by the calculation of physical indicators, especially when it is the number of employees with a high turnover or accounting for vehicles leased and accepted.

You also need to pay attention to the K2 coefficient, which is set by local authorities; it can be a fixed amount, or it can be determined by complex calculations. The principle of calculating the coefficient, the procedure for establishing and changing it are also entirely within the competence of local authorities. And taking into account the fact that K2 can be from 0.008 to 1, this is a very important indicator for calculating tax.

Tax deduction for UTII for the purchase of cash registers

According to the law, an LLC that does not have employees cannot reduce UTII, since it does not pay any contributions.

All factors that serve as the basis for reducing UTII are entered into the tax return - it has a separate column for this. Do not forget that organizations and individual entrepreneurs must submit declarations on “imputation” quarterly.

As can be seen from the above, there is nothing complicated when calculating the reduction in tax collection on UTII. A competent accountant with certain skills will easily make all these calculations, subject to full compliance with all necessary conditions.

Let's look at many different situations and figure out how to reduce taxes on insurance premiums for individual entrepreneurs.

Is it possible to deduct paid contributions when calculating advances on the simplified tax system?

Of course you can. This is why they are paid in installments. If your quarterly income is approximately equal, and accordingly the tax amount is approximately the same, then it is more profitable to transfer contributions in equal parts quarterly - this way they are evenly distributed throughout the year, and you do not overpay the amount of advance payments.

If the tax in the 1st quarter is less than the contributions, can the balance of the contributions be deducted in the next quarter?

On the simplified tax system, reporting periods are set to 1 quarter, and then half a year and 9 months - there is no separate calculation for each quarter. Both income, the tax itself, and contributions are taken into account on an accrual basis. Therefore, there are no remaining contributions and there cannot be any. When calculating the advance for the 1st quarter, you take the income for the first quarter, calculate the tax, and subtract the contributions paid before March 31. When you calculate an advance for six months, you take income for 6 months, calculate taxes, deduct contributions paid before June 30, etc.

On UTII the situation is different: there are no advances, the tax is calculated every quarter. Therefore, only contributions related to this quarter are deducted from tax here! If at the end of the quarter your tax contributions are less, then you simply reset the tax to zero and that’s it - no balance of contributions is carried over to the next quarter.

How to deduct an additional contribution to the Pension Fund

Additional contributions are paid by those individual entrepreneurs whose annual income is more than 300 thousand rubles.

Let us remind you that the additional contribution is calculated based on the results of the year and must be paid before April 1 of the next year. This additional contribution relates to the individual entrepreneur’s contributions for himself, therefore, in fact, all other rules for reducing the simplified tax system and UTII for fixed contributions apply to it - that is, the additional contribution also reduces the tax!

Here you need to take into account this: if you transfer the additional contribution next year, then you can deduct it from the next year’s tax. But if during the year you already understand that your income exceeds 300 thousand rubles, then you have the right not to wait for the end of the year, but to count and transfer the additional contribution in the current year - accordingly, and you can deduct such amounts immediately in the current year . When calculating the additional contribution, remember that for the simplified tax system, actual income is taken to calculate it, and for UTII - imputed income!

Can an individual entrepreneur deduct his contributions from tax at the same time as contributions for employees?

Previously, the answer depended on the mode used! Using the simplified tax system, you could deduct both contributions for yourself and contributions for employees. But on UTII it was possible to deduct only contributions for employees. Now this difference between the special regimes has been removed: in both the simplified and imputation regimes, individual entrepreneurs can deduct both contributions for themselves and for their employees. Do not forget that the tax can be reduced by a maximum of 50% of its originally calculated amount.

What to do if an individual entrepreneur on the simplified tax system forgot to pay contributions for himself before December 31 and transferred them already in January of the next year

You can still deduct these contributions, but only from the tax of the year in which they were paid. That is, if you forgot to pay contributions for yourself in 2021, and only did it, for example, in January 2021, then you can deduct them from the tax for 2021.

At the same time, remember that since you did not pay your fees on time, you will also need to pay penalties. The tax cannot be reduced by the amount of penalties in any case!

Is it possible to deduct from tax contributions paid before filing a declaration on UTII?

During imputation, the declaration is submitted to the tax authorities every quarter, and a situation may arise that you paid contributions for the past quarter after its completion, but before submitting the declaration. Here the individual entrepreneur is lucky so far: there is a letter from the Ministry of Finance No. 03-11-09/2852 dated 01/26/2016 and a letter from the Federal Tax Service No. SD-4-3/2691 dated 02/19/2016.

, which confirm that contributions paid after the end of the quarter, but before submitting the declaration, can be deducted when calculating the UTII tax for the past quarter. It's possible, but not necessary. You can deduct them from the tax for the past quarter or take them into account when calculating the tax for the quarter in which you actually transferred them. To avoid complete confusion with calculations and filling out the declaration, we still recommend not to be late with the payment of contributions.

