Terms and procedure for provision

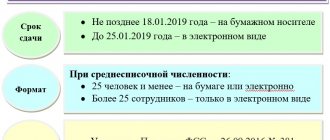

The deadline for submitting the calculation is the same for all employers - the form must be sent to the territorial body of the Federal Tax Service at the place of registration of the insurance premium payer no later than the 30th day of the month following the reporting period. In this case, the calculation period for contributions is a calendar year, and the reporting periods are:

- I quarter;

- half year;

- 9 months.

The deadlines for submitting the report in 2021 are as follows:

- for the first quarter of 2021 - until 05/03/2019;

- for the first half of 2021 - until July 30, 2019;

- for 9 months of 2021 - until October 30, 2019;

- for the billing period (2020) - until 01/30/2019.

Basic information ↑

RSV-1 is a very important document. Any entrepreneur or head of an organization, regardless of the type of tax regime used, should be sure to familiarize themselves with all the basic provisions and information regarding this certificate.

This will avoid many problems, as well as unnecessary attention from the Federal Tax Service. Basic information you need to know:

- definitions;

- who should take the test;

- normative base.

Definitions

All kinds of concepts and definitions relating to RSV-1 are reflected in various regulatory documents, as well as current legislation.

This abbreviation has the following definition: “calculation of accrued and paid insurance premiums.” Moreover, contributions to the following funds are taken into account:

| In compulsory medical insurance | Compulsory health insurance |

| To the Pension Fund | Russian Pension Fund |

This document displays all amounts that were allocated for the following purposes:

| Formation of the insurance part of the pension | SSP |

| Formation of the funded part of the pension | PPP |

| To the Federal Compulsory Medical Insurance Fund (compulsory medical insurance) | FFOMS |

| To territorial compulsory medical insurance funds | TFOMS |

The duration of the billing period for DAM-1 is 12 calendar months. The duration of the reporting periods is 12, 9, 6, 3 months.

In this case, this document must be submitted quarterly. All information is received on a cumulative basis from the very beginning of the calendar year.

The legislation defines the following deadlines for filing RSV-1:

| General principle | By the 15th day of the month following the reporting period |

| After the first quarter | Until May 15 |

| After 6 months | Until August 15 |

| After 9 months | Until November 15 |

| After 12 months | Until February 15 |

If the organization was created in the middle of the year, then RSV-1 is also required to be submitted to it.

This must be done after the end of the quarter in which it was registered and began to conduct commercial activities and make contributions for individuals to the relevant funds.

Who should take it?

The list of organizations, as well as persons obligated to take the RSV-1, is announced in the legislation of the Russian Federation.

Thus, this document is required to be submitted to the Pension Fund of the Russian Federation within the established time frame:

| Individual entrepreneurs | Having employees on their staff |

| Individuals | Individual entrepreneurs who are not, but have entered into an employment contract with another individual |

| Organizations | Regardless of the form of ownership |

The basis for this is Federal Law No. 212-FZ.

Normative base

The regulatory framework relating to the document in the RSV-1 form is quite extensive. It includes the following:

- Federal Law No. 333-FZ of December 2, 2013

- Decree of the Government of the Russian Federation dated November 30, 2013 - this PP determines the amount of the amount based on which insurance premiums are formed (for 2021 the amount was 624,000 rubles).

This is interesting: What is the income limit under the simplified tax system in force in 2019

Over time, various amendments have been made to the regulatory framework. Most of them were included precisely in Federal Law No. 333 of December 2, 2013:

| Federal Law No. 212-FZ regarding insurance premiums has been amended | A reduction in tariffs is used for individual entrepreneurs and organizations using the “simplified system” |

| Amended Article No. 58.2 (Law No. 212-FZ) | The tariff rate of 22% was extended |

There is one important nuance - reduced tariffs apply only to certain types of activities and organizations:

- charitable;

- pharmacy;

- Individual entrepreneurs applying the patent taxation system.

However, the reduced rate can only be used until 2019. Also, the regulatory framework regarding RSV-1 should include:

| Federal Law No. 351-FZ | Some amendments have been made to the laws - on Pension Insurance No. 163-FZ, on accounting (personalized) No. 27-FZ |

| Federal Law No. 421-FZ | Amendments were made to laws No. 212-FZ, No. 167-FZ |

Pension legislation will soon be subject to reform. The most important change that will affect everyone (individual entrepreneurs and legal entities) is that it will be necessary to submit monthly RSV-1 calculations to the Pension Fund of the Russian Federation.

The innovation is necessary to track the wages of workers by age or who have retired due to other circumstances.

In the future, the Ministry of Labor plans to refuse pension payments to working pensioners at a certain salary level.

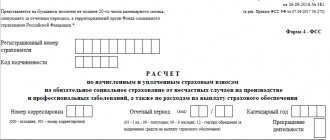

RSV submission form

If the average number of employees of an organization for the previous reporting (calculation) period exceeds 25 people, then the policyholder can only submit an electronic DAM; paper version is not required. The accounting department knows very well what this is: you need to generate a report in a special program, certify it with an electronic signature and send it to the tax service via the Internet. A similar requirement applies to all newly created organizations with more than 25 employees. All other companies can report on paper.

We must not forget that failure to comply with the procedure for submitting the DAM form threatens the payer with a fine of 200 rubles under Article 119.1 of the Tax Code of the Russian Federation.

RSV form: report submission deadline

It is well known that in Russia the employer is not only obliged to pay wages to his employees on time, but also must act as their tax agent. That is, citizens do not pay taxes and insurance premiums on their own; this responsibility is assigned to their employers. The latter are obliged not only to replenish the budget and funds on time, but also to document this replenishment.

Preparing the RSV-1 declaration requires quite a lot of time, specific knowledge and care. Over time, this form becomes easier to submit because some of the information will actually be duplicated (for example, much of the content in Section 6). However, it will be difficult to work with this document the first time in any case. To make things a little easier, try:

We recommend reading: What documents are required for the purchase and sale of an apartment?

Filling procedure and features

When filling out DAM forms, you still need to follow certain rules. Information about them can be found both in administrative and explanatory acts of the Federal Tax Service. The current form for a single calculation for insurance premiums and the procedure for filling it out are approved by Order of the Federal Tax Service of the Russian Federation dated October 10, 2016 No. ММВ-7-11/ [email protected] KND code 1151111. Second source: letters and official explanations. The Russian Federal Tax Service constantly publishes various explanations on how to fill out this report. For example, the Letter of the Federal Tax Service of the Russian Federation dated April 12, 2017 No. BS-4-11 / [email protected] states who must fill out which section. These data are shown in the table:

| Category of employer-insurer | What you need to fill out |

| All insurers (legal entities and individual entrepreneurs, except heads of peasant farms) |

|

| Additionally, these employers must fill out if they fall into the following categories: | |

|

|

|

|

|

|

At the same time, policyholders are required to submit a “zero” DAM. In letter No. BS-4-11/4859 dated March 17, 2017, tax officials reminded that if employees were not paid wages in the reporting quarter, then subsection 3.2 of Section 3 does not need to be filled out. There are also opinions that if an organization does not make payments in favor of individuals, and therefore no insurance premiums during the billing (reporting) period, it is still obliged to provide a calculation with zero indicators. This, in particular, is stated in the Letter of the Ministry of Finance of the Russian Federation dated March 24, 2017 No. 03-15-07/17273.

Let's look at a few more important explanations about the features of filling out this form in more detail.

