The form of the payment order is fixed in a special form according to “OKUD-0401060”, which is contained in a separate Appendix No. 2 in

SZV-M report: general description There are a lot of reporting forms in the Pension Fund of Russia, but in 2021

The decision of the first instance did not satisfy anyone. Based on the results of the on-site inspection, large sums were accrued to the company

Our author Alexey Ivanov talks about the legal reduction of income tax in his Telegram channel.

Home / Real estate / Purchasing real estate / Buying an apartment / Deduction Back Published: 12/28/2017

An individual may carry out independent commercial activities after state registration. The procedure is of a notification nature,

The product is subject to VAT, but the bonus is not. A wholesale trade organization supplies goods to a retail outlet.

01/02/2021 When purchasing real estate in 2013 (2012, 2011, 2010 and earlier), property deduction

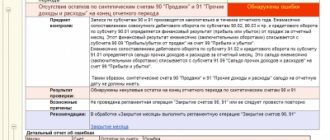

Closing account 91 “Other income and expenses” 91 accounting account is closed in

Is sick leave subject to personal income tax? There are several grounds for obtaining sick leave. The main ones