If contributions are transferred after submitting the declaration, then they can be deducted when calculating the tax for the quarter in which the payment occurred.

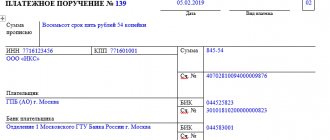

What to do if you made a mistake when making a payment and paid more contributions for employees than you needed

It happens that you paid the wrong amount of contributions, for example, you simply made a mistake in the number on the payment slip. Such an overpayment cannot be deducted from tax. You can reduce the tax only on contributions within the amounts accrued for the reporting period. You will be able to deduct the overpayment in the next period, provided that you write a statement to the funds with a request to offset these amounts against your next payments and the fund will carry out an operation to offset these amounts. It is impossible to take into account the overpayment when reducing the tax before the fund takes it into account.

Another example of a similar situation: you incorrectly calculated your contributions and overpaid them due to an incorrect calculation. If you have already deducted the overpaid amount of contributions from the tax and submitted a declaration (for example, we report quarterly on imputation), and found an error in calculating contributions only later, then the actions here will be slightly different. You will need to submit an updated declaration, pay additional tax and penalties, and then offset it with the fund again.

Individual entrepreneurs who use UTII can deduct the costs of an online cash register. This opportunity has been available since 2018. The deduction amount is no more than 18,000 rubles for each cash register. This includes the cost of a cash register, the purchase of a cash register program, modernization and configuration to bring it into working condition.

To apply the deduction, please comply with the following conditions:

- purchase a cash register, which is included in the official register of the Federal Tax Service;

- register the cash register with the tax office;

- use the online cash register at “impute”.

You need to register the cash register with the tax office on time. A retail and catering business with employees had to register a cash register before July 1, 2018; unfortunately, with later registration there is no way to receive a deduction. And other individual entrepreneurs can receive a deduction if they register a cash register before July 1, 2019.

To receive a deduction, individual entrepreneurs must submit a tax return on UTII, which reflects the costs of purchasing and putting the cash register into working condition.

Author of the article: Elizaveta Kobrina

The Kontur.Accounting service automatically calculates insurance premiums and tax amounts. Keep records, pay salaries, generate reports and send them via the Internet. All new users can use the service for free for a month.

To reduce the amount of UTII tax on contributions paid, you need to:

- Pay contributions to the budget during the tax period for which the UTII declaration is submitted.

Example 3.

IP Ivanov I.O. paid insurance premiums for compulsory pension insurance for myself in January 2021 in the amount of 2500 rubles, in February in the amount of 2500, in March in the amount of 3000 rubles. In the UTII declaration for the first quarter, the amount of UTII tax payable came out to be 11,000 rubles. The deadline for submitting the declaration is April 20, the tax payment deadline is April 25.

This tax can be reduced by the amount of contributions in the amount of 100%, because the entrepreneur does not have employees. The amount of the reduction must be indicated in the declaration and is equal to 2500 2500 3000 = 8000 rubles. Thus, IP Ivanov I.O. Must pay to the budget by April 25, 2021 11000-8000=3000 rubles.

- Indicate the amount of contributions paid in the UTII declaration for the corresponding period.

Example 4.

Roman LLC paid contributions in the 1st quarter of 2021 in the amount of 5,000 rubles, and the amount of UTII tax payable was 12,000 rubles. To take advantage of the tax benefit of reducing payments, Roman LLC must indicate in the UTII declaration for the first quarter of 2021 the amount of contributions paid. In the declaration, the amount payable is calculated automatically after indicating the amount of paid contributions.

If an organization or entrepreneur combines several tax regimes, then the reduction will be based on several rules:

- The amount of UTII can be reduced by the amount of insurance premiums paid only for those employees who are engaged in activities that fall under the payment of “imputation”. That is, if the organization employs 10 people. The organization combines the simplified tax system and UTII. There are 6 employees working in the UTII activities, and 4 employees in the simplified tax system activities. Then the amount of tax can be reduced only by the amount of insurance premiums paid for 6 employees engaged in this activity.

- If it is impossible to differentiate in what specific activities employees are engaged, then the calculation of the amount of insurance premiums is made on the basis of a proportional determination based on the amount of income. To make it clear, let's give an example.

Example 5.

Submitting reports

A businessman can submit a report to regulatory authorities using the following methods:

- On a personal visit;

- Through official representatives;

- On the Internet;

- By registered mail.

Reporting deadlines

If you fail to submit reports on time, an individual entrepreneur will have to pay heavy fines. Federal legislation establishes the following deadlines for individual entrepreneurs’ reporting to the tax service:

- The deadline for submitting UTII for the 1st quarter of 2021 is April 20.

- The deadline for submitting UTII for the 2nd quarter of 2021 is July 20.

