Non-operating income is all those income of the organization that does not relate to sales revenue (from core activities).

The concept of non-operating income is not fixed in the legal documentation that regulates accounting and financial reporting in the Republic of Kazakhstan. There is also no such definition in financial reporting standards (International Financial Reporting Standards (IFRS), IFRS for small and medium-sized enterprises, National Financial Reporting Standard) or in the Tax Code.

One of the main criteria for classifying income as non-operating is the main activity of the organization.

For example, if an enterprise engaged in the production and sale of food products rents out one of the rooms in its office, then the rental income will be non-operating. And if rent is the main business of the enterprise, then income from it will be included in sales revenue.

The same applies to the sale of fixed assets, the profit from which should not be classified as revenue (clause 68 of IAS 16 “Fixed Assets”).

However, if an entity regularly sells items of property, plant and equipment in the ordinary course of business, the proceeds from the sale of those assets must be recognized as revenue in accordance with IFRS 15 Revenue from Contracts with Customers.

Thus, non-operating income is usually the company’s other income, for example:

– rent;

– amounts of fines, penalties, and other sanctions recognized by the debtor for violation of contractual obligations, as well as amounts payable by the debtor by court decision;

– property received free of charge;

- exchange differences;

– amounts of accounts payable written off due to debt forgiveness or expiration of the statute of limitations;

– the cost of surpluses identified during the inventory of property, etc.

What income is not realized?

When the definition states that the defined concept includes all indicators except those listed, then the necessary factors can be calculated by the method of elimination. It can be said that all types of income not mentioned in Art. 249 of the Tax Code of the Russian Federation. In turn, in Art. 250 of the Tax Code of the Russian Federation states that all income of an organization is recognized as non-operating, except :

- amounts received as a result of sales;

- tax-free financial income (they are specifically stipulated in Article 251 of the Tax Code of the Russian Federation).

Interest on restructured loans

The borrowers mentioned above could demand either a suspension of payments or a reduction during the grace period. With such a change in the terms of the loan agreement, in accordance with subparagraph 1 of paragraph 4 of Article 271 of the Tax Code of the Russian Federation, the lender recognizes interest income during the grace period on each date of payment of interest by the borrower under the changed terms of the loan. And after the grace period ends, the normal rules apply again. And if the lender uses the accrual method, then after the end of the grace period it reflects income in the form of interest at the end of each month

List of non-operating income

Another approach to determining this form of profit is to list the possible types of income that Art. 250 Tax Code classifies as non-operating:

- profit received from equity participation in other associations (if additional shares are purchased with dividends, then this income is excluded from non-operating income);

- paid ]penalties[/anchor], fines, penalties under contracts (or even not yet paid, but only awarded or recognized by the debtor);

- compensation received for damage or loss;

- insurance payments;

- profit from leasing or subletting tangible assets or real estate (except for those situations when this activity is the main activity for the company - then this is already income from the provision of services);

- assets received free of charge, for example, as a gift;

- past profit for the reporting year;

- the cost of surplus property credited to the balance sheet based on the results of the regular inventory;

- payment of debts on loans and deposits, the statute of limitations of which has already expired (“unexpectedly returned debt”);

- profit from differences in exchange rates;

- the result of revaluation of assets;

- some others.

Don't forget to include these incomes in non-operating income

Taxpayers often miss out on certain types of profit, which are also considered non-operating, thereby, wittingly or unwittingly, underestimating the tax base. However, these revenues to the organization’s budget are included in non-operating income:

- interest on issued loans, deposits, promissory notes (both in relations with counterparties and with the Central Bank);

- market value of materials obtained as a result of dismantling written-off property;

- charitable contributions received by the company and targeted donations used for the stated purpose;

- assessment of written-off and returned printed products;

- correction of calculated profit due to changes in calculation methods;

- plus the difference between deductions and excise taxes.

NOTE! Understating profits due to the omission of certain items of income, committed due to intent or lack of knowledge, is fraught with troubles on the part of the regulatory tax authorities: this may well be regarded as tax evasion.

Which loans have been restructured?

The rules for restructuring debt obligations during a period of decreased business activity due to the coronavirus epidemic are set out in Article 6 of Federal Law No. 106-FZ dated April 3, 2020. It says here that borrowers - individuals and entrepreneurs who entered into an agreement to receive a loan or credit before 04/03/2020 - have the right to apply for changes in the terms of a consumer loan or credit. In this case, we are talking only about such agreements as:

- consumer bank loan;

- consumer bank loan;

- a consumer loan received from a non-credit financial institution.

