Payment

Fixed assets are those assets that are used as means of labor for more than 12 months.

Foreigners from the EAEU If you employ citizens from the EAEU countries (Armenians, Belarusians, Kazakhs,

SZV-M report: general description There are a lot of reporting forms in the Pension Fund of Russia, but in 2021

Our author Alexey Ivanov talks about the legal reduction of income tax in his Telegram channel.

An individual may carry out independent commercial activities after state registration. The procedure is of a notification nature,

The product is subject to VAT, but the bonus is not. A wholesale trade organization supplies goods to a retail outlet.

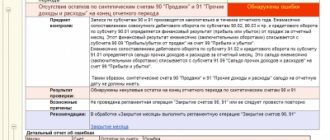

Closing account 91 “Other income and expenses” 91 accounting account is closed in

The high motivational component of working in private companies is ensured by various methods of financial and non-material incentives

Is sick leave subject to personal income tax? There are several grounds for obtaining sick leave. The main ones

Unified agricultural tax: basic concepts In 2002, the unified agricultural tax payment regime was first introduced in the territory