- The deadline for submitting UTII for the 3rd quarter of 2021 is October 20.

- The deadline for submitting UTII for the 4th quarter of 2021 is January 20, 2017.

Reporting is submitted to the Pension Fund quarterly in the form RSV-1, as well as CMEA-6-1 and CMEA-6-2. Submission must be made by the middle of the next quarter (I quarter - May 15, II quarter - August 15, III quarter - November 15 and IV quarter - February 15, 2021). If the report is on electronic media, the period is increased by 5 days - the 20th day of the second month. The SZV-M form must be submitted to the fund by the 10th of the next month. The first report of the year is due May 10.

The FSS submits a 4-FSS report for each quarter. Paper submissions are due by the 20th of the next month, and electronic submissions are due by the 25th.

Annual reporting

In 2021, individual entrepreneurs on UTII must submit reports for 2021 within the following deadlines:

- For a single tax for all types of services: form KND-1152016 until January 20;

- Salaries of individuals and necessary taxes withheld: 2-NDFL submitted before April 1;

- Payments to individuals: SZV-6-3 until February 15;

- Average number of workers: KND 1110018 is provided until January 20.

The Tax Code of the Russian Federation precisely states what kind of reporting an individual entrepreneur submits to UTII with and without employees in 2021, and establishes deadlines and reporting forms. Any delay or error will result in heavy fines and penalties.

from the tax service.

Individual entrepreneurs without employees: reduction in UTII payments

If an individual entrepreneur does not use the help of employees and runs his business alone, then he has the right to reduce the amount of UTII deductions by the entire amount of fixed payments, that is, by 100% of payments made to extra-budgetary funds (PFR, MHIF) for himself personally.

In this case, it is very convenient for individual entrepreneurs - UTII payers who do not have hired employees - to divide fixed contributions into four parts quarterly and pay them at ¼ of the total annual contribution amount in each quarter. But even if for some reason this is not possible, it is important that the entire amount of fixed insurance premiums be paid in full during the year.

Example: IP Shklyaev D.K. no workers. In September of this year he paid 5,000 rubles. to the Pension Fund and 2000 rubles. to the MHIF. At the same time, the amount of his UTII tax payment is 17,500 rubles. After simple calculations, it is clear that he actually needs to pay to the budget: UTII = 17,500 - (5,000 2,000) = 10,500 rubles.

From January 1, 2021, the single tax on imputed income will be cancelled.

Coefficients K1 and K2 allow you to adjust the basic profitability taking into account the influence of various external conditions (factors) on the amount of income received.

K1 is a deflator coefficient established by federal legislation for the calendar year. It is determined annually by the Ministry of Economic Development of Russia and published no later than November 20 of the year in which deflator coefficients are established. Its value corresponds to the indexation of consumer prices for various categories of goods and services.

UTII Coefficient K1 for 2021 is 1.915

K2 – adjustment coefficient of basic profitability, established by local legislation and taking into account the totality of features of doing business (list of goods, services, other features).

The organization operates to provide motor transport services for the transportation of goods by 3 vehicles.

| Business activity code | 05 |

| Basic income per month (RUB) | 6000 |

| The value of the physical indicator (number of vehicles used to transport goods) | 3 |

| K1 coefficient for 2021 | 1,868 |

| K2 coefficient | 1,0 |

| Paid insurance premiums for employees | 27 000 |

Tax base for the month = DB*FP*K1*K2= 6,000 rubles. x 3 mash. x 1,868 x 1= 33,624 rub.

Tax base for the quarter = RUB 33,624. x 3 months = 100,872 rub.

UTII for the quarter = 100,872*15% = 15,131 rubles.

The amount of insurance premiums paid in the reporting period for employees engaged in business activities for which a single tax is paid amounted to 27,000 rubles. Thus, the calculated single tax can be reduced by insurance premiums paid, but not less than 50% of the total tax amount.

The amount of contributions by which UTII can be reduced for the quarter was 7,565 rubles. (RUB 15,131 x 50%

Thus, the amount of UTII payable for the quarter will be 7,565 rubles. (RUB 15,131 – RUB 7,565).

If an organization registered as a UTII payer on the 10th day of the second month of the quarter, then the tax base for the quarter will be calculated as follows:

- 1 month of the quarter – 0 rub.;

- 2nd month of the quarter – 23,537 rubles. (RUB 6,000 x 3 cars x 1,868 x 1/30 days x 21 days);

- 3rd month of the quarter – RUB 33,624. (RUB 6,000 x 3 cars x 1,868 x 1/31 days x 31 days).

UTII can be applied to retail trade in cases where the activity is carried out through:

- shops and pavilions with a sales floor area of no more than 150 sq. m.;

- objects of a stationary trading network that do not have trading floors, as well as objects of a non-stationary trading network;

- vending machines.

Delivery and distribution retail trade also falls under the single tax taxation system.

