How the form is structured. Main features Employee personal cards are the necessary basis for creating

As you know, statistics know everything, and, of course, the number and classification of business entities in

Who pays property tax Obligations to pay property tax in accordance with Article

What is an income statement Along with the balance sheet, the income statement is -

We have already discussed the “One-page charter of an LLC with two directors electronically and opening an account in

The coming year 2021 has brought a number of tax innovations that an entrepreneur needs to know. Let us remember that IP

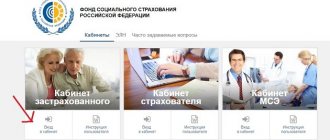

Functions of the insured person’s personal account There are two types of electronic accounts on the FSS website - for

When applying for a new job, among the documents provided to the accounting department is a 2-NDFL certificate. Often

Property and property rights of the Tax Code of the Russian Federation, focusing on the Civil Code of the Russian Federation, determines that property is

How much is spent on patients with rare diseases in 2021 to provide for all patients