“Export” package of documents VAT taxation of goods exported in the customs export procedure is carried out at zero

Main features Lack of documents is not a valid reason for non-payment of taxes. The company also does not

Free legal consultation by phone: 8 Through the Resolution of the Board, a new

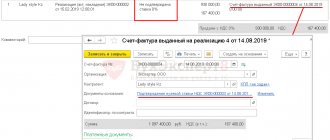

According to current legislation, a taxpayer has the right to reduce VAT by the amount of tax deductions due to him. IN

Step-by-step instructions April 01 An organization using the simplified tax system (income-expenses) received from the supplier an act for the provision of

All articles Replacing a defective fixed asset with a serviceable one: tax and accounting (Vightman E.)

What is financial assistance for vacation? To answer the question, enter

The procedure for submitting claims is established by the following orders of the Federal Tax Service: dated February 27, 2021 N ММВ-7-8/ [email protected] ;

November 27, 2018 Accounting Anna Kuklina Working capital is one of the main criteria that determines

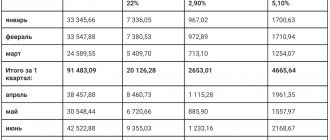

To calculate UTII obligations, in addition to basic profitability and physical indicators, it is necessary to take into account adjustment factors: