Algorithm for the operation of ASK VAT-2 The program compares the VAT accrued by the seller (according to his sales book),

The high motivational component of working in private companies is ensured by various methods of financial and non-material incentives

Notification in form N P15001 is used when the company’s participants make a decision on its liquidation,

Reasons for postponing vacation People plan their vacation in advance and do not want to lose any

What is TORG-12? A consignment note is a document that is used when registering the movement of material

Unified agricultural tax: basic concepts In 2002, the unified agricultural tax payment regime was first introduced in the territory

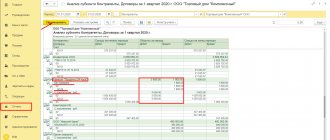

Checking the purchase book by turnover The purchase book is a large table that is maintained in

A forwarding organization applying the general taxation regime has entered into a transport expedition agreement, within the framework of which it carries out

According to the general rule enshrined in paragraph 1 of Art. 284 Tax Code of the Russian Federation, tax rate

Who submits a VAT tax return Value added tax reporting is required to be submitted by: