Each company must keep records of the income it pays to individuals, records of tax

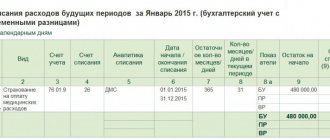

How to register an insurance premium paid to an insurer? How the standard is calculated in the 1C: Accounting program

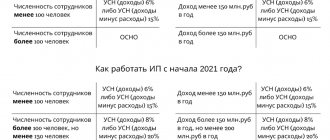

Conditions for applying the simplified tax system The legislation establishes certain rules that allow you to work on a simplified basis. In 2021

Despite economic difficulties, housing construction is gaining momentum, returning to pre-crisis levels. For financing

Kontur.Accounting - cloud accounting for business! Quick establishment of primary accounts, automatic calculation of taxes, sending reports

We distribute direct production costs According to tax legislation, direct costs can be taken into account when calculating tax

New edition of Art. 346.17 Tax Code of the Russian Federation 1. For the purposes of this chapter, the date of receipt of income

Often, when conducting on-site or desk audits, the Federal Tax Service Inspectorate requests from companies many copies of documents,

Form 6-NDFL was introduced in 2021, but still raises questions about its

Features of taxation of dividends The rules for taxation of dividends are established by Article 275 of the Tax Code of the Russian Federation. According to the tax code