Deduction

Form 4-NDFL is submitted by individual taxpayers receiving income from business activities or private practice

The advance payment date in the organization is the 20th. After the 15th, but before the 20th

Features of the return of money to the cash desk by an accountable person Organizations (IP) can issue cash on account

Without complicated formulations or fuss, we’ll tell you about the operating principle of cloud cash registers. When and where

The article will discuss issues regarding personal income tax rates on dividends in 2021 for

Who is eligible for the child tax credit? By law, if you have

Home — Articles Returning goods is fraught with accounting difficulties. And everyone tries to avoid them.

A standard tax deduction is an operation to subtract a certain amount (its amount is determined

A tax deduction is a benefit provided to citizens of the Russian Federation and is expressed either in the return of part

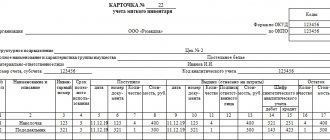

03.23.2019 We have repeatedly touched upon the topic of accounting for soft inventory items. However, there are no questions