For some time now, when calculating transport tax on expensive passenger cars, it is necessary to use an increasing

Last changes: January 2021 When emergency situations arise, you often have to be absent from work.

The essence of offset Offset of counterclaims should not be confused with barter. Barter is a deal

Source: Journal “Income Tax: Accounting for Income and Expenses” The organization acquired a security –

It is important to stipulate the basis on which the individual entrepreneur operates in the contract with the entrepreneur. Incorrect wording may

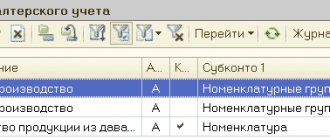

Cost accounts and their number Cost accounts in accounting are a list of accounts,

Analysis of the situation step by step: Step 1. Prepare an application and necessary documents Step 2. Present

April 07, 2021 Is your employee sick? Good health to him, of course, but headaches for you too

Oddly enough, there are also types of taxes that are not so offensive

Remuneration under an agency agreement is a source of income for the agent. To receive the expected cash