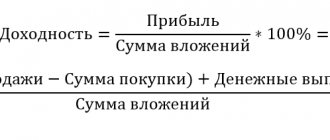

How to calculate return on investment? - This question interests every investor. The main purpose of investing is

Taxes on premiums | Is the bonus taxable - Kontur.Accounting For employees for quality work

Working with the register of professional standards For several years now, the National System of Professional Standards has been actively developing in Russia.

State control over money circulation Changes made to the procedure for cash and non-cash payments in

Truck cranes are self-propelled lifting equipment on which boom equipment is located. They are quite stable

What are the benefits Tax legislation establishes property tax benefits in relation to certain

Concept and types of tax benefits Tax benefits are a more favorable regime for the transfer of mandatory

Documentation The fact of obtaining rights under the license agreement is documented in a free form, unified

The Federal Tax Service deciphered the error codes and explained how to act when receiving a Request Request tax authority

Taxation when performing R&D A scientific budget organization conducts business activities in the form of R&D on