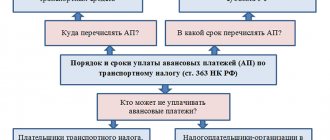

Payment

According to the general rule enshrined in paragraph 1 of Art. 284 Tax Code of the Russian Federation, tax rate

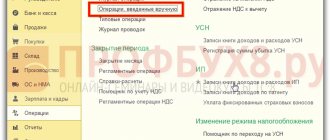

An erroneously entered document in 1C can be freely marked for deletion and deleted only in

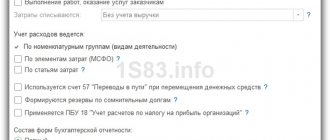

This review is devoted to the procedure for calculating income tax and filling out the corresponding declaration in 1C

There are several tax regimes in Russia, and depending on the choice, the amount of mandatory payments

All vehicle owners are required to pay transport tax annually to the treasury, regardless of whether they use

Grounds for assignment of the right of claim to the simplified tax system In modern conditions, some partners often do not

02/13/2015 129 196 49 Reading time: 12 min. Rating: Author: Konstantin Bely

Accounting for fixed assets Readers' questions are answered by NK Your Tax Representative LLC Phone numbers in

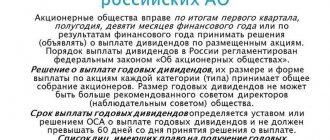

Regulatory framework The main regulatory framework is the laws “On joint stock companies” and “On companies with

In accordance with the provisions of Art. 42 of the Law on JSC[1] a joint stock company has the right, based on the results