The tax calculation formula used for trading activities is standard and no different from that discussed earlier, but the physical indicator that will be used when calculating imputed income depends on the conditions under which trading is conducted.

Organizations or individual entrepreneurs (individual entrepreneurs) carrying out commercial activities in the area have the right to pay taxes in accordance with UTII (Unified Tax on Imputed Income).

- retail trade (the area of the outlet should not exceed 150 sq/m);

- catering (total area of the hall should not be more than 150 sq/m);

- veterinary, household services (repair of electrical equipment, plumbing, electronic devices, apartment cleaning, etc.);

- distribution and (or) placement of advertising;

- rental services for retail outlets, land plots (with the exception of petrol and gas filling stations, as well as facilities exceeding 500 sq/m in area);

- hotel business and rental housing (including rental apartments);

- repair, maintenance and washing of vehicles;

- delivery of goods and transportation of passengers by road;

- provision of parking.

The full list of services is specified in Article 346.26 of the Tax Code of the Russian Federation.

It should be noted that when paying UTII, both individual entrepreneurs and organizations are exempt from paying the following taxes:

- on property;

- on profit (personal income tax);

- value added (VAT).

In general, the possibility of applying the Unified Tax on imputed income is regulated by regulations of local authorities. At the same time, the procedure for paying UTII may be different due to the fact that the K2 coefficient may differ in different regions.

The use of UTII involves payment of tax based on the amount of income not actual, but imputed by officials of an individual entrepreneur or organization.

The 2021 UTII formula includes basic yield, as well as physical indicators and coefficients K1 (deflator) and K2 (adjustment).

When choosing UTII, individual entrepreneurs and organizations are required to register as payers of this tax within five days after the start of activities on UTII. Conducting activities on UTII without registration entails a fine in the amount of 40,000 rubles or 10% of the potentially received income.

UTII does not have the right to apply to individual entrepreneurs and organizations with more than 100 employees.

Reducing the amount of UTII

Do not transfer the calculated UTII amount to the budget in full. First, check to see if you can use the deduction. Payers of UTII reduce the quarterly payment by the amount of insurance premiums for employees or for the entrepreneur himself. The amount of the deduction and the opportunity to reduce the tax payment depend on the category of the “imputed”: organizations and individual entrepreneurs with employees or individual entrepreneurs without employees.

- Organizations and individual entrepreneurs with employees reduce the tax on the amount of insurance premiums for themselves and their employees, but not by more than 50%.

- Individual entrepreneurs without employees reduce the single tax on the amount of insurance premiums to 100%.

Receiving a tax deduction is your right, not an opportunity. Therefore, the tax office will not remind you about this and will not tell you how to optimize the payment of contributions.

Example 3.

Example 4.

Calculation of payments for UTII tax in 2021 and 2021

Minimum ERU

for this category of “simplified workers” is 22% of the minimum wage.

Accordingly, entrepreneurs in the first group this year must pay as follows: from January 1

- 1320 UAH (6000 UAH x 22: 100 = 1320 UAH);

from December 1

- 1430 UAH (6500 UAH x 22: 100 = 1430 UAH).

Single tax amount

for this group, local authorities set, but not higher than 10% of the subsistence level for able-bodied persons as of January 1. Accordingly, this year the maximum single tax rate will be UAH 227 per month.

Minimum ERU

— 22% of the minimum wage.

Accordingly, you need to pay: from January 1

- 1320 UAH (6000 UAH x 22: 100 = 1320 UAH);

from December 1

- 1430 UAH (6500 UAH x 22: 100 = 1430 UAH).

Single tax amount

for this group are set by local authorities, but not higher than 20% of the minimum wage established on January 1.

The maximum single tax rate will be 1200 UAH per month.

From January 1, employees cannot receive a salary less than UAH 6,000. And from December 1, employers will have to raise staff salaries to at least 6,500 UAH. From your salary it is necessary to withhold personal income tax (personal income tax - 18%) and military duty (MS - 1.5%).

From January 1, tax calculations look like this:

Rate - 6000 UAH Personal income tax - 6000×18% = 1080 UAH Sun - 6000×1.5% = 90 UAH Single social contribution - 6000×22% = 1320 UAH Withholding: 1170 UAH (personal income tax + sun)

That is, the cost per employee is

t: rate 6000 UAH (of which personal income tax (1080 UAH) + military tax (90 UAH)) + unified social contribution 1320 UAH = 7320 UAH “In your hands” the employee will receive 4830 UAH/month, since personal income tax and military taxes are withheld from his rate, and the employer contributes the ERU.

Deadlines for payment of insurance premiums for individual entrepreneurs on UTII in 2021

Entrepreneurs who work without employees and do not pay remuneration to individuals draw up a deduction from the insurance premiums they pay for themselves. Individual entrepreneurs’ insurance premiums for themselves consist of:

- fixed part - 32,385 rubles per year in 2018;

- variable part - 1% of the amount of income, if it is above 300,000 rubles per year. 1% is calculated on the amount of imputed, not actual income.

