At first glance, it may seem that in order to prepare a supply agreement that is competent from the point of view of civil law, it is sometimes enough to refer to Chapter. 30 of the Civil Code of the Russian Federation. But in practice, the provisions of the code are not enough to provide a transaction with business benefits, legal protection and tax security. Therefore, when drawing up a supply agreement, or any other agreement, it is necessary to take into account commercial, legal and tax features.

- Commercial Features

- Legal features

- Tax risks: taxation and expenses

- Features of VAT calculation

- Features of calculating income tax

- Distribution of costs between buyer and seller in accordance with the terms of the contract

Commercial Features

A supply agreement is a type of purchase and sale agreement, which is regulated by clause 3 of Chapter. 30 Civil Code of the Russian Federation. In order to understand what it is, you first need to refer to the definition of a purchase and sale agreement.

According to paragraph 1 of Art. 454 of the Civil Code of the Russian Federation, under a purchase and sale agreement, one party (seller) undertakes to transfer the thing (product) into ownership of the other party (buyer), and the buyer - to accept this product and pay a certain amount of money (price) for it. Those. The purpose of the purchase and sale is the transfer of ownership. An agreement may be concluded for the purchase and sale of goods available to the seller at the time of conclusion of the agreement, as well as goods that will be created or acquired by the seller in the future, unless otherwise follows from the nature of the goods.

To conclude a contract, the parties must reach agreement on the essential terms of the contract. In a purchase and sale agreement, as well as in a supply agreement, such a condition is the subject of the agreement. The subject of the contract in this case implies the name and quantity of the goods. Those. the parties need to understand what we are selling and how much we are selling. It is important to note that the price in the purchase and sale agreement is an essential condition only when selling real estate. In other cases, price is not an essential condition, but serves as a necessary one.

In practice, the price is most often agreed upon in advance by the parties and fixed on paper, since the parties do not want to take risks. A supply agreement is characterized by an indication through a reference to another document (for example, the price is determined in accordance with the price list, catalog, specification, invoice, etc.). The parties are given the opportunity to independently determine in the contract a document that will reflect the cost of the goods.

Other conditions, such as quality, assortment, completeness, and so on, are called necessary and can be determined on the basis of criteria introduced by law.

If the parties have reached an agreement on all essential terms, then from that moment the contract is considered concluded.

How VAT works: example.

The best option for a general understanding of how VAT works is a simple example:

- Let's say we have a factory for sewing jeans, and our VAT rate is 20%;

- In order to sew a pair of jeans, we need to buy material from the manufacturer;

- Manufacturer of fabric, sells it for 100 USD. but, when selling, in accordance with tax legislation, he must add 20% VAT, in the end we actually buy it for 120 USD;

- Having purchased fabric including VAT and following all formalities, we have the right to compensation for this tax from the budget. Ideally, the state returns this money to us (compensation schemes may be different, depending on the legislation of a particular country);

- We then make jeans from this fabric. Taking into account the cost and our earnings, we form an acceptable price for us at 200 USD. But now we, as entrepreneurs, are subject to the tax law and are forced to include a 20% value added tax in the price when selling our jeans. As a result, we sell them for 240 USD. We keep 200 for ourselves, and send 40 to the country’s budget;

- The buyer who purchased jeans for 240 USD is a private individual and will use them for their intended purpose without reselling them. Thus, he does not need to deduct anything to the tax office, since we did it instead, including value added tax in the final price of the product.

- As a result, the consumer paid the tax, and the producers received a VAT refund. Such a production chain may be much longer, but the essence of the scheme will remain the same.

Value added tax in reality.

It should be noted that everything described above quite often works well only on paper. In reality, the operation of this scheme and price formation may differ depending on legislation or other factors. So, for example, the simplest error in an invoice can lead to the fact that the manufacturer is not compensated for VAT. In turn, this trouble can lead to the fact that the manufacturer simply includes its losses in the cost of production. As a result, the final cost of the product will increase.

