Objectives The reference book itself places emphasis on the relationship between budget classification codes and tax codes

Responsibility for this violation of the deadlines for submitting tax returns is provided for in Article 119 of the Tax Code

In this material we have summarized samples of payment orders for the payment of insurance premiums in 2021

What does it mean to repay a loan using the bank's created reserves? Sometimes personal loans are repaid

Questions discussed in the material: What is the procedure for returning insurance premiums How to return insurance premiums to individual entrepreneurs

Good day! I continue to write articles about changes in business in 2021 and

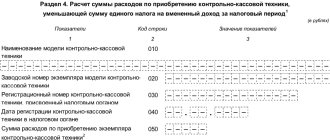

Features of the UTII declaration The UTII declaration is, in fact, a statement from the taxpayer

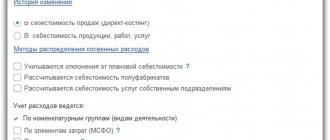

The main goal of tax accounting in the 1C program is to correctly determine the value

Procedure and timing of inventory of fixed assets Inventory of fixed assets is carried out in the manner established

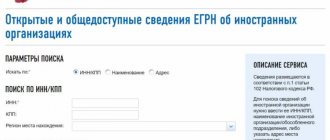

Checkpoint for individual entrepreneurs Despite the fact that counterparties often require individual entrepreneurs to indicate