21.07.2021How to fill out the new form for notification of a reduction in the PSN tax on contributions

Since July 12, 2021, a notification form has been in effect, with which an individual entrepreneur on PSN notifies tax authorities about a reduction in the “patent” tax on the amount of insurance payments and benefits. But before the approval of this form, individual entrepreneurs sent a similar document to the Federal Tax Service in the form that was recommended by the Federal Tax Service letter dated January 26, 2021 No. SD-4-3/ [email protected] On how to fill out the new form if entrepreneurs had previously submitted this document to the tax authorities , representatives of the Federal Tax Service said in a letter dated July 19, 2021 No. SD-4-3/ [email protected]

21.07.2021Clarification during a desk audit: when they won’t accept

If you submit a clarification during a desk audit, then the inspection, according to the rules, must begin checking it and stop checking the initial declaration. But this doesn't always happen. The inspector will continue the begun inspection if he finds reasons not to accept the clarification.

21.07.2021Who pays 15% personal income tax if the employee has several employers and his income is 5 million rubles

The question, unfortunately, is relevant for a small group of Russians, but still quite interesting, and the Russian Ministry of Finance answered it in letter dated 06/11/2021 No. 03-04-05/46440.

21.07.2021Non-working days prevented the submission of SZV-M: the court canceled the fine and collected a state fee from the Pension Fund of Russia

In May 2021, an individual entrepreneur submitted to the Pension Fund information about employees in the SZV-M form for March 2021. For this he was given a fine. But the individual entrepreneur managed to challenge the prosecution, since this time was declared a non-working time by the President.

21.07.2021Who gets paid for travel to and from vacation?

Organizations located in the Far North must pay their employees for travel and luggage transportation to and from their vacation destination. When and how do you pay for such vacation travel?

21.07.2021Rostrud explained what “repeatedness” means when dismissing those who have committed misconduct

Repeated failure by an employee to fulfill his job duties without good reason, if the employee has already been subject to disciplinary action, is grounds for dismissal. But to prevent an employee from challenging his dismissal in court, the employer must correctly determine what constitutes repeated violations.

21.07.2021Bloggers' income from Google advertising: personal income tax or American income tax?

Google pays bloggers who post videos an income if they contain certain ads. How are such proceeds taxed?

20.07.2021Changes in payments from July 17, 2021

From July 17, 2021, there have been changes to the rules for filling out payment orders. They were introduced by order of the Ministry of Finance dated September 14, 2020 No. 199n. You need to fill out fields 60 “Payer INN” and 22 “Code” in a new way.

20.07.2021How to take into account recruitment costs using the simplified tax system

The organization provides recruitment services. She advertises vacancies in newspapers, magazines and on Internet sites. Can she take these expenses into account for the tax paid in connection with the application of the simplified tax system?

20.07.2021Investment income tax deduction: application features

Since 2021, organizations have an alternative to depreciation - an investment deduction. A number of regions have already adopted laws on the conditions for their provision. Where such laws exist, organizations have the right to reduce income tax by the amount of individual expenses.

20.07.2021Public catering 2022: which of the applicants for reduced contributions must meet the conditions for VAT exemption

Reduced insurance premium rates are valid for SMEs, including catering, in 2021. But starting from 2022, a new group of beneficiaries will appear, which includes catering enterprises with an increased number of people. In order to pay insurance premiums at a reduced rate, they must simultaneously meet the conditions under which a VAT benefit is given. That is, one determines the other.

20.07.2021Safe share of VAT deductions based on the results of the 2nd quarter of 2021

The safe VAT share is an indicator that depends on the region, type of activity, period, etc. At the beginning of July, the tax office updated information on VAT indicators. It makes sense for everyone who submits VAT returns to check them with their data.

20.07.2021Is it possible for a foreigner to become self-employed in Russia?

Many foreigners earn income in Russia. Can they register as self-employed and pay tax on professional income?

20.07.2021Traveling workers also have absenteeism, for which they are fired

The organization hired an employee for a traveling job. He doesn't have a job. During the working day, the employee did not show up for a meeting with clients. Can this be classified as absenteeism and the employee fired? Recommendations on what an employer should do in such a situation were given by Rostrud in a letter dated June 24, 2021 No. PG/16935-6-1.