IMPORTANT! Especially for accountants and other economic specialists:

This article is not intended to introduce a person to all the intricacies and delights of the world of finance. For this, there are special specialized resources. It contains general concepts and assumptions that are intended to familiarize people in the simplest form with what VAT is and how it works.

Legal features

The definition of delivery is contained in Art. 506 of the Civil Code of the Russian Federation. Under a supply agreement, the supplier (aka seller), engaged in business activities, undertakes to transfer, within a specified period, the goods produced or purchased by him to the buyer for use in business activities or for other purposes not related to personal, family, home and other similar use.

It follows from the definition that the supply is carried out exclusively within the framework of business activity and cannot be related to personal needs. This is the specificity of the supply agreement. Otherwise, the sale for personal use is a retail sales contract. It is important to understand that the main difference between retail purchase and sale and delivery is not the quantity of goods, but the purpose of its use. In practice, quite often there is a substitution of concepts where the supply is formalized as the retail sale of goods. Sometimes this happens out of ignorance, and sometimes deliberately in order to optimize taxation. So, for example, retail purchase and sale in some cases may fall under a special UTII tax regime, which is most often the most beneficial for the entrepreneur, and the entrepreneur “disguises” the supply as a retail purchase and sale. However, this method is not correct and in the event of a tax audit it is fraught with additional charges.

If in practice there is a contradiction between the actual goals of the parties and their legal formalization, it is necessary to bring them into agreement. The form of the agreement must correspond to its content. Disguise will sooner or later break the legal form. In accounting and tax accounting, a transaction is taken into account based on its economic content, and not on contractual structures. Therefore, if this rule is violated, the tax authority will recalculate your taxes. Do not underestimate tax inspectors, who sometimes read the agreement more carefully than the parties. If you call everything by its proper name and back it up with references to articles of the Civil and Tax Codes, it will be much easier for you to convince the tax authority and the court that you have given exactly as much to the budget as is due.

One should also not confuse a delivery agreement with a transportation agreement. The contract of carriage is governed by Sec. 40 Civil Code of the Russian Federation.

Sometimes, when a supply contract is implemented with the condition of delivery of goods, it begins to be confused with transportation, since outwardly these two contracts may be similar, but their essence is different. The purpose of delivery is the transfer of ownership within the framework of business activity. And it is not at all necessary that the goods be delivered (delivered). Delivery may also include pickup, for example (Article 515 of the Civil Code of the Russian Federation “Selection of goods”). But the purpose of transportation is precisely the actual movement of goods (or passengers) from point A to point B. Moreover, during transportation, the owner of the goods may not even change. Incorrect qualification of the contract may result in a tax audit, which will lead to adverse tax consequences.

What is VAT for, why and who pays it.

If you understand why VAT is needed in general, then you should note the important fact that this particular tax plays a very important role in filling the budget of a particular country. And this is very logical, since every day millions of sales or resale transactions are carried out, from which the state receives taxes. In addition, such a tax system allows you to receive taxes from the manufacturer without waiting for the actual sale of the finished product to the end consumer.

In relation to who directly pays VAT (physically transfers money to the state treasury) and deals with all accounting operations, these are mainly: Legal entities and private (individual) entrepreneurs. The end consumer does not need to pay these fees on their own, since they are already included in the final price of the product. However, the receipt indicates in a separate column the amount of value added tax that will be paid to the budget from this purchase.

Tax risks: taxation and expenses

It should immediately be noted that the taxation procedure in the supply agreement is affected by the moment of transfer of ownership of the goods. This very moment is determined by the contract. Therefore, if the parties to the contract stipulated that ownership of the goods passes at the moment of its signing, then the corresponding tax consequences will arise for the party to the transaction at this very moment, that is, for the seller - the sale, and for the buyer - the acquisition. In this case, the goods may not actually move anywhere, since the moment of transfer of ownership of it is not associated with its physical movement.

