Individual entrepreneurs’ contributions to the simplified tax system are made in two versions - in a fixed amount upon payment

Individual entrepreneurs engaged in private practice and without employees are proposed to be released in 2021

The smallest wage established by the state pursues one very important goal - protection

The topic of the need to exercise due diligence when choosing a counterparty has already been actively discussed by the tax authorities.

The VAT return for the 3rd quarter of 2021 is submitted in the form approved by the Federal Tax Service by order

Self-employment is a new experimental tax regime that allows for the legalization of private commercial activities. In 2021

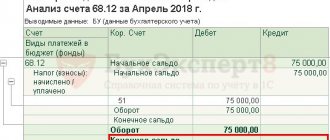

Entrepreneurs and organizations using the “simplified” tax system several times during the year

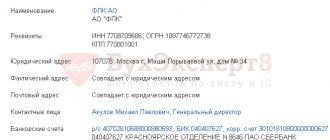

The current legislation provides for a procedure for reorganizing a legal entity in the form of transformation. For example, a joint stock company may

Express Newspaper answers current, inconvenient and unexpected questions. We asked a lawyer to tell us

On January 1, 2021, a new bill on self-employed citizens came into force. Self-employed