If the account is seized by bailiffs, what is the order of payments? About current changes in

A car owned by an organization is depreciable movable property. From the month following the month of adoption

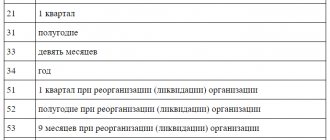

What are the codes approved by the Federal Tax Service for? They help inspection specialists quickly and accurately

You will find the 2021 reporting schedule broken down by quarter below. Information will be

From time to time, every legal entity or individual may need to find out the code of the tax authority to which

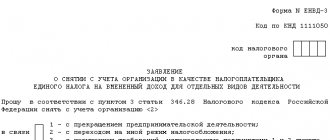

Why is UTII form 3 submitted? An application for UTII form 3 is submitted if the organization

A universal transfer document (UDD) is a form that combines primary accounting documentation and an invoice,

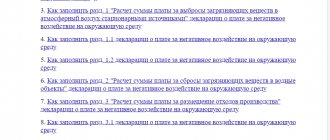

The principles of payment for the use of natural resources are laid down in the main environmental law of the Russian Federation - the Law “On Environmental Protection”.

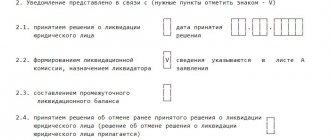

Liquidation commission After the decision to terminate the activities of the organization, the founders (participants) appoint a liquidation commission (liquidator)

OSNO companies pay tax on their profits in installments throughout the year. When is the year