Under these agreements, borrowers—individuals and entrepreneurs—could demand that a bank or non-credit financial institution change the terms of the agreement in such a way as to suspend or reduce payments for a period determined by the borrower and called the grace period. An approximate form of the requirement is given in the Information Letter of the Bank of Russia dated 04/05/2020 No. IN-06-59/49. People who have:

- the amount of the principal debt on a loan or credit does not exceed the maximum limit approved by Decree of the Government of the Russian Federation dated April 3, 2020 No. 435;

- revenues are down more than 30 percent compared to average monthly revenue for 2021.

As for small and medium-sized businesses, whose main activity belongs to the sector of the economy most affected by the coronavirus, they had the right to demand the restructuring of any of their loans and credits - both bank and received from non-credit financial organizations. This is stated in Article 7 of Federal Law No. 106-FZ dated 04/03/2020.

Non-operating income and taxation

The significance of this type of profit is its influence on the formation of the tax base. Non-operating income must be taken into account when calculating the following types of taxes:

- profit tax - types of profit are summed up both from the sale of goods, works, services (under Article 249 of the Tax Code of the Russian Federation), and non-sales turnover (under Article 250 of the Tax Code of the Russian Federation);

- determination of the tax base under the special regime of the simplified tax system (Article 346.16 of the Tax Code of the Russian Federation);

- taxable base for the tax regime of the Unified Agricultural Tax (Article 346.5 of the Tax Code of the Russian Federation).

TAX ACCOUNTING

For tax purposes, the following articles of the Tax Code apply to accounting for certain non-operating income:

EXAMPLE

Income from disposal of fixed assets

During the reporting tax period, the company (a VAT payer applying the generally established tax regime (GTS)) sold equipment included in fixed assets and fixed assets of group II (usually the company does not sell such equipment).

The following information is available:

– initial cost of equipment – 1,400,000 tenge;

– the amount of accumulated depreciation on the date of sale – 400,000 tenge;

– sales price – 1,456,000 tenge (including VAT);

– value balance of group II at the beginning of the tax reporting period – 850,000 tenge;

– receipt of fixed assets of group II during the reporting period (initial cost excluding VAT) – 85,000 tenge;

– subsequent costs for fixed assets of group II capital nature – 200,000 tenge.

How to take into account this operation in tax and accounting?

Analysis

Taxation

CPN

In this situation, for CIT purposes, income may arise from the disposal of fixed assets, which is calculated in accordance with Article 234 of the Tax Code:

“If the value of retired fixed assets of a subgroup (for group I) or group (for groups II, III and IV), determined in accordance with Article 270 of the Tax Code, exceeds the cost balance of the subgroup (for group I) or group (for groups II, III and IV groups) at the beginning of the tax period, taking into account the value of received fixed assets in the tax period, as well as subsequent expenses incurred in the tax period and taken into account in accordance with paragraph 2 of Article 272 of this Code, the excess amount is subject to inclusion in the total annual income (AGI). The value balance of this subgroup (for group I) or group (for groups II, III and IV) at the end of the tax period becomes equal to zero.

Income from the disposal of fixed assets is recognized in the tax period in which the disposal of such assets occurred in accordance with Article 270 of this Code.”

Based on paragraph 3 of Article 270 of the Tax Code, when selling fixed assets, except for transfer under a leasing agreement, the cost balance of the subgroup (group) is reduced by the cost of sales, excluding VAT.

Calculation of the result of disposal of a fixed asset of group II (equipment) after its sale:

value balance of group II of fixed assets at the beginning of the tax period (850,000 tenge)

plus

receipt of fixed assets of group II during the reporting tax period (85,000 tenge)

minus

disposed of fixed assets of group II during the reporting tax period (1,456,000 / 1.12)

plus

adjustments made in accordance with paragraph 2 of Article 272 of the Tax Code (200,000 tenge),

equals

income from the disposal of a fixed asset of group II (165,000 tenge).

The calculated income from the disposal of equipment, which is a fixed asset, in the amount of 165,000 tenge is included in the SRS of the reporting tax period in which this object was sold and is subject to CIT.

The value balance of group II at the end of the tax reporting period is reset to zero.

