In what case should a company submit zero reporting? To what extent is zero reporting submitted?

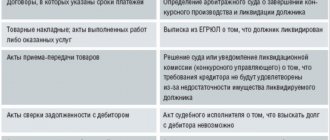

The procedure for writing off accounts receivable and payable always raises many questions even among accountants with

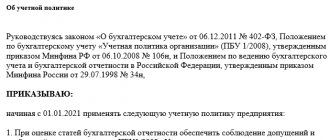

Download a free example of an LLC accounting policy using the simplified tax system for 2021. As a source

Until relatively recently, electronic documents without a “live” signature and seal did not have any legal

Postings to the 79th accounting account - On-farm settlements 79th accounting account -

Deduction code 601 in personal income tax certificate 2 Deduction code 601 in personal income tax certificate 2

What are the advantages of the simplified tax system? The main advantage of “simplified” is that business does not need

As a general rule, the calculation of child care benefits for children up to one and a half years old is 40%

Materials are the main element of current assets, which is used as an intermediate element in activities

Selling and general business expenses: how to differentiate Selling expenses are also called selling expenses. IN