If the amount of insurance premiums of an individual entrepreneur without employees for himself is equal to or exceeds the calculated UTII, then he will not have to pay tax at all. The amount of single tax can be reduced to zero, but the excess amount cannot be transferred to other periods.

Divide insurance premiums wisely into periods. To reduce your tax evenly, pay your contributions quarterly in equal installments. This is especially important when the amount of contributions is close to the amount of the tax.

Example. The annual insurance premium for individual entrepreneurs is 32,385 rubles. The amount of UTII once a quarter is 9,000 rubles.

Situation 1. If an individual entrepreneur decides to pay insurance premiums once a year, for example, in the 4th quarter, then he will pay UTII 9,000 for the first three quarters, and in the fourth the tax will be reduced to zero.

| UTII | Contributions | |

| 1st quarter | 9 000 | 0 |

| 2nd quarter | 9 000 | 0 |

| 3rd quarter | 9 000 | 0 |

| 4th quarter | 0 | 32 385 |

| TOTAL | 59,385 rubles | |

Savings - 9,000 rubles.

Situation 2. If an individual entrepreneur pays insurance premiums evenly, then the quarterly tax amount will decrease and significant savings will result.

| UTII | Contributions | |

| 1st quarter | 904 | 8 096 |

| 2nd quarter | 903 | 8 097 |

| 3rd quarter | 904 | 8 096 |

| 4th quarter | 904 | 8 096 |

| TOTAL | 36 000 | |

Savings - 32,385 rubles.

In the tax return for UTII, reflect the amount of insurance premiums of individual entrepreneurs for themselves in line 030 of section 3 in the amount in which insurance premiums were paid.

Organizations and individual entrepreneurs with employees can reduce UTII only by half due to:

- contributions to the Pension Fund, FFOMS and Social Insurance Fund for employees and individual entrepreneurs;

- voluntary health insurance for employees, if you pay for it;

- sick leave paid by the employer for the first 3 days of incapacity for work.

Even if the amount of insurance and sick leave contributions exceeds the amount of the calculated tax, you will not be able to reduce it by more than half. You will always have to pay 50% of the UTII.

Please comply with the following conditions so that insurance premiums can be deducted:

- insurance premiums and debts on them were paid in the corresponding tax period;

- the amounts paid are within the calculated insurance premiums;

- amounts accrued for the period of activity on UTII;

- contributions were paid in favor of employees involved in UTII activities.

The frequency of payment of contributions to reduce tax is also important here. The amount of insurance premiums for employees calculated and paid in the reporting quarter should be indicated in line 020 of section 3 of the declaration.

An individual entrepreneur is considered an employer only if he pays a salary. What is important is the moment of the first payment, not the conclusion of an employment contract. Therefore, if you concluded an employment contract in March and paid your salary in April, in the second quarter you are an employer and will not be able to reduce the tax by more than 50%, although you could have done this in the first quarter.

The contribution to pension insurance will not be calculated from the minimum wage established on January 1, 2018, as was previously the case. Let us remind you that in 2021, the amount of contributions to pension insurance in a fixed amount was calculated using the formula: 7500 × 26% = 1,950 rubles per month.

From 2021, Federal Law No. 335-FZ dated November 27, 2017 stipulates that contribution rates for individual entrepreneurs will be approved by government decree, based on the value of pension points and the established coefficient annually, regardless of the minimum wage.

In 2021, the amount of fixed contributions to pension insurance for income less than 300,000 rubles will be 26,545 rubles.

7500×5.1% = 382.50 rubles per month.

In 2021, by analogy with the pension contribution, the contribution to compulsory health insurance in a fixed amount will be 5,840 rubles.

(Imputed income - 300,000) X 1%.

An additional medical contribution if the imputed income exceeds 300,000 rubles is not paid.

Contribution for voluntary insurance in case of temporary disability and in connection with maternity (by paying this contribution on a voluntary basis, individual entrepreneurs have the right to receive sick leave from the Social Insurance Fund) - payment for 2021 was 2,610 rubles.

In 2021, the amount of voluntary contributions in case of temporary disability and in connection with maternity will be calculated, as before, based on the minimum wage established on January 1 of the current year. Consequently, the amount of voluntary contributions in 2021 will be RUB 3,302.17. (9489 rub. x 12 x 2.9%).

For all these contributions, an individual entrepreneur who does not use hired labor has the right to reduce the imputed tax without limitation.

The imputed tax payable for the 1st quarter amounted to 10,000 rubles.

During the 1st quarter (until March 31), the individual entrepreneur transferred contributions in the amount of 9,000 rubles.

Therefore, 10,000 - 9,000 = 1,000 rubles must be paid imputed tax for the 1st quarter of 2021 by April 25, 2018.

