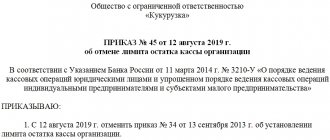

Legislative rationale The document regulating inspections is the Regulation on the procedure for conducting cash transactions No. 373-P,

Employers want employees to perform their duties well. But the needs of the enterprise change, and it is necessary

In accordance with current legislation, each vehicle owner must pay the appropriate transport tax,

An individual taxpayer number (TIN) is assigned to each individual or organization or institution that is required to pay

How to show compensation from the Social Insurance Fund in the RSV Starting from 2021 when filling out the RSV

Features of submitting reports for the fourth quarter of 2021 Features of submitting reports for the fourth quarter

To pay for necessary products, provide services, or make payments to its employees, almost any organization

How long to store documents Article 23 of the Tax Code of the Russian Federation states that documents must be stored for

Material liability of a storekeeper The position of a storekeeper is included in the list of categories of employees with whom agreements are concluded

Object of taxation Construction projects that have not yet been put into operation are considered to be construction in progress.