The Russian government has introduced a new standard for calculating taxes on real estate and movable property of individuals

The amount payable for UTII is calculated on the basis of the monthly tax base and is the product

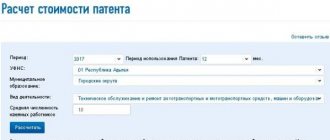

Law of Moscow dated October 31, 2012 N 53 “On the patent taxation system”

Table of changes in the minimum wage value in the region Date Value, rub. Regulatory act from 01/01/2019 14200

According to Article 9 of Law No. 69-FZ dated April 21, 2011, to carry out taxi activities you need to register an individual entrepreneur or

Name of payment KBK for transfer of tax (fee, other obligatory payment) KBK for transfer of penalties

As we know, the object of taxation with insurance premiums are payments and other remuneration in favor of

This article discusses the procedure for filling out the 4-FSS report for the 3rd quarter of 2021

Changes in 2021 Drastic changes in reporting deadlines, tax payment and procedure

The concept of the place of sale of goods To the concept of the place of sale of goods, regulated by Art. 147 Tax Code of the Russian Federation,