Features of VAT calculation

From the supplier (seller) in accordance with Art. 167 of the Tax Code of the Russian Federation, the tax base for VAT arises either at the time of receipt of an advance payment (prepayment) or at the time of shipment. Depending on the actual circumstances of the transaction, what happens first generates the VAT tax base. It is worth noting that the calculation of VAT does not depend on the transfer of ownership. Even if the parties in the supply agreement indicate a special procedure for the transfer of ownership of the goods in accordance with Art. 491 of the Civil Code of the Russian Federation, this provision will still not relieve the seller of VAT.

Therefore, it is necessary to focus on one of the following circumstances:

- Shipment. The term “shipment” is not defined in the Tax Code of the Russian Federation, but the Federal Tax Service in its letter long ago expressed its position on this matter, indicating that the date of shipment of goods should be considered the date of the first drawing up of the primary document. Established judicial practice suggests that the moment of shipment is not associated with the moment of transfer of ownership, but is determined by the date of actual shipment of goods recorded in the primary document.

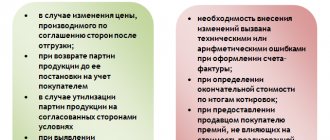

- Payment (full or partial). It should be noted here that in practice the parties, when making an advance, may call such payment a deposit in order to avoid paying VAT. However, courts have long considered such a “deposit” to be an advance, so it is better to avoid such wording in the contract. It is necessary to clearly distinguish the legal essence of an advance from a deposit so that you do not have to prove the essence of your payment in court. A deposit is a way to ensure the fulfillment of an obligation, that is, a certain guarantee. An advance is an advance payment for goods. The deposit is always paid by the party before the conclusion of the main contract, and the advance (prepayment) is paid after signing the contract as a partial payment. The advance is paid by the seller to pay off future payments, and the deposit is returned to the buyer upon fulfillment of obligations. Therefore, if your “deposit” is transferred to pay off the cost of the goods, then this is an advance, and it entails the need to pay VAT.

The buyer has the right to a tax deduction for VAT only for goods accepted for registration (Article 172 of the Tax Code of the Russian Federation), depending on the terms of the agreement on the transfer of ownership of this product.

What an ordinary person (individual, consumer) needs to know about value added tax:

- Despite the fact that the definition indicates the addition of a markup at each stage of sales, this does not mean that the final cost of the product will increase depending on the number of such markups. As a result, the price without taking into account the cost of the product and the income of the retailer[/anchor] will increase only by the amount of the VAT interest rate established by the state. This is due to the VAT compensation system for all taxpayers with the exception of the end consumer.

- The VAT rate is directly relevant to ordinary consumers, since they are the ones who will ultimately pay this tax at the time of purchasing a product or service.

- Value added tax rates vary depending on the group of goods or services. For example, the rate for medical drugs may be lower than for luxury products. On products that the country exports, as a rule, the VAT rate is 0%.

Distribution of costs between buyer and seller in accordance with the terms of the contract

In the supply agreement, it is necessary to distribute the costs under the agreement between the parties to the transaction. Otherwise, the tax authorities may recognize the expenses as unjustified.

For example, in practice there is often a situation where the terms of the contract do not stipulate who will deliver the goods. The supplier, in fulfillment of its obligations, delivers the goods at its own expense, and subsequently takes into account the costs incurred for delivery for tax purposes. In the described situation, the tax authority can exclude such expenses from the supplier, since there is no delivery condition in the supplier’s obligations section. The same situation is observed with the unloading/loading of goods and with its insurance. Therefore, before incurring any expenses in the hope of taking them into account later for tax purposes, you need to make sure whether the corresponding obligation is provided for in your contract. It is important to understand in advance where the seller's expenses end and the buyer's expenses begin.

To summarize, remember that your tax consequences depend solely on the provisions of the contract you enter into. Pay close attention to each wording of the contract, control the indication of all essential and necessary conditions and indicate those obligations that will be fulfilled in fact. Do not forget that your agreement may be closely scrutinized by a tax inspector. The absence of certain conditions in the contract may entail additional tax risks.