Purpose According to the text of the standard, the main purpose of persons who are engaged in accounting is

From March 4, a new procedure for obtaining a deferment (installment plan) for paying taxes and insurance has been in effect.

» Maintaining an individual entrepreneur » Patent Individual entrepreneurial activity is always associated with clear rules that

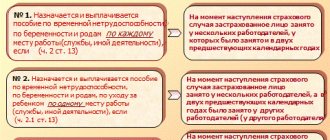

Maximum and minimum limit of payments for sick leave in 2019 From January 1

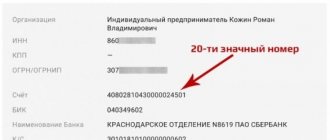

Each company that is registered as an individual entrepreneur or LLC has a bank account, and

General rules for individual entrepreneurs and organizations for calculating income tax First of all, to

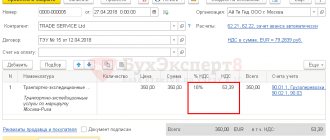

In accordance with paragraph 1 of Article 164 of the Tax Code of the Russian Federation, a zero VAT rate can be applied

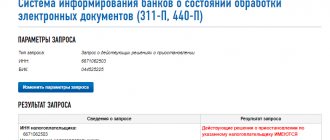

Reasons for blocking a current account by the tax inspectorate As one of the measures to influence

A limited liability company is a commercial entity created to make a profit. Get yours

Changes in the cost of shipped goods, services and works are possible either downward or downward.