Examination at the ITU Bureau during a period of temporary disability In accordance with clause 28 of the Procedure

Issues discussed in the material: What will be the taxation for employee training expenses? How to reflect

Submitting electronic VAT reporting: is there an alternative? VAT reporting should be submitted by everyone

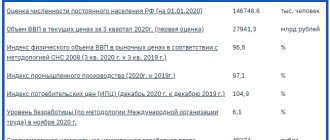

State › Committee on Statistics State Statistics, Statistical Office Rosstatistika, Rosgosstatistika Roskomstat Central statistical database

When do you need to withhold personal income tax Companies and individual entrepreneurs that make payments to individuals are recognized as tax agents

Procedure for withholding accountable money Funds that are issued to the employee as accountable money, in the case of

Rules for maintaining a book of income and expenses Entries in the book are made only if there is an appropriate

New forms From 01/01/2021, the order of the Ministry of Internal Affairs of Russia dated 07/30/2020 No. 536 came into force,

Comments 09/02/2015 Donatella Good day, dear colleagues! I have a question for you

Checking an account for blocking The Federal Tax Service monitors the status of legal accounts. persons and carried out on