Encouraging customers is a technique without which it is almost impossible to imagine running a business. Need him

Any organization deals with certain financial flows - income and expenses. Income –

The property was received free of charge. Of course, tax authorities may suspect something is wrong and still try to attribute it to your

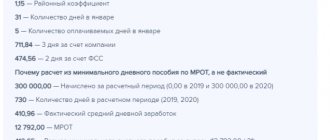

Minimum wages and sick leave As for sick leave, a new rule has appeared in 2021 -

A busy schedule prevents you from attending professional development events? We found a way out! Consultation provided

Lawyer (and previously also a GIT inspector) Natalya Siverskaya tells what documents are now

Legislative framework Financial assistance in connection with marriage is a dispositive category that can be

Keyboard malfunctions Incorrect information displayed on the monitor. When you press some keys, the following appears on the monitor:

Settings in 1C To reflect transactions on a current account: in the Functionality settings, define additional

The procedure for paying fines The Federal Tax Service has the right to impose monetary sanctions on taxpayers for violations listed in