VAT

Since the company is a VAT payer, and the sale of equipment within the Republic of Kazakhstan is not an exempt turnover, the company has obligations to charge VAT on sales on the basis of subparagraph 1 of paragraph 1 and paragraph 2 of Article 369, subparagraph 1 of paragraph 1 of Article 372 of the Tax Code.

The amount of taxable turnover in this case is determined on the basis of paragraph 1 of Article 380 of the Tax Code, according to which, the amount of sales turnover is determined as the cost of goods, works, services sold, based on the prices and tariffs applied by the parties to the transaction without including VAT, unless otherwise provided for by the legislation of the Republic of Kazakhstan on transfer pricing.

For this example:

– amount of taxable turnover:

1,456,000 / 1.12 = 1,300,000 tenge;

– VAT on sales:

1,300,000 × 12% = 156,000 tenge.

Accounting

Recommended correspondence of invoices as of the date of sale of equipment:

EXAMPLE

Free receipt of property

A LLP (applying ERM, VAT payer) receives property (fixed assets) free of charge from another LLP (using ERM, VAT payer).

According to the act of acceptance and transfer of fixed assets, their cost is 120,000 tenge (including VAT 12%).

LLP, the recipient of the property, assessed the fair (market) value of the property, which amounted to 150,000 tenge (at the same value, fixed assets were capitalized in accounting).

How to take into account this operation in tax and accounting?

Analysis

Taxation

Don't make a mistake when accounting for non-operating income

Determining all profit items is a rather complex and cumbersome task in which it is not easy to avoid mistakes. Let's look at the most common difficulties that arise when recognizing non-operating income, and also analyze how to more effectively avoid them.

- Dating problems. Income tax is “tied” to a certain accounting period, usually a year. Therefore, it is very important what date a particular receipt will be assigned to. Sometimes the issue of determining the date can be controversial. For example, insurance compensation was paid - undoubtedly non-operating income. To what period should this profit be attributed? There are two different possible answers, depending on which tax calculation method the taxpayer uses:

- with the cash method, the date of transfer of funds from the insurance company will be important (clause 2 of Article 273 of the Tax Code of the Russian Federation);

with the accrual method, the key date will be the day when the insurer made the decision to pay (subclause 4, clause 4, article 271 of the Tax Code of the Russian Federation).

- Issues of reimbursement and compensation. Often, compensation obtained legally does not cover the damage received by the company. The businessman believes that since he actually suffered a loss, which was not covered by the funds received, they will not be included in profit, and therefore no tax is due on them. The letter of the law says something else: any insurance compensation is subject to taxation, even if the property cannot be restored or there is absolutely nothing to take from the person convicted of its theft (letter of the Federal Tax Service dated November 15, 2005 No. 22-2-14-2096).

- Free services. If the company was provided with certain services free of charge, this is not a personal matter of the managers at all, but a change in the balance. These services must be reflected in non-operating income at the average market value (Article 105.3 of the Tax Code of the Russian Federation). The value of the asset itself, in which the gratuitous services were “invested,” will not increase - after all, the owner did not spend his own money on it.

- Reduction of authorized capital . When the authorized capital becomes less than net assets, the resulting difference must either be divided among all participants or attributed to non-operating income. If the capital reduction is triggered by legal requirements, no adjustment is required.

- A debt that will no longer be called upon . If the creditor is overdue on your debt or the counterparty company was liquidated without demanding payment of obligations, this is again non-operating income. You should not try to hide an unexpectedly generated surplus of funds - tracking such “delays” is the responsibility of the taxpayer. If the tax office finds this, you will be charged with a violation, even if there is no director’s order to write it off (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 8, 2010 No. 17462/09).

- Money received from penalties . Any contract usually contains obligations in case of violation of any provisions. If the counterparty “got” a fine, this does not mean that your company has already automatically received this income. These funds will become accountable non-operating profit only when the debtor recognizes the required amount or there is a corresponding court decision.

The same difficulties may arise when setting the date for receipt of rental income. According to the agreement, rent is paid at one frequency or another, and the accounting date may be shifted from that specified in the agreement to the day the money is actually received.

Why are sales income better than non-operating income?

Natalia MARTYNYUK

Usually people don’t really rack their brains over which of these two groups to include certain incomes in tax accounting. What would seem to be the difference if in any case you have to pay income tax on them. However, sometimes there is a difference: by recognizing as much of the income as sales income, you can legally reduce the tax.

What expenses will we increase?

