Organizations located and operating on the territory of the Russian Federation are required to contribute to the state budget

Features of the financial result according to UTII According to Art. 346.30 Tax Code of the Russian Federation tax period for UTII

You can register on the State Services website and use it without a qualified electronic signature (CES).

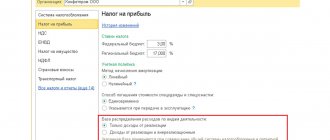

By virtue of clause 7 of Art. 346.26 of the Tax Code of the Russian Federation, taxpayers carrying out, along with entrepreneurial activities,

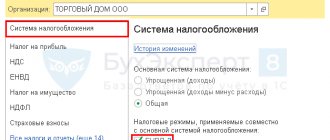

Revenue under the simplified tax system for 2020–2021 One of the main requirements regarding the possibility of using the simplified tax system by a company

Other office machines OKOF-2 (as amended on 05/08/2018, taking into account changes that came into force on 07/01/2018)

Bulatova Evgeniya “THORY OF LAW” The director of the company is responsible for everything that happens in it, in

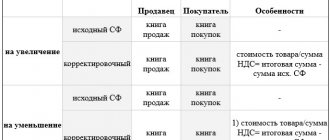

What are adjustments and corrections? If the cost of shipped products (services, property rights) changes, the Tax

Labor inspections can be either scheduled or unscheduled. In this article we will tell you what

Fixed payments of individual entrepreneurs for themselves in 2021: new terms, kbk and other details