In addition to the contributions listed above, which an individual entrepreneur pays for himself, having employees, he is obliged to transfer contributions for his employees.

You can reduce the imputed tax in 2021 by the amount of insurance premiums paid for yourself and for your employees, but by no more than 50% of the calculated tax.

The calculated imputed tax for the 1st quarter of 2021 amounted to 20,000 rubles.

Contributions paid by individual entrepreneurs for themselves - 7,000 rubles.

Contributions paid by individual entrepreneurs for hired workers - 8,000 rubles.

Despite the fact that the total amount of contributions transferred to the budget was 15,000 rubles, the tax cannot be reduced by more than 50%. Therefore, it is necessary to transfer the imputed tax for the 1st quarter in the amount of 10,000 rubles.

The Tax Code of the Russian Federation, clause 1, clause 2, article 346.32, determines that the amount of imputed tax calculated for the quarter is reduced by insurance premiums actually transferred in the reporting quarter, no matter for what period the contributions were transferred.

Contributions that an individual entrepreneur pays for himself can be paid in installments over the course of a calendar year, or can be paid one-time. The main thing is not to miss the payment deadline.

- contributions until December 31 of the current year;

- contributions from the amount exceeding the imputed income until July 31 of the year following the accounting year.

The maximum amount of pension insurance contributions in 2021 has been determined.

More than 212,360 rub. (RUB 26,545 x in 2021 there is no need to make payments as pension contributions.

In 2021, individual entrepreneurs pay insurance premiums for themselves only for the time they are in individual entrepreneur status. That is, if an individual has not been registered as an individual entrepreneur since the beginning of the year, then the amount of fixed contributions is reduced in proportion to this period.

Features of the UTII tax system

Imputation taxation is available to all persons who meet the conditions of the Tax Code of the Russian Federation, Article 346.26. This tax system is designed for individuals who work independently or use hired labor. To use UTII, you must meet the following requirements:

- The total number of hired workers per year does not exceed 100 employees;

- An individual entrepreneur using UTII is not a payer of the Unified Agricultural Tax and does not participate in trust management agreements and simple partnerships;

- The maximum size of retail space is 150 sq. m.;

- Business is not subject to trade tax;

- The entrepreneur does not rent out gas stations.

Taxes and obligatory payments of individual entrepreneurs on imputation in 2021 do not include

:

- Property tax (except for the objects listed in Article 378 of the Tax Code);

- Income tax (pay only 13% of profit to yourself);

- VAT (exception – imported goods).

UTII is not the same: we consider which regime is more profitable to switch to from January 1, 2021

What alternative options do those who currently work for UTII have:

- General system (OSNO);

- simplified tax system “income minus expenses”;

- simplified tax system “income”;

- Patent;

- Professional income tax (PIT).

Let's consider the features, pros and cons of each system or mode.

You don't have to do anything at all to make the transition. If you used exclusively UTII and did not apply for the simplified tax system earlier, then upon termination of the imputation you will automatically find yourself paying income tax (or personal income tax for individual entrepreneurs) and VAT.

The only positive thing here is that companies that are interested in receiving a VAT deduction will be happy to work with you. Otherwise, the general system is unprofitable for most taxpayers.

Judge for yourself:

- Tax rates:

20% income tax for organizations or 13% personal income tax for individual entrepreneurs and 20% VAT. This is against a 15% single tax, which is calculated not even on real income, but on imputed income.

It is possible to apply for exemption from VAT (Article 145 of the Tax Code of the Russian Federation). To do this, your revenue excluding tax for the three previous consecutive calendar months should not exceed a total of 2 million rubles.

- It is advantageous to select only OSNO taxpayers as suppliers

in order to receive a VAT deduction. If you are currently buying goods from simplifiers, it is worth reconsidering your supply channels. - Complex accounting,

requiring a competent specialist on staff - an accountant familiar with this regime. And also confirmation of expenses, which you cared little about on UTII, will play a big role here, because if there are no documents, then there is no reduction in the taxable base = high taxes. - Large volume of reporting.

According to the imputation, the report was submitted once a quarter and was quite simple to fill out. On OSNO you can immediately say goodbye to simplicity, and somewhere even logic - Experienced accountants will confirm that on OSNO the number of requirements, checks and calls to the carpet is higher

than on other taxation systems. For example, tax authorities may not like the high share of VAT deductions; they will have to prove that you have no criminal intentions and you just want to return what is due by law, and not get rich at the expense of the state.

So, the general system is not our option. Let's look for an alternative further.

One of the most acceptable options. Compared to the previous ones, there are many more advantages. For example, the tax rate is only 6%, in some regions it is even lower for certain types of activities. You can reduce the tax (not the base!) on insurance premiums paid for employees, individual entrepreneur contributions “for yourself” and sick leave at the expense of the employer. The tax amount for organizations is reduced up to 50% and for individual entrepreneurs without employees up to 100%. Tax calculation is as simple as possible; the declaration is also submitted once a year.

