All organizations and individual entrepreneurs paying income to individuals are required to withhold personal income tax from this income,

Recalculation of wages for the previous period is a correction of accrued amounts for past periods. IN

Costs for compulsory motor liability insurance relate to other expenses for ordinary activities. Enterprises on the simplified tax system “Income

Dividends are part of the profit of a commercial organization that is distributed among its participants. If

Composition of information on line 010 of the form sections Report information on line 010 contains information about

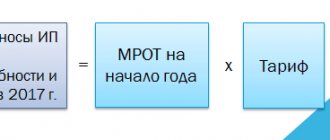

Insurance premiums refer to those payments made for their employees by individual entrepreneurs and legal entities.

Six most important changes in invoices Product type code added Column 1a added to the invoice

Individuals and legal entities are responsible for paying taxes and fees to budgets

N. N. Kataeva author of the article, leading expert of the Main Book magazine It happens that in order to participate

Blog Any taxpayer can assess the likelihood of including an organization in the plan of on-site tax audits. For