20.07.2021Pre-trial procedure is not needed to challenge collection

The tax decision and the collection order are two different documents. One of them needs to be appealed pre-trial, the other does not.

20.07.2021Should the vaccination premium be included in the profit base?

Bonuses are the most common cause of quibbles among tax authorities, since many requirements must be met in order to take them into account as income expenses. Despite this, authorities are calling on employers to reward employees who have been vaccinated. We suggest you figure out whether such a premium can be taken into account in expenses or whether it’s better not to.

20.07.2021The Federal Tax Service of Russia clarified what functions a fiscal drive should have

The organization contacted the Federal Tax Service with a request. She believes that the purchase of fiscal drives creates a serious burden on business.

19.07.2021The year the property was built affects its cadastral value

The year of completion of construction and the year of commissioning of the facility and the entry of information about this into the Unified State Register entails a change in the base for the property tax of organizations. These factors determine prices for cadastral objects, the Ministry of Finance recalled.

19.07.2021Suspension from work due to vaccination, if there is no order from a health doctor on vaccination in the region

The Russian Federation has a number of laws and regulations that establish rules for the removal from work of employees who refuse to be vaccinated. At first glance, their positions do not fit together. But representatives of Rostrud do not see a contradiction in this.

19.07.2021Electronic signature exchange: the most frequently asked questions

Electronic signature: is it time to change it to the tax electronic signature, where to apply, what documents are needed?

These and other issues became especially relevant after July 1, 2021. The Federal Tax Service certification center began to function and new rules for issuing electronic signatures came into effect. 1 Next page >>

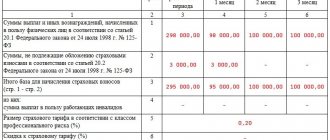

Reflection of expenses not subject to insurance premiums

The Federal Tax Service of Russia, in Letter No. GD-4-11/ [email protected] , explained how the payer must reflect in the DAM the amount of expenses and payments in favor of employees who are not subject to contributions. Such expenses are listed in Article 422 of the Tax Code of the Russian Federation and they must be included in reporting if they are recognized as an object of contributions. And all payments that are not subject to taxation do not need to be indicated in the calculation.

As a result, the policyholder must determine the taxable base as the difference between payments accrued in favor of individuals, subject to insurance premiums, and amounts exempt from them. This is the value that needs to be entered into the report to avoid errors. An example of such payments is a child care allowance for up to 1.5 years; the employer must indicate it. Since, according to the provisions of Article 420 of the Tax Code of the Russian Federation, such a payment is subject to compulsory social insurance, but according to the provisions of Article 422 of the Tax Code of the Russian Federation, it is exempt from taxation.

Filling out the DAM by employers on UTII or simplified tax system

Organizations or individual entrepreneurs that operate under a simplified taxation system or are payers of a single tax on imputed income may also have employees, which means they are required to submit calculations on a general basis, and they are concerned about the question of how to correctly fill out the RSV certificate. 1. What are these features that simplifiers need to take into account? Tax officials spoke about this in Letter No. GD-4-11 dated December 28, 2017 / [email protected] It, in particular, says that organizations that pay contributions at the general rate and at the same time apply the simplified tax system or UTII must fill out Appendix 1 to Section 1 of the RSV indicating one payer tariff code from those listed below:

- «01»,

- «02»,

- «03»,

since they correspond to the same category code of the insured person “NR”. Tax officials also explain that all tariff codes used by payers are specified in Appendix No. 5 to the procedure for filling out the form. It is also necessary to take into account that in field 200 of section 3 it is necessary to indicate the category code of the insured person in accordance with Appendix No. 8 to the filling procedure. The tariff code and the category code of the insured person must correspond to each other.

