This article describes the method of reflecting an increase in the initial cost of fixed assets in 1C: Accounting 8.

To receive a VAT deduction, collect a dossier on the counterparty Inspectors refuse organizations to deduct

The inventory act is one of the most important documents drawn up by the inventory commission according to a special established

Everyone knows that when considering a client’s request for a loan, the lending bank pays increased attention to

“Forbidden” digits of the payment order number Payment order number is a mandatory detail, and in the form 0401060

Safe share of deductions The safe share is the difference between the amount of tax payable and

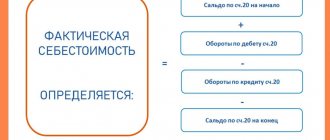

Almost all costing instructions indicate the need for a monthly inventory of work in progress. Examination

List of basic details that a cash receipt printed on new cash registers should include

How the tax office checks the correctness of VAT Before explaining what the VAT gap means, we’ll tell you:

How does a security deposit work? The tenant makes a security deposit if there is a clause in the lease agreement