The fact is that when calculating income tax, the Tax Code does not allow certain expenses to be taken into account in full, but only within the limits of the standard, which is determined as a percentage of revenue. And it is nothing more than income from sales (clause 1 of Article 249 of the Tax Code). The greater the revenue, the greater the amount of expenses by which taxable income can be reduced. There are only three types of such expenses, but two of them can amount to significant amounts for many companies.

Firstly, this is a reserve for doubtful debts designed to smooth out the consequences of the accrual method, the size of which is limited by paragraph 4 of Article 266 of the Tax Code to 10 percent of revenue. Secondly, these are the costs of certain types of advertising. When calculating income tax, you can fully take into account the costs of advertising in the media, outdoor advertising, production of advertising catalogs, window dressing and participation in exhibitions and fairs. But expenses for all other types of advertising, paragraph 4 of Article 264 of the Tax Code, allow you to write off only within 1 percent of revenue. And input VAT on such costs can be deducted only from that part of them that fits into this standard (clause 7 of Article 171 of the Tax Code).

The third type of revenue-dependent expenses is not nearly as common as the first two. These are contributions to R&D financing funds. They can be recognized when calculating taxable profit only within 0.5 percent of revenue (clause 3 of Article 262 of the Tax Code).

Of course, in order to increase the amount of expenses that “fits” into the standard, you can artificially “inflate” revenue by buying and immediately selling something unnecessary with zero profit. But before you resort to this trick, at the risk of being accused by the tax authorities of sham transactions, analyze the composition of the income that you classify as non-operating: are there any among them that can be included in sales income?

With what income?

Articles 249 and 250 of the Tax Code provide room for maneuver. The first establishes what should be classified as income from sales when calculating income tax - proceeds from the sale of any goods, works, services and property rights. Moreover, it is determined based on all receipts that are associated with payments for sold products. Article 250 prescribes “on a residual basis” to consider those that are not specified in Article 249 as non-operating income, and contains an open list of them. That is, non-operating income is everything that was not included in revenue.

It is obvious that some types of income cannot be revenue by definition, since firms clearly do not receive them from the sale of anything. These are, for example, sanctions for violating the terms of a contract.

Others can sometimes be taken into account both as income from sales and as non-operating income. The tax department also agrees with this (letter from the Ministry of Taxation dated July 30, 2002).

No. 02-11-08/125-Yu707SH). Considering that there is no list of income from sales in the code, and the list of non-sales income is open, tax authorities recognized the right of companies to independently classify income not mentioned in Article 250 into one group or another.

Moreover, the legislators themselves recognized this possibility, directly stipulating it for income from the rental of property and from the provision for use of rights to the results of intellectual activity (clauses 4 and 5 of Article 250 of the Tax Code). Moreover, there is no criterion in the code to determine in which case these incomes should be considered received from sales, and in which - non-sales. That is, everything is left to your discretion.

True, with regard to income from the provision of property for rent, the tax department developed its own criterion quite a long time ago. It can be found in section 4 of the Methodological Recommendations for the Application of Chapter 25 (approved by order of the Ministry of Taxes and Taxes dated December 20, 2002.

No. BG-3-02/729). Tax authorities are convinced that rent can be recognized as revenue only if. Otherwise, inspectors will consider tenant fees to be non-operating income. The tax authorities decided to take the concept of systematicity from paragraph 3 of Article 120 of the Tax Code: at least 2 times during the calendar year.

In order not to argue with the tax authorities, it is best to use this criterion by writing it down in the company’s accounting policy. And in case you don’t have the second transaction necessary to recognize income as revenue within a year, nothing prevents you from creating it artificially. In the case of the same rental, you can briefly “rent out” some inexpensive property to a director or another employee for a weekend.

In order for income from certain operations to be included in revenue, they must be carried out at least twice during the calendar year, that is, in the period from January 1 to December 31. If they occur, for example, in December of one year and January of the next, then inspectors will refuse to recognize them as systematic.

Pay attention to the income from the sale of fixed assets and other property of the company. In accounting they are classified as operating income, but in tax accounting they can be included in sales revenue. After all, they are not named in the list from Article 250 of the Tax Code.

The Ministry of Finance recently demanded that the Ministry of Finance recognize as taxable income the seller the transportation costs reimbursed by the buyer in excess of the price of the goods (details of the letter dated March 10, 2005.

No. 03-03-01-04/1/103 read on page 112). But the financial department did not specify what income the amount of compensation should be attributed to. Therefore, if you avoid disputes with inspectors and decide to comply with the Ministry of Finance’s requirement, then nothing prevents you from including these amounts in revenue.