Negative aspects

— the limits on revenue and other indicators are similar to those that apply to the simplified tax system “income minus expenses”, and other restrictions on the “income” simplification also apply.

Another alternative is a patent. Many compare it with UTII or even equate it. Indeed, the types of activities are painfully familiar (from January 1, 2021, the list will even be expanded), and the tax is calculated based on potential income.

The undoubted advantages of a patent

— the tax office will send or hand over a document that clearly states what amount must be paid and by what date. You won't get confused. There is no tax reporting. The exception is reports for employees.

You can choose your own validity period - from 1 to 12 months. The main thing is not to forget the rules:

- The period must be included in one calendar year; the patent cannot move from one year to another.

- The patent start date can be any - 1, 10, 24, etc. number, but the months included in the patent period must be complete. For example, you cannot start applying a patent on August 10 and end on December 3; the end date will be December 9.

- An application for a patent must be submitted no later than 10 working days before the start of its validity.

What’s good about a patent is that you can try it for one or two months and, if you don’t like it, you won’t get a new one again. Also pleasing is the rate - 6% of potential income.

The main disadvantage is that only individual entrepreneurs are allowed to use the patent taxation system.

This is followed by restrictions - revenue is no more than 60 million rubles per year; according to the average number - up to 15 people and the absence of the opportunity to reduce the tax, for example, on contributions as under the simplified tax system. This issue, by the way, has been discussed for a long time, but so far no amendments, relaxations or even bills have been considered by the government to change the situation.

To switch to PSN, an entrepreneur must submit an application in form 26.5-1 to the tax service at the place of residence or place of business (for more details, see paragraph 2 of Article 346.45 of the Tax Code of the Russian Federation).

Over 15 years of impeccable work, our services have been used by more than 14,000 clients who have many requests for services that you can provide. And we are ready to provide you with the opportunity to provide services in your area for our clients!

Fill out the form below in order to participate in the selection of companies to replenish the business ecosystem from the Business-Garant company.

The UTII declaration for the 4th quarter of 2020 must be submitted no later than January 20, 2021 , and the tax must be paid no later than January 25, 2021 .

Reports must be submitted to the tax authority with which the organization or individual entrepreneur was registered as imputed persons before the abolition of UTII.

How to leave UTII from 2021

There is no need to do anything special for this : the Federal Tax Service automatically remove organizations and individual entrepreneurs from tax registration as UTII taxpayers.

There is no need to submit any applications and/or notifications to the Federal Tax Service . not receive a notification from the tax office about deregistration as a UTII payer .

Organizations that did not choose the special regime before December 31, 2020 are automatically transferred to OSNO. Companies and individual entrepreneurs are allowed to submit a notice of transition to the simplified tax system or unified agricultural tax only after a year - January 1, 2022.

STS is a simplified taxation system. A special mode that allows you to select a bid depending on the object.

Features of the mode:

- closed list of expenses;

- submission of reports once a year;

- quarterly advance payments;

- payment of annual tax;

- maintaining a ledger of income and expenses;

- limited list of activities.

The rate is 6% for those who choose the simplified tax system “Income”, 15% - “Income reduced by the amount of expenses”.

Unified Agricultural Tax is a taxation system for agricultural producers, which has the following features:

- tax rate 6%;

- submission of annual reports;

- payment of a semi-annual advance payment;

- payment of annual tax;

- payment of VAT (every quarter);

- accounting of income and expenses;

- restrictions on types of activities.

In addition to OSNO, simplified taxation system and unified agricultural tax, PSNO is also available - a patent taxation system. The patent is only suitable for individual entrepreneurs who are engaged in certain activities; their list is similar to the canceled UTII.

In 2021, individual entrepreneurs and individuals can register for self-employment and pay tax on professional income NAP. The tax rate depends on the method of obtaining profit and ranges from 4% to 6%.

After the abolition of UTII in 2021, most organizations switched to the simplified tax system. Only 60 thousand out of 1.5 million organizations and individual entrepreneurs did not choose the new special regime.

When an individual entrepreneur becomes a payer of insurance premiums for UTII for hired personnel

From the moment when an individual entrepreneur hired his first employee and concluded any contract with him - labor or civil law, he must, within 30 days, register as a payer of mandatory insurance payments for pension and health insurance and an insurer in case of temporary disability, for pregnancy and childbirth and against accidents at work for those working for him.

The date when a businessman begins to hire individuals is extremely important:

- on the one hand, you cannot violate the deadlines for registering with the Pension Fund as an employer-insurant (penalties are strict);

- on the other hand, it is this moment that will subsequently influence the size and type of insurance premiums accepted for expenses.