Critical errors in reporting

The Federal Tax Service accepts reporting with some types of errors, and some are considered critical, so if they were made, the tax authorities will recognize the calculation as not provided. Such errors, in the case of RSV in particular, include:

- discrepancy between the data on the total amount of insurance contributions for pension insurance and the data on the amount of calculated contributions for each insured person for the reporting period. That is, in the RSV, line 061 in columns 3–5 of Appendix 1 of Section 1 of the calculation must coincide with the data in line 240 of Section 3;

- inaccurate personal data of the insured persons (SNILS, TIN (if available) and full name).

In addition, critical errors include incorrectly specified information in section 3 by line:

- 210 - the amount of payments and other remuneration for each of the last three months of the reporting or billing period;

- 220 - the base for calculating pension contributions within the limit for the same months;

- 240 - the amount of calculated pension contributions within the limit for the same months;

- 250 - totals for columns 210, 220 and 240;

- 280 - the base for calculating pension contributions at the additional tariff for each of the last three months of the reporting or billing period;

- 290 - the amount of calculated pension contributions at the additional tariff for the same months;

- 300 - totals for columns 280, 290.

Such errors can be corrected by submitting a new calculation with the correct data within the established time frame. Otherwise you will have to pay a fine.

Checking the report online ↑

The formation of RSV-1 is not so simple. It is for this reason that a large number of different specialized resources have appeared on the Internet, allowing you to use various programs to check whether the form has been filled out correctly.

This is interesting: Clock change: will there be a transition to summer time in 2019 in Russia?

The most commonly used applications for this are:

- CheckXML.

- CheckXML-UFA.

Moreover, most of the resources use only current programs; the use of outdated ones is excluded.

If during the testing process any error was discovered in a document uploaded to the site, specialists collaborating with the resource will be able to help make all the necessary corrections - while confidentiality is guaranteed.

Video: insurance contributions to funds (PFR, Social Insurance Fund, Compulsory Medical Insurance)

Specialists from the Pension Fund of Russia, the Social Insurance Fund and the Federal Tax Service took part in the development of many such online verification tools. You should look for confirmation of this on the pages of the site.

Responsibility for late submission and errors

If an organization or individual entrepreneur untimely sends the DAM to the Federal Tax Service, it faces a fine under Article 119 of the Tax Code of the Russian Federation. Its amount is 5% of the amount of insurance premiums not paid on time based on the data provided by the calculation. The maximum penalty is 30% of the amount of contributions. If there is no underpayment, the employer who is late with reporting will still be fined 1,000 rubles. In addition, if the payment is not provided within 10 days after the due date, in accordance with the new edition of Article 76 of the Tax Code of the Russian Federation, tax authorities have the right to block transactions on the bank account of the paying organization.

Also responsible in this case will be the officials of the insured organization, as a rule, the director. According to the provisions of Article 15.5 of the Code of Administrative Offenses of the Russian Federation, in this case, a warning or an administrative fine in the amount of 300 to 500 rubles is provided.

Legal documents

- Article 119.1 of the Tax Code of the Russian Federation. Violation of the established method of submitting a tax return (calculation)

- Order of the Federal Tax Service of Russia dated October 10, 2016 N ММВ-7-11/ [email protected]

- <Letter> Federal Tax Service of Russia dated 08.08.2017 N ГД-4-11/ [email protected]

- Article 422 of the Tax Code of the Russian Federation. Amounts not subject to insurance premiums

- Article 420 of the Tax Code of the Russian Federation. Object of taxation of insurance premiums

- Article 119 of the Tax Code of the Russian Federation. Failure to submit a tax return (calculation of the financial result of an investment partnership, calculation of insurance premiums)

- Article 76 of the Tax Code of the Russian Federation. Suspension of transactions on bank accounts, as well as electronic money transfers of organizations and individual entrepreneurs

- Article 15.5 of the Code of Administrative Offenses of the Russian Federation. Violation of deadlines for submitting a tax return (calculation of insurance premiums)