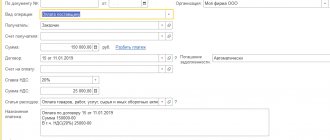

We are often asked how to enter a GPC agreement for the performance of work into the accounting program

VAT Declaration Income Tax Declaration Corporate Property Tax Declaration

The ability to optimize the most complex tax, which is a headache for most organizations in the general taxation system,

Determination of the tax base The section of the legislation of the Russian Federation devoted to taxation interprets in detail the concept of tax and

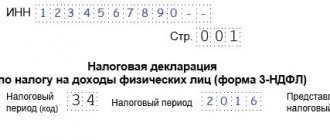

To report to the Federal Tax Service on income for the past year, individuals must use the form

GLAVBUKH-INFO The actual cost of materials purchased for a fee is recognized as the amount of the organization’s actual costs for the acquisition,

on the basis of paragraph 2 of Article 169 of the Tax Code.... 2. Invoices compiled and issued in violation of the order,

Accounting accounts for accounting for finished products Information about manufactured products is stored in account 43

Who submits RSV-1 and RSV-2 to the Pension Fund In accordance with Federal Law No.

In accordance with the current legislation of the Russian Federation, economic entities required to maintain accounting records submit annual