Taking a close look at each of your company's income that you classify as non-operating, you may find that there are others among them that are worthy of the “title” of income.

But first, let's calculate everything

Before “reshaping” your existing income grouping, consider whether it will be profitable. After all, not only expense standards depend on revenue, but also the right to pay quarterly income tax (clause 3 of Article 286 of the Tax Code). It can be used if, during the previous four quarters, sales revenue for each of them does not on average exceed three million rubles. So, by increasing revenue in order to write off more expenses, you may find that the company is forced to switch to monthly tax payments.

The right to calculate tax using the cash method also depends on the amount of revenue (clause 1 of Article 273 of the Tax Code). It is used when the average quarterly revenue for the previous four quarters does not exceed one million rubles. True, for companies using the cash method, increasing the amount of the reserve for doubtful debts is not relevant, since only those who determine tax on an accrual basis can create it. But it won’t hurt to check whether the company will “flip” from the cash method if you are chasing the opportunity to write off more advertising costs.

In addition, do not forget that the costs of those operations, the income from which you classify as revenue, will have to be recognized as expenses associated with production and sales. This means separating out direct expenses from them in tax accounting. With regard to the costs of maintaining leased property (primarily its depreciation), there is even a special clause in subparagraph 1 of paragraph 1 of Article 265 of the Tax Code. It says that these expenses must be written off as related to production and sales if the company rents out its property on a systematic basis (by the way, it is from this that the tax department apparently derived its criterion for classifying rent as revenue or non-operating income ).

When everything is the other way around

If you plan to transfer the company to a simplified system from the beginning of next year, then for you the income from sales is worse than non-operating income. After all, only those companies whose revenue (and not all income) for nine months of the year do not exceed 11 million rubles (clause 2 of Article 346.12 of the Tax Code) can switch to a simplified system. Therefore, it is beneficial for such companies to recognize as much of their income as possible not as revenue, but as non-operating income.But it is quite possible that this state of affairs will soon change. Back in March, the government approved a draft law amending Chapter 26.2 of the Tax Code. One of the amendments establishes a new income threshold for switching to a simplified tax system: 15 million rubles. But unlike the current 11, they already include all the company’s income, including non-operating ones, and not just sales revenue. By the way, if the deputies agree with this, then for many the threshold will be a fiction.

Non-operating expenses

The Tax Code devoted non-operating expenses to Art. 265. This type of documented, justified costs does not have a direct connection with trade in goods, payment for services and work, and some types of losses may also be included in such costs.

IMPORTANT! One of the main criteria for classifying expenses (as well as income) as non-operating is the main activity of the organization. For example, if a company engaged in the production and sale of office supplies rents out one of the rooms in its office, then the costs of maintaining this room will be non-operating (as will the rental income). And if rent is the main business of the company, then you have to deal with production costs.

Open list of non-operating expenses

Article 265 of the Tax Code of the Russian Federation lists 20 types of such expenses. Undoubtedly non-operating costs and financial losses of the organization include:

- funds spent on the maintenance and servicing of tangible assets rented or under a leasing agreement;

- interest that had to be paid on certain obligations during the reporting period: loans, credits, securities;

- costs of issuing the organization’s own securities (these include not only shares, but also forms, registers, magazines, publications in the media);

- registration costs;

- servicing purchased securities;

- losses caused by exchange rate fluctuations;

- expenses for liquidation of fixed assets, insufficient amount of accrued depreciation, liquidation of unfinished objects;

- expenses for conservation and re-preservation of the production process (to justify the costs, the decision of the manager and the availability of an estimate are required);

- costs for containers and packaging;

- obligation to pay fines, penalties, compensation;

- spending on various corporate events;

- funds for organizing and holding meetings of LLC founders or shareholders;

- the result of markdown of goods, inventories;

- some other expenses.

Could other expenses be non-operating?

Listing in Art. 265 of the Tax Code is open, that is, it provides for the subclause “and others”. There are costs for which it is not always possible to unambiguously determine their affiliation; they can equally belong to both the implementation ones and their opposite. In such cases, the law provides the taxpayer with a choice; only this choice must be justified in the relevant internal documents.

NOTE! Other costs recognized as non-operating expenses must comply with the requirements of the Tax Code, that is, be economically justified, supported by documentation and related to the generation of income.

