Are you planning to open a catering establishment? Form of ownership (IP or LLC) and taxation system for

Many large companies have separate divisions. In the process of activity, various situations arise when branches,

An employee who has the right to a property deduction has the right to use any method convenient for himself.

KBK 2013 for payment of Pension Fund and Compulsory Medical Insurance The table shows the budget classification codes of KBK

Sanatorium as a non-core asset In modern large manufacturing enterprises, originally from the Soviet Union,

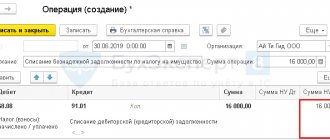

Reasons for recognizing tax debts as bad Debts on taxes, contributions, penalties, fines, interest can be

Relevance of the accounting business Before you open an accounting firm, you should think about the feasibility of such

Trading without permission entails penalties under administrative law. To carry out trading activities

Initially, the list of discounted publications was approved by Decree of the Government of the Russian Federation dated January 23, 2003 No. 41, in which

During the month you receive money from customers, pay bills from suppliers, pay salaries, taxes