The deadline for registering with extra-budgetary funds of an individual entrepreneur as an insurer of hired employees, both citizens of the Russian Federation and foreigners, is 30 days from the date of conclusion of the employment contract.

Individual entrepreneur taxes in 2021: important changes, new laws and much more

As an example, let’s take the auto business of an entrepreneur. In the first month of the quarter, the staff including the entrepreneur consisted of 3 people, in the second of 4, in the third - 6 people (physical indicator). Basic income is 12,000 rubles. 28,456 taxes were transferred from the employees' salaries; the entrepreneur paid 3,000 rubles for himself.

Tax calculation procedure:

- The tax amount for the first month is: 12000*3 (person)*1.915*0.9= 62,046

- Next, we calculate the amount of tax for the second month, it is equal to: 12000*4 (person)*1.915*0.9= 82,728

- The tax amount for the third month is: 12000*6 (person)*1.915*0.9= 124,092

- Total amount for the quarter: 62,046+82,728+124,092=268,866

- The tax amount is 268,866*15% = 40,330

- We reduce the amount of tax by the amount of insurance premiums transferred for this period for employees and entrepreneurs, but not more than 50%. In our case, we can reduce the tax by no more than 40,330/2=20,165. Since the amount of contributions was 28456+3000=31456, which is more than 50%. Thus, the amount of tax payable will be 20,165. Since We take the maximum amount we can reduce.

The Tax Code establishes that the tax period for imputation is one quarter. It is after this period of time that the tax must be calculated. The same period is also set as a reporting period, which means that at the same time as paying the tax, you need to submit a declaration to the Federal Tax Service.

Procedure and deadlines for tax payment

At the end of each quarter of the year, the entity must calculate the tax and remit it before the 25th day of the month following the quarter.

It must be remembered that UTII cannot have a “zero” period, since it is not actual, but imputed income that is subject to taxation. Therefore, it is necessary to make calculations and payments even if no activity was carried out at all in the original quarter.

Important! The fine for non-payment or payment of tax at the wrong time is set at 20% of the unpaid amount. If the tax office proves that the non-payment was made intentionally, its amount will increase to 40%.

Important! Contributions accepted to reduce tax by organizations and individual entrepreneurs must be paid in the same quarter for which the calculation is made. It is impossible, for example, to reduce the 2nd quarter due to payments paid in the 1st, 3rd or 4th quarter.

UTII is a single tax on imputed income. It has been used in tax legislation for a long time, and since 2013 the transition to UTII has become voluntary.

The payer of such a tax has the right to engage in:

- retail trade (except for excisable goods) with a floor area of no more than 150 sq.m.;

- household services;

- repair work on vehicles and car washes;

- veterinary services;

- hotel business (no more than 500 sq.m.);

- catering services in premises with an area of no more than 150 sq.m.;

- distribution of outdoor advertising;

- road transport of citizens;

- other services listed in paragraph 2 of Article 346.26 of the Tax Code of the Russian Federation.

Cancellation of UTII in 2021: which regime to switch to

- Digest No. 56: solving practical issues

- Digest No. 55: amendments to the tax code adopted

- Digest No. 54: news for those on the simplified tax system

- Digest No. 53: clarifications on VAT and a new property tax return

- Digest No. 52. Switched from UTII to simplified tax system? Translate all calculations and obligations into “simplified”

- Tax digest No. 51. Important things for the first half of December

A single tax on imputed income for certain types of activities, when used, involves the replacement of part of the taxes. Let's take a closer look at what exactly it is used for.

Entrepreneurs who apply this regime are exempt from the following taxes:

- Personal income tax, which is levied on the results of activities now transferred under UTII;

- Property tax for individuals - does not apply to the property that is used to carry out activities under UTII;

- VAT, excluding the tax that is paid when importing goods into the country from abroad.

For organizations that have switched to imputation, UTII will replace the following taxes:

- Income tax for activities for which UTII is applied;

- Organizational property tax. Does not apply to those property objects that are used to carry out activities under UTII;

- VAT excluding the amount of tax that is charged for the import of goods into the territory of the state.

The main condition for applying the tax for both firms and entrepreneurs is that the activity being performed is on a closed list, and the physical indicator must not be greater than the established maximum value. All this information can be obtained from the Tax Code of the Russian Federation.

The imputation for the trade sphere of activity cannot be applied to both types of entities if a trade tax has been introduced on the territory of the municipality. It is also impossible to apply this regime within the framework of simple partnership agreements and trust agreements.

In addition to having the type of activity on the list of permitted activities and matching the size of the physical indicator, the entrepreneur must employ no more than 100 people.

In addition to the presence of the type of activity in the list, two more criteria apply to companies:

- The number of employees should not be more than 100 people;

- In the authorized capital of the company, other legal entities should not own a total share of more than 25%;

- The company should not be of the “largest” type;

- The company is not: a non-profit organization involving funds from people with disabilities;

- educational or medical institution providing nutrition services.