Examples of expenses that can be legitimately considered non-operating:

- banking fees;

- discounts provided;

- expenses for maintaining a trade union organization;

- legal costs if a case concerning the company’s production activities is being considered in court;

- interest on a loan taken to pay dividends or to purchase fixed assets.

ATTENTION! Interest is an independent type of expense, for which there are accounting rules provided for by the Tax Code. Therefore, depending on the purpose of the loan, interest on it can be classified as non-operating expenses or other types of expenses.

Are losses also expenses?

Funds lost or underreceived during the reporting period may also be classified as non-operating expenses if they meet their criteria. The Tax Code of the Russian Federation includes:

- any losses that were received earlier, but were identified precisely during the reporting period (don’t forget to check your tax return!);

- unpaid debt that is recognized as bad (unsecured, overdue);

- results of production downtime due to internal reasons;

- losses caused by emergencies, catastrophes, natural disasters, cataclysms, etc.;

- expenses to eliminate the consequences of such situations;

- a deficiency identified by an audit without the possibility of identifying the culprit;

- other qualifying losses.

Recognition of expenses as non-operating

The importance of attributing expenses specifically to this type of expense helps in reducing the tax base for income tax.

Write-off of expenses is carried out using one of two methods, and for each the Tax Code of the Russian Federation has its own procedure:

- When using the accrual method, you need to use clause 7 of Art. 272 Tax Code of the Russian Federation;

- for the cash method , the procedure described in paragraph 3 of Art. 273 Tax Code of the Russian Federation.

The moment of recognition of expenses depends on the choice of method: in the first case, this is the date of documentary confirmation of the basis, and in the case of using the cash method, the actual occurrence of the event.

It is necessary that expenses have mandatory documentary evidence; this requirement is clearly stated in the Tax Code of the Russian Federation. What kind of confirmation this will be will have to be decided on a case-by-case basis.

For example, when writing off as a non-operating expense losses from a fire that occurred in a given period, one of the documents can serve as confirmation:

- a certificate issued by the fire service (government body);

- report from the scene of the incident;

- act of establishing the cause of the fire;

- inventory acts, etc.

How is interest income recognized?

In a normal situation, for profit tax purposes, income in the form of interest receivable on issued loans and credits is qualified in accordance with Article 250 of the Tax Code of the Russian Federation as non-operating income of the lender or creditor. Such revenues, in accordance with Article 269 of the Tax Code of the Russian Federation, are recognized in the amount determined based on the actual interest rate specified in the agreement, if the transaction between the parties is not considered controlled.

Interest receivable on loans and credits increases the tax base of the lender or creditor according to the rules of Article 271 of the Tax Code of the Russian Federation - at the end of each month during the reporting period or the year as a whole. In the normal situation, for the purposes of recognizing interest income, the actual date of payment of interest by the borrower and its receipt by the lender or creditor is irrelevant.

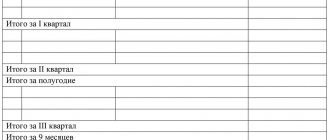

More information about reporting periods during the calendar year for different methods of calculating advance payments is in the table.

Table. Reporting periods for corporate income tax

| Advance payment calculation method | Reporting periods throughout the year |

| Quarterly or monthly, based on the profit of the previous quarter | First quarter, half year and nine months |

| Monthly, based on actual profit | One month, two months, three months and so on until the end of the calendar year |

At the same time, the principal amount of a loan or credit issued to the borrower and subject to repayment, in accordance with Article 251 of the Tax Code of the Russian Federation, does not form taxable income of the lender or creditor.

Non-operating expenses and accounting

The accountant must take these expenses into account in the reporting period, because their amounts will affect the size of the tax base in the next period.

FOR YOUR INFORMATION! In the accounting provisions “Income of the organization” (PBU 9/99) and “Expenses of the organization” (PBU 10/99) the lists of amounts received and spent do not coincide with the Tax Code. Non-operating income in accounting is classified as “Other”, where it is taken into account together with operating income. Therefore, temporary expense differences may arise, which are constantly adjusted.

What is considered interest income?

For tax purposes, interest is considered to be any predetermined income, including in the form of a discount, on a debt obligation of any type, regardless of the method of its execution. From a profit tax point of view, debt obligations are:

- cash bank loans;

- commodity and commercial loans;

- loans;

- bank deposits;

- bank accounts;

- other borrowings, regardless of the method of their execution - for example, bonds.