FSBU 5/2019 introduced new accounting rules for inventories. Let's look at: what assets are classified as reserves;

Source: Magazine “Human Resources Department of a Commercial Organization” The head of the organization, on the one hand, is the same employee,

Additional information 10:47 July 11, 2011 Social Insurance Fund launched a system of direct transfer of benefits

Merger of enterprises and their consequences One of the forms aimed at consolidation, reorganization of a legal entity

Exemption from VAT under Article 145 of the Tax Code of the Russian Federation Exemption from VAT obtained in accordance with Article

Do I need to pay tax on a car purchased in 2013? Benefit for movable property,

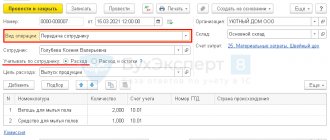

Accounting: purchase of fuel and lubricants In accounting, reflect the issue of cash by posting: Debit 71 Credit 50

A tax return not submitted on time. Ignorance of deadlines or forgetfulness leads to the fact that an entrepreneur

Source: Journal “Unified tax on imputed income: accounting and taxation” Taxation system in

Financiers report: after the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” came into force