Author: Alena Donmezova - RKO Specialist Date of publication: 10/09/2019 Current as of May 2021

When a legal entity buys any vehicle and puts it on the balance sheet of the enterprise, it

UTII is one of the most popular taxation systems for retail trade and other types of

Deadlines for submitting form 4-FSS for 2021 Companies submit form 4-FSS to the FSS office

Current as of January 30, 2021 To offset insurance premiums, penalties and fines in the Pension Fund of the Russian Federation

Innovations in the declaration under the simplified tax system in 2021. Useful documents on changes in the tax

Tax officials have the right to request documents necessary for verification from the company itself (clause 1 of article 93

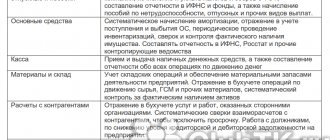

What are the main tasks of an accountant? In the production sector, there is a Regulation on the organization of accounting, because

Still, amazing news recently appeared on the Internet... The State Duma announced a competition for training

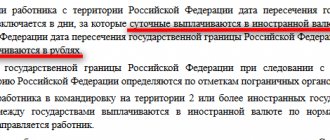

Daily allowances are one of the items of employee travel expenses subject to mandatory reimbursement. It is their payment